- Commissioner Peirce argues for regulation that does not stifle innovation

- The Howey Test determines whether a crypto token is a security

- The SEC failed to classify the FTX token (FTT) as a security

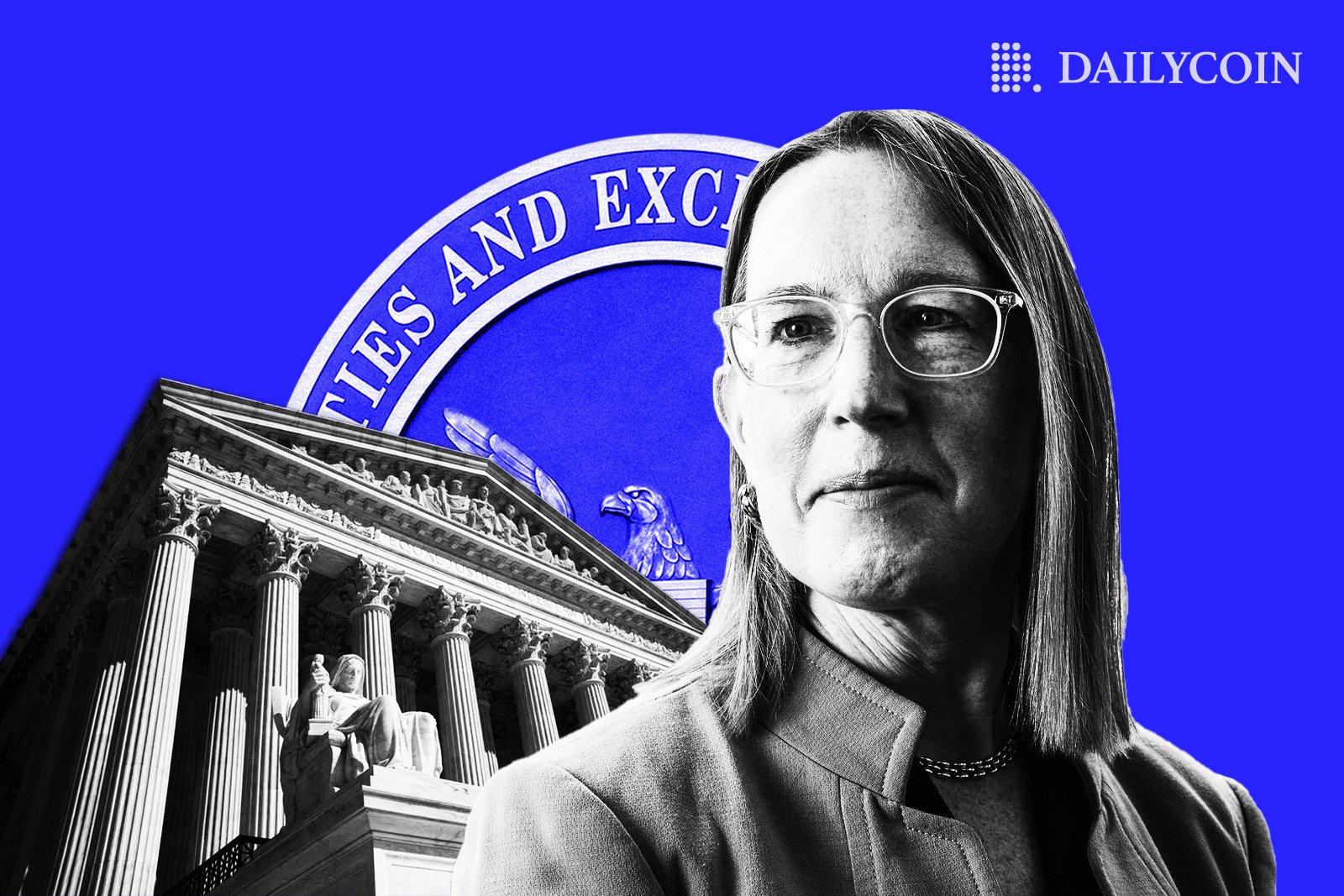

One of the main issues for the crypto industry is regulatory uncertainty. This could change if the SEC Commissioner Hester Peirce gets her way. She believes that the SEC needs to clarify its stance on the crucial piece of crypto regulation – the Howey Test.

The Howey Test, which determines whether an investment contract is a security, was referenced in lawsuits against crypto projects. Its main criterion is whether a token relies on the “efforts of others,” such as the founding team.

“There's been a lot of emphasis on the Howey test in the crypto world because [...] a lot of these things were sold as tokens plus a promise that we're going to build a network,” Peirce, the US Securities and Exchange Commission (SEC) Commissioner said for the gm from Decrypt podcast on Sunday.

