- Pepe records a strong seven-day price performance.

- The price pump was not driven by retail.

- Pepe suffered a theft at the hands of rogue devs.

Whether you love them or hate them, it’s undeniable that memecoins have a knack for capturing hearts and minds with their light-hearted and humorous nature. However, memecoin fervor has cooled considerably during crypto winter as social media mentions plunged, particularly in the case of Dogecoin.

Pepe has defied the bearish trend to its credit, gaining an increasing social dominance score and surging by 33% in value over the past week. This remarkable achievement follows recent controversies, including rumors of a rug pull triggered by the mysterious transfer of tokens from the CEX wallet. A deeper look reveals that centralized exchanges are behind this pump.

CEXs Love Pepe

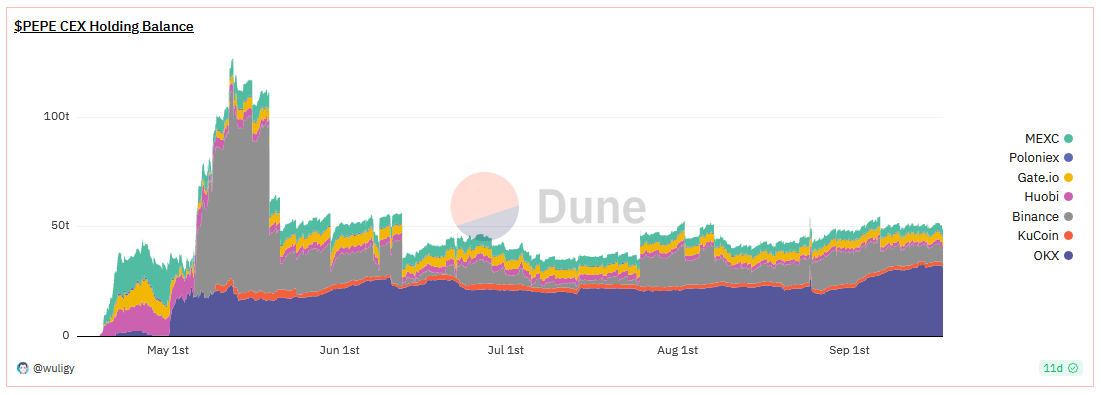

On-chain data from Dune Analytics shows that centralized exchanges began increasing their PEPE holdings from July onwards. Although the controversies started in late August, centralized exchanges did not significantly lower their PEPE holdings in response.

Sponsored

The top 3 PEPE centralized exchange holders are Poloniex, Gate.io, and Huobi. As controversies mounted, Dune data showed that Poloniex increased its PEPE holdings.

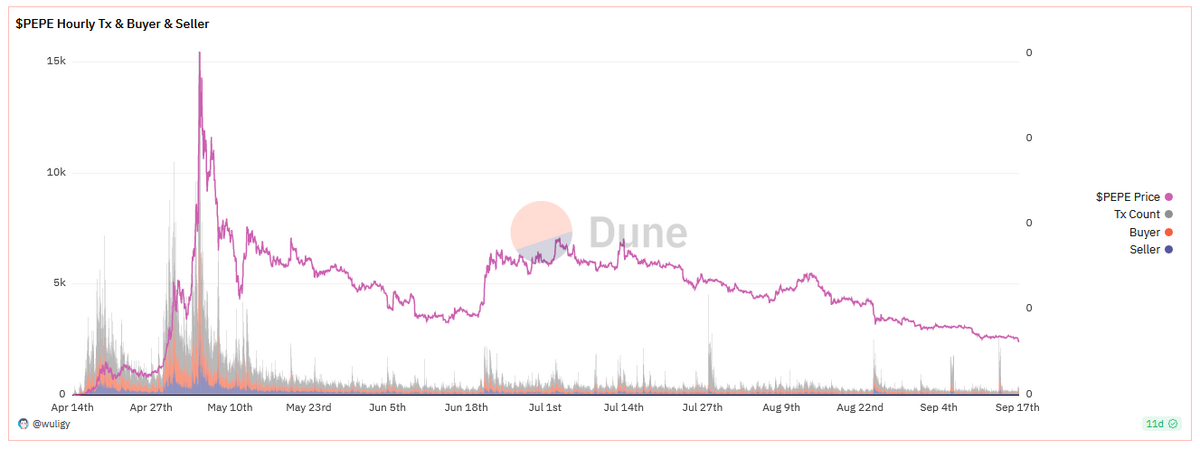

Meanwhile, other on-chain metrics paint a different picture. The hourly buyer and seller transaction count shows a significant dip in trading activity, particularly since the mania witnessed in May when the transaction count peaked at over seven thousand hourly transactions at one point. The most recent hourly transaction count comes in at just 44.

Likewise, this pattern is repeated with Pepe’s hourly trading volume, which saw a peak of $27.92 million sells and $29.47 million buys on May 5, compared to the most recent reading of $18.3k sells and $26.6k buys on September 17.

This suggests that Pepe’s 33% price surge is not driven by retail trader activity, with on-chain data highlighting a significant drop in transaction count and volume even before the controversies broke.

Sponsored

Even so, the controversies did little to assure the PEPE community that everything at the project was above board.

Rogue Devs

Controversy struck the Pepe community on August 24 following news that 16 trillion (approximately US$15 million) PEPE tokens were transferred out of the project’s CEX wallet, fueling rumors of a rug pull in action.

The following day, a post from the Pepe Twitter account explained that the outflows resulted from conflict within the Pepe team, leading to team members making unauthorized withdrawals with the intent of leaving the project with one last bumper payday.

“Since its inception, $PEPE has unfortunately been plagued by inner strife with a portion of the team being bad actors led by big egos and greed. $PEPE is now entirely free of this baggage, with clear roads ahead”, wrote the remaining Pepe team.

Looking to reassure investors, the post stated that the individuals responsible for the controversy were no longer part of the project. It also conveyed that the remaining team aims to serve the community’s best interests.

On the Flipside

- The lack of retail trading indicates everyday buyers remain uncertain about Pepe after the token theft scandal.

- Despite the positive price news, PEPE is still down 81% from its May 5 all-time high price.

- Investors favor fundamentals over memes in bear markets.

Why This Matters

Pepe’s strong seven-day price performance is an outlier in a flatlining memecoin market. Without backing from retail investors, Pepe faces an uphill battle to recapture its glory days.

Learn more about the Pepe community’s reaction to the rogue dev incident here:

Pepe Skepticism at All-Time High after $16M Withdrawal

Find out more on the drop in memecoin social media activity here:

Memecoin Mania Melts Down as Social Dominance Tanks