- Lido sees new ETH deposits grow continuously.

- stETH withdrawals have been enabled but not processed yet.

- LDO is up by 28% in the past week.

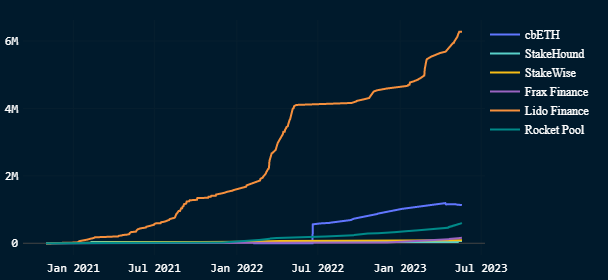

Lido, the largest liquid staking derivatives (LSD) protocol in the market, enabled staked ETH (stETH) withdrawals a few days ago. Many anticipated that stakers will unstake en masse.

However, not only has this not happened, but ETH deposits have been steadily increasing. On Friday, ETH deposits on Lido hit an all-time high.

Lido Hits All-Time High in ETH Deposits

Lido is proving that, at least in the short term, liquid staking is here to stay. That’s because despite activating stETH withdrawals, deposits keep growing higher.

Sponsored

In fact, on Friday, the total number of ETH deposited on Lido hit a new all-time high. According to data from Lido, there are now 6,373,289 ETH staked with Lido, equivalent to $11,521,990,033.

As for withdrawals, they’ve flattened around the 450,000 ETH mark, according to data from Nansen. Withdrawals haven’t been processed yet, just requested.

Lido’s governance token, LDO, is also enjoying a small rally. In the past seven days, LDO is up 28%, according to data from CoinGecko. However, LDO is down 5% on the day, currently trading at $2.15.

Sponsored

Lido is the largest LSD protocol. According to data from Nansen, Lido has a 75% market share among all other LSD protocols, with Coinbase and Rocket Pool coming in second and third, respectively.

On the Flipside

- The total number of ETH staked on Lido is set to decrease once the 450,000 withdrawal requests are processed. However, with the pace deposits have been growing, it won’t take long for Lido to get back to record-high numbers.

Why This Matters

stETH staking withdrawals are the largest source of potential price suppression for ETH. Once stETH conversions are successfully processed, ETH will be essentially free from potential mass withdrawal/selling.

Read more about FIL’s reaction to the SEC’s comments:

Filecoin (FIL) Barely Moves After SEC Tells Grayscale Token Is Security

Read more about increased activity on Polygon zkEVM and a potential airdrop:

Polygon zkEVM Activity Spikes Following Co-Founder’s Airdrop Hint