- Solana’s price drops by 9% amid FTX liquidation fears.

- FTX estate holds a staggering $1.5 billion in Solana network assets.

- However, the Solana community is shrugging off concerns.

Solana is once again in the spotlight for all the wrong reasons. With its price taking a 9.5% dip in the last seven days, many are pointing fingers at defunct FTX, with substantial SOL holdings, as a reason for alarm. However, the Solana community remains undeterred, citing interesting facts to boost their claims.

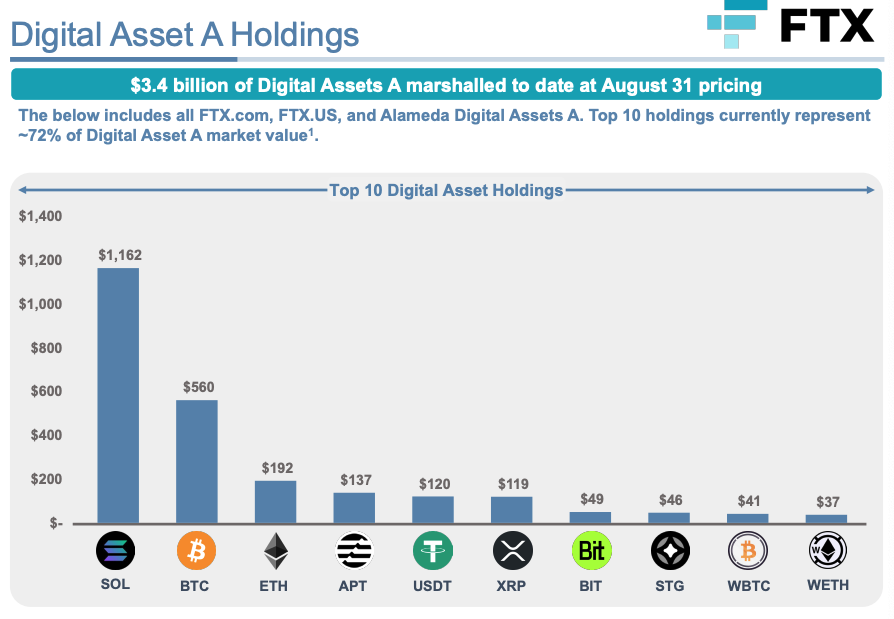

FTX Entities Hold 20% of All Solana Tokens

On Monday, September 11, court filings from the FTX bankruptcy case revealed that FTX and affiliated entities hold a whopping $1.5 billion in SOL tokens. As Solana has a market cap of $7.4 billion, FTX’s holdings represent 20% of all Solana tokens.

Luckily for Solana holders, these tokens will vest over several years. This is why many in the Solana community are calling for calm.

Reactions to FTX’s Potential Solana Sell-off

The crypto community has been buzzing with various predictions and concerns. Many took to social media platforms to express their apprehensions about the impending sell-off. Users were concerned about the impending sell-off of $600 million Solana tokens.

“I saw some influencers shilling Solana some time ago. Not looking great. FTX about to dump $680 mil worth of SOL,” one user tweeted.

However, others advocate for calm, saying the exchange will likely sell these tokens gradually. This way, FTX would also avoid tanking SOL’s price, of which they are a substantial holder. One user even emphasized that some major Layer 1 blockchains have higher inflation rates yet don’t attract the same level of scrutiny.

Moreover, other holders point out that the bankruptcy plan for FTX limits the amount of assets that can be sold at once. According to FTX’s bankruptcy filings, there are conditions imposed on the token sales, with a weekly cap of $100 million, which can be increased to $200 million for individual tokens.

On the Flipside

- Crypto analytics firm Messari found that despite large holdings, Solana is less at risk of liquidation than other, smaller projects.

- Solana has been hit hard by the FTX bankruptcy due to its close ties with Sam Bankman-Fried. The SOL token fell 94.2% in 2022.

Why This Matters

Understanding the dynamics between Solana and FTX’s potential liquidation is crucial for Solana holders. FTX’s substantial holdings can significantly impact the price of the SOL token.

Sponsored

Read more about other crypto tokens at risk of FTX liquidation:

TRX, MATIC, DOGE at Risk in FTX Liquidation Event: Messari

Read more about Ankr’s Partnership with Tencent Cloud:

Ankr’s Landmark Tencent Partnership for Blockchain Explained