- Coinbase’s Base metrics have exploded following the Dencun upgrade.

- The recent excitement had seen fees sometimes reach above pre-Dencun levels.

- Coinbase’s success may be the key to understanding the recent Base frenzy.

The Ethereum Layer 2 ecosystem has been awash with excitement recently, and for good reason. With the implementation of EIP-4844 or proto-danksharding with the recent Ethereum Dencun upgrade, fees on many Layer 2 chains have dramatically reduced, opening the door for increased activity, adoption, and even new application use cases.

Amid the frenzy, however, one Layer 2 chain has stood out: the Coinbase-incubated Base. Recently, the network has garnered so much activity and attention that fees have sometimes exceeded pre-EIP-4844 levels.

The sustained interest, even with rising fees, suggests there is more to this rising activity than excitement over the Dencun upgrade.

Coinbase’s Base Metrics Soar

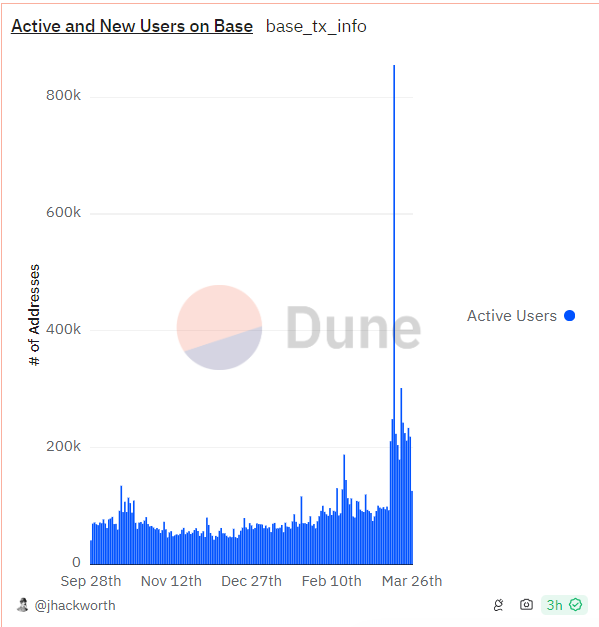

Following the March 13 Ethereum Dencun upgrade, Base on-chain metrics have exploded. For starters, the network now averages over 200,000 active and new users daily from below 100,000 before the upgrade, per Dune Analytics data. On March 16, this metric peaked with over 850,000 active new users.

At the same time, daily transactions on the network have tripled from around 450,000 to an average of over 1.2 million. All the while, the network’s TVL has also been rising.

Per Defi Llama data, Base’s TVL is inching close to $1 billion at $985 million. Per L2Beat data, however, which goes beyond assets locked in specific protocols to include bridged and natively minted assets, this value is at $2.57 billion, representing a staggering 82% growth in the past seven days. Among the top ten Ethereum Layer 2 networks by TVL, Starknet, the second fastest-growing by TVL in the past seven days, has seen only a 30% bump.

So why is the Coinbase-incubated Layer 2 stealing the show after the Dencun upgrade? The answer appears to lie in good old-fashioned crypto degeneracy and speculation over Base’s ties to Coinbase.

Will Coinbase’s Base Be the Home of Retail? Degens Believe So

The success of a crypto project is often dependent on its ability to attract users. Base may have an advantage over most Ethereum Layer 2 networks in this regard. Coinbase, the largest crypto exchange in the U.S. with over 100 million registered users, serves as an on-ramp for the network and promises to build its on-chain products on the network.

Sponsored

As recently highlighted by market observers like Miles Deutscher, this Base edge has not been lost on the crypto industry’s most notorious players: degens (investors who often ape into new projects in hopes that one will return huge gains). Data suggests these crypto investors are migrating to Base with gains from the ongoing Solana memecoin frenzy.

As to why this influx is coming after Dencun, with the upgrade, Layer 2 chains like Base can offer even lower fees and faster transactions, which drew these degens to Solana in the first place.

Further evidence of the recent degen and potential retail influx to Base is the recent memecoin excitement on the network that has sent fees soaring to pre-Dencun levels. Tokens like the cat-themed Toshi have gained over 100% in the past week.

On the Flipside

- Beyond memecoins, capital is also rotating to tokens tied to tangible projects like Aerodome Finance’s AERO. The token has gained over 110% in the past seven days, per CoinMarketCap data at the time of writing.

- The speculative fever on Base has also attracted bad actors, with rugpulls becoming increasingly frequent.

Why This Matters

With the recent boom in activity on Base, it becomes necessary to understand the factors driving the frenzy.

Read this for more on Coinbase’s Base:

Base Memecoin Bots Drive Gas Fees to Pre-Dencun Levels

See how global crypto funds fared last week:

Crypto Funds Hit Record $1B Weekly Outflows on BTC Price Scare