However, Peirce believes much remains to be clarified when discussing the test. One question is whether the token is a security or its initial offering. The other crucial question is when a token stops being a security.

“You can say, ‘Well, look, a lot of these initial sales sure look like securities offerings,’ but then the question is, is that token, is the crypto asset itself, a security?” she asked. “That's a much harder question to answer, and I think it's one that people answer differently.”

Tokens Don’t Have to Be Securities Forever

The SEC Commissioner said regulators could differentiate between initial coin offerings (ICOs) and subsequent token sales.

Sponsored

“Just because I sold you the orange grove as part of an investment contract doesn't turn the orange grove into a security,” Peirce said.

This regulatory treatment could allow the SEC to crack down on ICOs, without banning many crypto tokens. “The orange grove, plus the promises I made to you about how I was going to tend the orange grove and generate profits for you—that was the securities offering,” she added.

Moreover, the SEC Commissioner believes tokens don’t have to remain securities indefinitely. She said that the SEC could consider one token a security at the time of its sale. However, she added, “that doesn’t mean that the token continues to be a security for the rest of its life.”

Sponsored

She believes that the SEC needs to give clearer guidelines on how the Howey Test needs can be applied. “If we were more precise, I think that there would be fewer objections to applying the Howey test…” she said.

SEC Commissioner Hester Peirce is a vocal proponent of giving innovators more leeway to develop crypto projects. She believes that US regulators should be careful not to stifle innovation in the industry.

In particular, she has pushed for a “safe harbor” for crypto projects. Such a program would offer innovators protection from legal issues as they develop their tokens and related technologies.

Did Sam Bankman-Fried’s FTT Token Pass the Howey Test?

The SEC drew criticism for its regulatory efforts (or lack thereof) after the collapse of the crypto exchange FTX. The top financial regulator failed to sanction FTX for selling its FTT tokens.

FTX marketed FTT as utility tokens, which offered trading discounts to FTX users. However, they also pledged to buy back FTT regularly. This had the effect of tying the token price to the performance of FTX.

This is why some said that the FTT token fails the Howey Test. “If you have a token that is a claim on profits, that is a security,” said businessman Bob Greifeld. Tokens like these are “directly in the purview of the SEC’s mission,” he added.

Yet, the SEC did not sanction FTX or Sam Bankman-Fried, drawing concerns over potential conflicts of interest among regulators. Notably, Bankman-Fried was one of the biggest political donors in the last election cycle.

Last week, the SEC finally charged Bankman-Fried with securities fraud. However, the charges notably do not include the unlicensed sale of securities.

At the same time, other, more decentralized projects feel they are under threat of a crackdown by the SEC.

How Much Decentralization?

Crypto projects are paying close attention to SEC’s statements, especially those related to decentralization and the Howey Test. While the SEC broadly agrees that projects that depend on the efforts of a founding team should classify as securities, it does not provide clear guidelines for a threshold of that decentralization.

This means that most crypto projects face the risk of being classified as securities. This could mean stricter regulation or even a total ban on the traditional sales of these tokens.

One notable exception is Bitcoin. In September, SEC Chair Garry Gensler said that Bitcoin is not a security. This is because of its decentralization, as no group or individual effectively owns Bitcoin. However, he also implied that the second-largest crypto, Ethereum (ETH), might be a security.

SEC Chair Garry Gensler said that Bitcoin is not a security because of how decentralized it is. No group or individual effectively owns Bitcoin. However, he also implied that the second-largest crypto, Ethereum (ETH), might be a security.

ETH is one of the more decentralized networks out there. Other such projects include Litecoin and Monero. That’s why Gensler’s view is trouble for most crypto projects. If Ethereum is a security, the SEC could take action against any project whose tokens are deemed securities.

Howey Test, Orange Groves, and Crypto

The Howey Test comes from a legal precedent from a Supreme Court case from 1946. The case handled the issue of when a financial instrument or agreement qualifies as a security. Recently, the test became relevant in relation to crypto tokens. In 2020, the SEC referenced the Howey Test in a lawsuit against the founders of Ripple (XRP).

According to the test, a transaction qualifies as an investment contract if it involves three key points. These are (1) an investment of money, (2) in a common enterprise, and (3) an expectation of profits from the efforts of others. The last point is key, as many crypto projects fit that criterion.

The original decision references an orange grove in Florida owned by Howey and Co. The company sold contracts to investors who wanted to purchase orange groves. However, instead of selling the groves, they sold shares of revenue from the oranges.

On the Flipside

- More regulatory clarity about token offerings could favor decentralized projects. These projects could be at lower risk of being declared securities.

- At the same time, more regulation could help clear out the crypto space of scammers.

Why You Should Care

The SEC’s stance on the Howey Test matters to anyone who invests in a crypto token. It could mean that certain tokens you invest in are considered securities and thus subject to stricter regulation.