- User protection funds are becoming vital for exchanges.

- Binance boasts the biggest, by far.

- Exchanges are taking different approaches to ensuring their users’ funds.

As many users found out the hard way in the wake of FTX’s collapse, user funds are often not as well protected in the crypto space as they are in traditional finance and investing. Yet, there look to be lessons learned by some of the most proliferate exchanges.

A new report from blockchain analytics firm Nansen shows that many reputable cryptocurrency exchanges have built user protection funds that boast some substantial figures. Binance is banking the most protection with a billion dollars in their fund.

Ready for the Worst

User Protection Funds are in place as a buffer if an exchange loses its customer’s assets. They serve as an insurance policy for users against the exchange and help instill confidence in the exchange.

Sponsored

Nansen highlighted five major exchanges and found six relatively different approaches to user protection funds.

Huobi has two funds intended to protect against any customer losses. The Security Reserve Fund is collateralized against 20,000 BTC (around $50 million at publishing). Huobi also has the Investor Protection Fund, where 20% of their income goes to buyback, and repurchased Huobi Tokens are stored in their user protection fund.

OKX has its OKX Risk Shield Fund, which holds $700 million, while Bitget has $300 million in its fund. Coinbase does not have a global fund but rather offers £150,000 protection for its UK customers’ accounts.

Sponsored

Finally, Binance comes in strong with its Binance SAFU fund, where $1 billion is set aside for possible losses.

Interestingly, only Binance and Bitget have made their wallet addresses for these funds public.

More Transparency

Again, after the fall of FTX, exchanges quickly started offering Proof-of-Reserves. Proof-of-Reserve refers to when a centralized exchange publicly declares its reserve assets. This is usually accomplished through an independent audit.

This was a step in the right direction, considering the FTX collapse resulted from insufficient reserves; however, it is somewhat flawed.

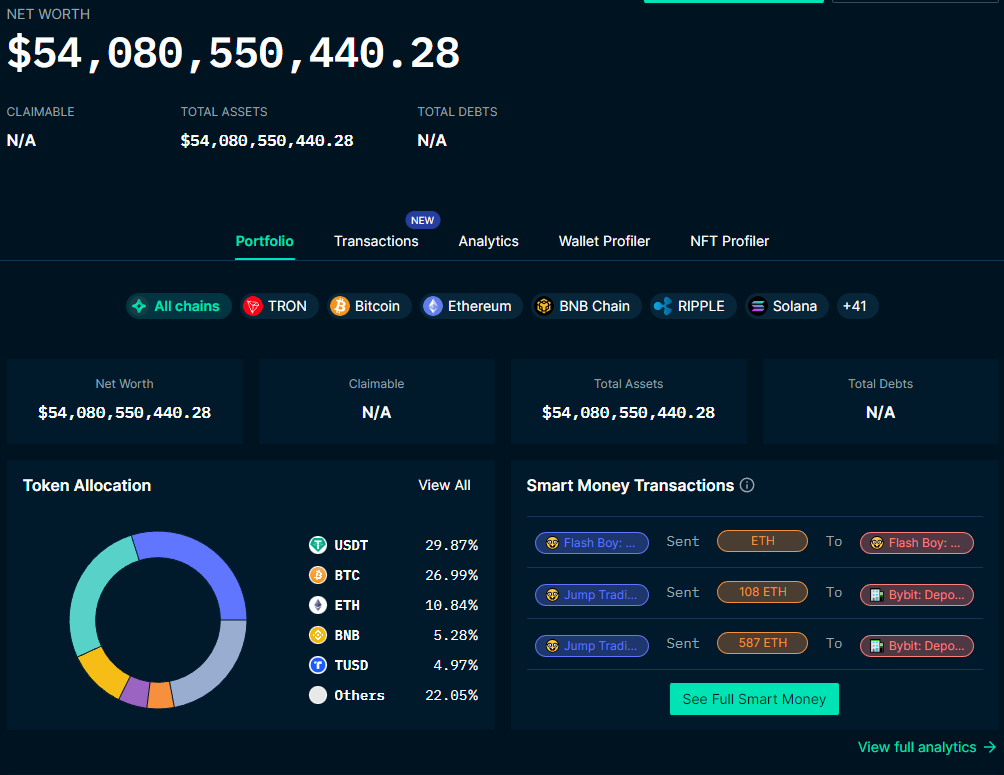

Proof-of-Reserve does not guarantee an exchange’s solvency without an accompanying breakdown of liabilities. This makes it insufficient to rely on fully. Binance’s Proof-of-Reserve from Nansen can be seen below:

A lot of information about the exchange’s funds can be sought here, but this info tied in with a verifiable user protection fund is a much stronger guarantee of user protection and peace of mind.

On the Flipside

- Many figures were thrown around regarding money lost in the FTX crash, with some sources saying FTX spreadsheets indicated that between $1 billion and $2 billion in client money was unaccounted for.

Why This Matters

User Protection Funds are a good way to ensure that customers are protected in the event of a catastrophic collapse of an exchange. Similar funds and insurance policies are in place in traditional finance, and for crypto, these will help with mainstream adoption.

Read more about FTX’s collapse:

Latest FTX Report Shows How Bad Things Really Were

Read more about plans to change up the SEC: