- The legal standoff of the SEC vs. Ripple has escalated as trial preparations have moved forward.

- The countdown to a courtroom clash has gained momentum as trial preparation has intensified.

- Availability clashes and blackout dates have injected complexity into the trial timeline.

The ongoing legal dispute between Ripple Labs and the United States Securities and Exchange Commission (SEC) continues. Both parties have recently communicated their respective availabilities to Judge Analisa Torres in anticipation of the upcoming trial.

The trial is slated for the second quarter of 2024 and aims to address the lawsuit instigated by the SEC against Ripple Labs, CEO Brad Garlinghouse, and Executive Chairman Chris Larsen.

SEC’s Claims Against Ripple Executives Denied by NY Court

The lawsuit was set in motion in December 2020, alleging the unlawful offering and sale of an unregistered security, explicitly referring to XRP, which purportedly violated Section 5 of the Securities Act 1933. The SEC has additionally accused Garlinghouse and Larsen of aiding and abetting the alleged infringements committed by Ripple.

Sponsored

On July 13th, 2023, Judge Torres, a district judge at the United States District Court for the Southern District of New York, delivered a momentous verdict. The court granted the SEC’s motion for summary judgment on the Institutional Sales aspect, while it was denied for other elements.

The court granted Ripple’s motion for summary judgment regarding Programmatic Sales, Other Distributions, and the sales executed by Larsen and Garlinghouse. However, the court rejected Ripple’s motion regarding Institutional Sales. The SEC’s motion for summary judgment on the aiding and abetting claim against Larsen and Garlinghouse was denied.

Court Establishes Dates for Highly Anticipated Trial

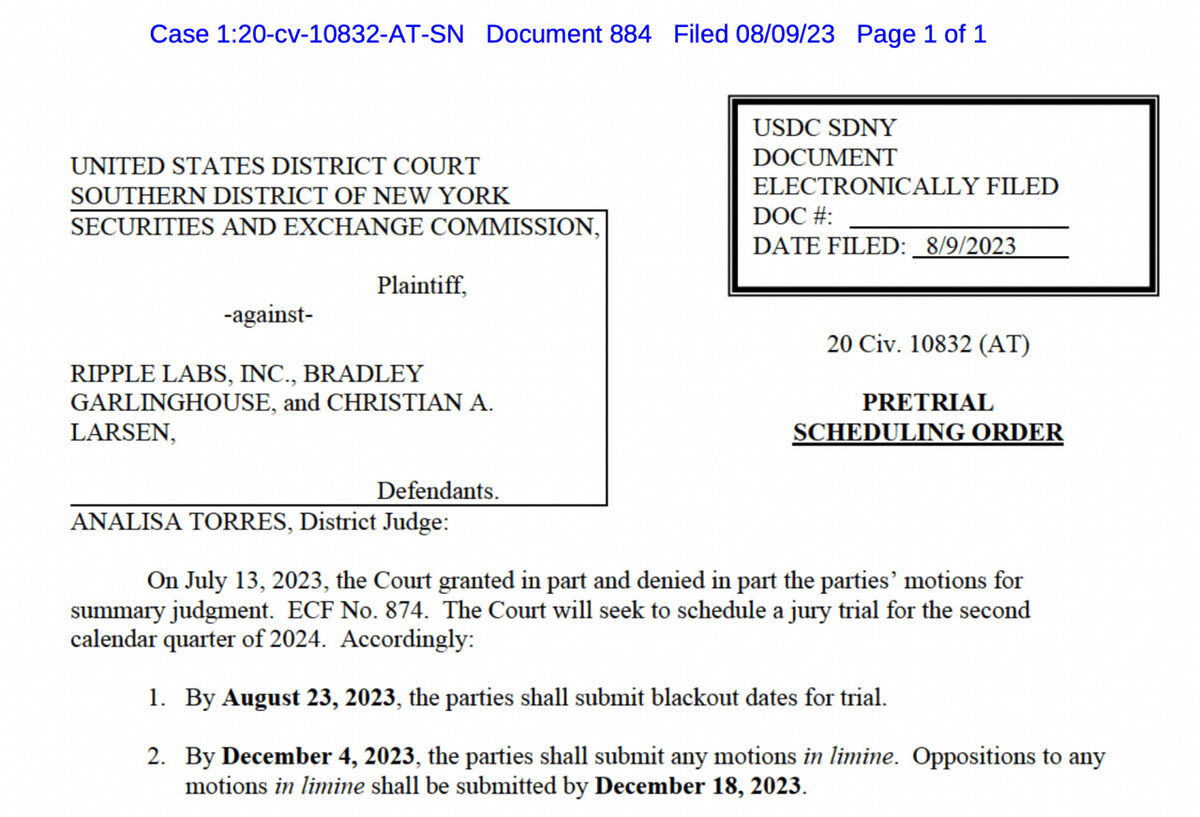

In a Pretrial Scheduling Order submitted on August 9th in the U.S. District Court for the Southern District of New York, Judge Torres communicated the court’s intention to proceed with preparations for a jury trial involving the three defendants.

A deadline of August 23rd was established for the parties to communicate their blackout dates for the trial, to commence the trial anywhere between April 1st and June 30th, 2024. The counsel representing Garlinghouse and Larsen indicated that these two defendants would not be available for trial from April 1st to 14th, 2024.

On the other hand, Ripple Labs stated its absence of blackout dates, affirming its readiness for trial throughout Q2 2024. The SEC’s trial attorneys conveyed to Judge Torres their blackout dates for Q2 2024: April 15th to 19th, May 1st to 7th, and May 27th to 31st.

On the Flipside

- Ripple Labs asserts that XRP is not a security and should not be subject to SEC regulations, arguing that it functions more like a digital asset than a traditional security.

- The court’s mixed verdict on summary judgment motions showcases the case’s complexity. This divergence in rulings underscores the contentious nature of determining whether XRP qualifies as a security.

- An overemphasis on regulatory enforcement might empower established financial institutions at the expense of the decentralized ethos that underpins many cryptocurrencies.

Why This Matters

The legal clash between Ripple Labs and the SEC over the classification of XRP as an unregistered security resonates deeply within the crypto landscape. The outcome of this trial could set a precedent for the regulatory treatment of digital assets, potentially influencing how similar tokens are perceived and traded in the market.

To learn more about the recent drop in XRP and its impact following the SEC’s ruling on Ripple Labs, read here:

XRP Drops 30% in a Month: Impact of SEC’s Ripple Labs Ruling

For insights into how the 20s age group is approaching altcoin investments, delve into this article:

Ripple’s XRP the Dominant Choice Among Young Crypto Investors