- FTX’s sister firm, Alameda Research, is seeking the return of $700 million paid to politicians and celebrities.

- The funds were allegedly used to gain access to influential figures.

- Filings detail the trail of money from Alameda Research to two well-connected agents.

The FTX trial saga continues to expose corruption at the highest levels. A recent filing claims that former owner Sam Bankman-Fried paid $700 million to gain access to influential celebrities and politicians. FTX’s sister firm Alameda Research wants to get that money back.

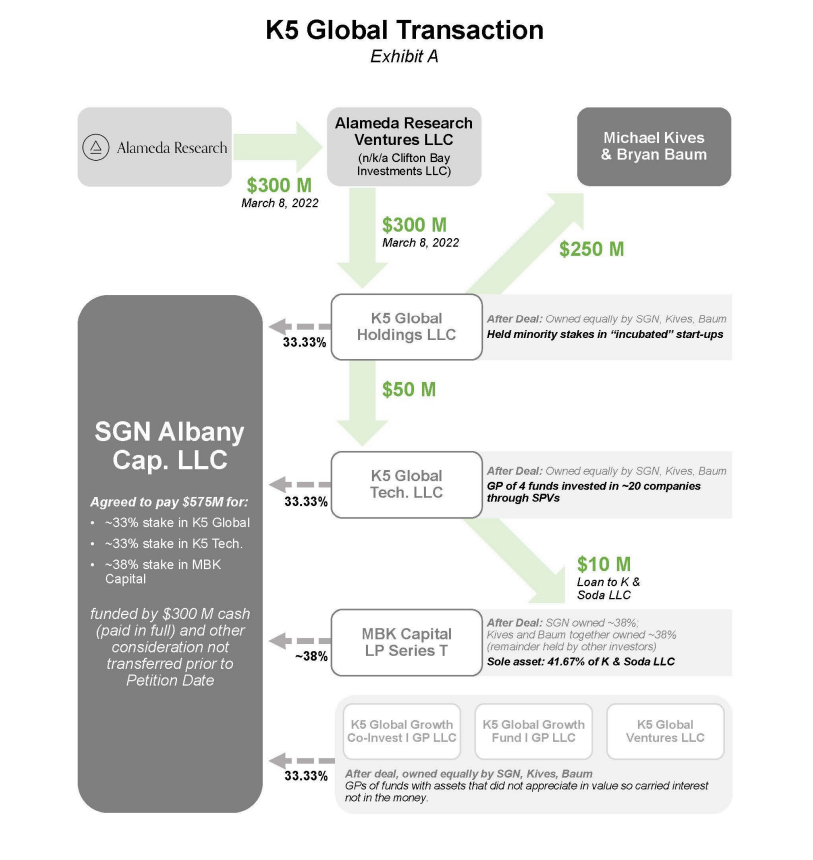

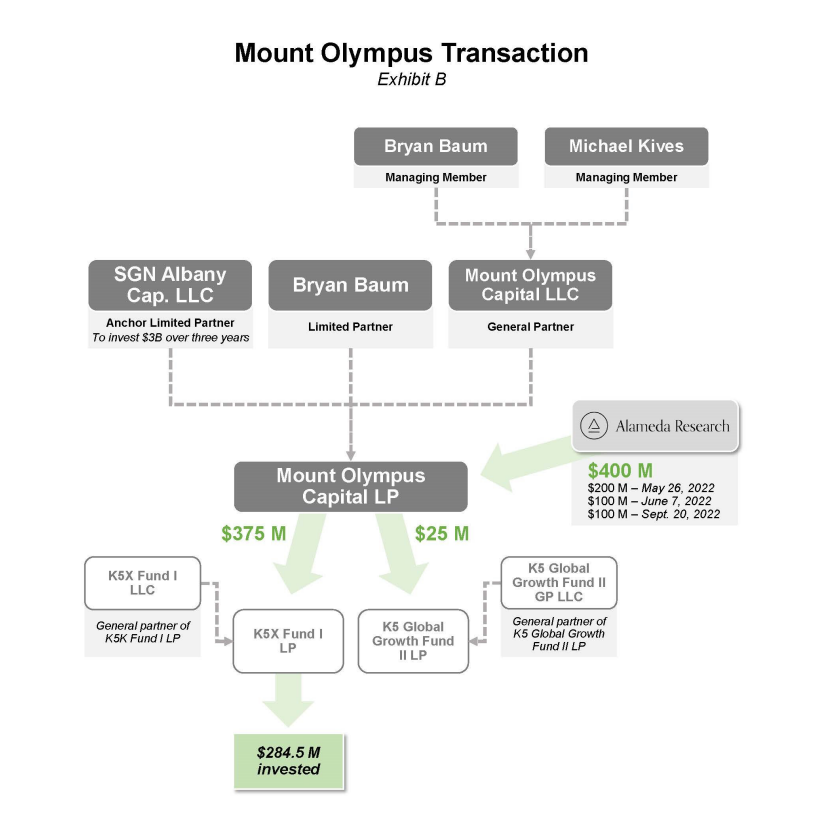

A Thursday, June 22, a court filing by Alameda Research details Sam Bankman-Fried dealings with two prominent agents with access to major figures in politics and show business.

Dealings with Former Clinton Aide, with ‘Extensive Connections’

The court filing deals with SBF’s deal with K5 Global, an advisory firm founded by Michael Kives and Bryan Baum. It details a number of payments, amounting to $700 million, to K5 Global, founded by Michael Kives and Bryan Baum.

Kieves is a former Creative Artists Agency (CAA) agent and a former aide to Bill and Hillary Clinton. He is known for his extensive network of connections, including celebrities and politicians, which he leveraged in his work with K5 Global.

Sponsored

The complaint alleges that Bankman-Fried, Kives, and Baum signed a term sheet in February 2022. This agreement stipulates that Bankman-Fried or a related entity would personally give each of Kives and Baum $125 million. Moreover, SBF also agreed to invest billions into K5 Global and affiliated entities over the next three years.

The complaint also alleges that by the end of September 2022, Alameda Research Ltd. had transferred another $200 million to K5 entities, bringing the total pre-petition transfers to Kives, Baum, and entities under their control to $700 million.

Lawyer’s Argument: SBF Treated FTX and Alameda as ‘Slush Funds’

The lawyers argue that these deals did not provide equivalent value to Alameda Research and that Kives and Baum knew that. They acted with “dishonest minds” and knowingly assisted SBF in breaching his fiduciary duty to Alameda Research.

Sponsored

“Bankman-Fried treated the legal entities that he controlled as a slush fund,” Alameda lawyers claimed in the filings. His behavior, they added, showed a “near-total disregard for corporate formalities.”

The filing alleges that Kives and Baum knew or should have known that the deal did not provide reasonably equivalent value to Alameda Research. Moreover, they also should have known that SBF personally benefited from them.

On the Flipside

- Previous court filings alleged that Sam Bankman-Fried and FTX insiders took $3.2 billion from the firm.

- Court filings represent the opinion of one side in a lawsuit. They don’t constitute official court decisions or proof of any wrongdoing.

Why This Matters

The FTX case is a significant development for crypto traders. It highlights the potential risks associated with the industry’s business practices and underscores the need for transparency and accountability.

Read more about SBF’s alleged crimes

Sam Bankman-Fried and Insiders Took $3.2B from FTX

Read more about SBF and his role in FTX: