- European Securities and Markets Authority (ESMA) are up next in getting MiCA out.

- The next year will involve three consultations for ESMA.

- By December 2024, MiCA should be in operation.

The European Markets in Crypto-Assets (MiCA) regulation is groundbreaking in global crypto law. However, even though it was agreed upon in the European Parliament on April 20, there is still a road to go down before it comes into force.

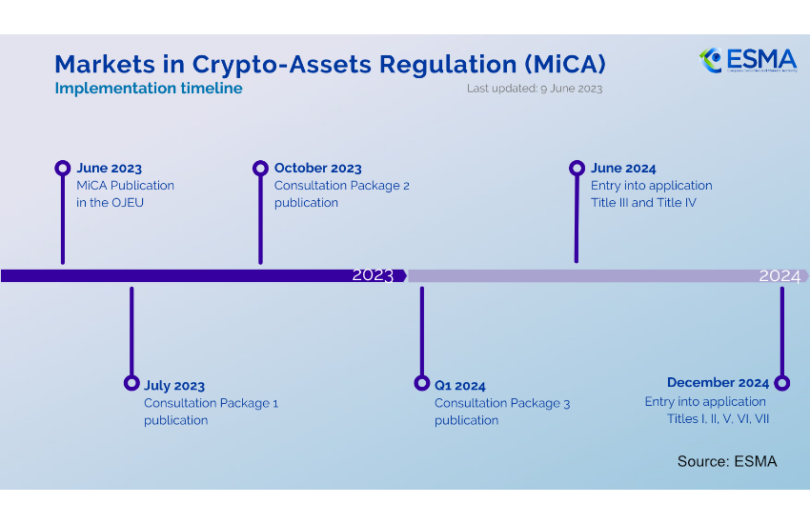

On June 9, the roll-out of MiCA was made far more apparent as the dates for the upcoming consultations and entries were listed.

The next stage begins Friday, 16 June, with the European Securities and Markets Authority (ESMA) stepping up and publishing a timeline of its plans for three consultations, with the first starting next month.

ESMA’s Crypto Guidelines and Standards

The three consultations by ESMA will take place in July, October, and the final in Q1 of 2024. The content of the three consultations has not been confirmed, but the first will include authorization, governance, conflicts of interest, and complaint-handling procedures.

ESMA is responsible for developing regulatory technical standards and guidelines for various areas, and the organization is often in consultation with the European Banking Authority. Some of the guidelines it will have to draw up regarding MiCA will be complex and warrant such a thorough process.

For example, ESMA has to develop criteria to decide when a crypto-asset should be considered a financial instrument under MiFID regulation versus MiCA. ESMA is also responsible for breathing the plan to make Bitcoin environmentally sustainable, especially after the MiCA debate once centered around banning Bitcoin for its environmental impact.

ESMA will need to conclude its consultations before the end of Q1 2024 before the first stage of the regulation rollout can begin. In a year, it is expected that Title III – regarding ‘Asset-Referenced Tokens’ – and Title IV – regarding ‘ElectronicMoney Tokens’ – will be entered into the application.

Sponsored

Following those initial title applications, the remaining five titles will come into effect in December 2024.

What Will a Crypto-Regulated Europe Look Like?

The MiCA regulations are comprehensive and cover several aspects of the industry, including stablecoin issuance and crypto business disclosures. The global crypto community has welcomed these laws, despite including the controversial “Travel Rule,” which will force crypto exchanges to disclose information on all users sending more than €1000.

Europe will be trend-setting globally in what it means to have tailored crypto regulations. There will be added restrictions for users, but many more protections not found in the general ‘Wild West’ crypto ecosystem.

For crypto businesses, there will be absolute clarity on how to remain compliant, which has been conspicuously missing from the U.S. crypto market.

On the Flipside

- European Central Bank President Christine Lagarde has called on lawmakers to start work on a “MiCA 2.0” to cover parts of DeFi, such as staking and lending.

Why This Matters

MiCA is setting a trend that many global jurisdictions will be watching closely. If the regulations succeed, they will offer a blueprint for other nations to bring this digital asset space into a regulated mainstream.

Read more about what MiCA means for you:

The EU Parliament Approves MiCA – Here’s What It Means for the Crypto Industry

Read more about Binance’s User Protection Fund:

Binance Boasts Majority of $2.5B Exchange-Held User Protection Funds