- FTX has filed a lawsuit against LayerZero.

- The bankrupt exchange claims the company initiated questionable practices.

- The exchange is eyeing $41 million from the lawsuit.

FTX’s new leadership is on a relentless witch hunt, trying to secure funds from every means possible as regulators, debtors, and users demand their pound of flesh. After seeking refunds on their extensive list of celebrity endorsements, the bankrupt exchange is now going through old partnerships to retrieve some funds.

FTX Looks for Bags

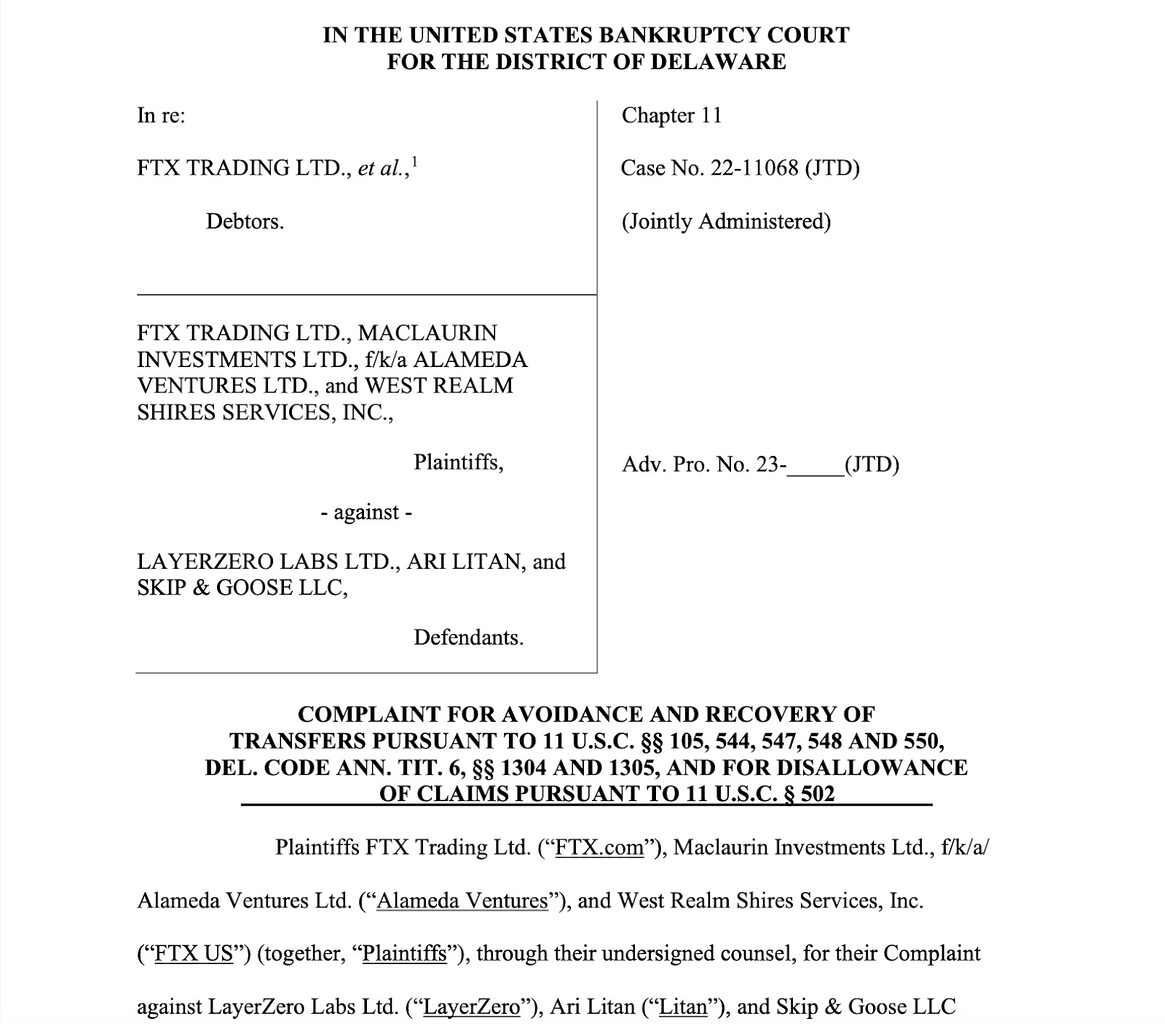

FTX’s freshly appointed CEO is out for blood, revisiting old deals, trying to steer the company away from its impending doom. The exchange recently filed a lawsuit against its former associate, LayerZero, accusing them of exploiting FTX’s dramatic downfall using insider information.

Taking legal action under the Bankruptcy Code to avoid and recover property transfers, the exchange is currently seeking over $41 million from the defendants. As per the official complaint, FTX claimed that LayerZero sought to capitalize on Alameda Research’s financial position by demanding immediate repayment of a $45 million loan while fully aware of the company’s liquidity crisis.

FTX and LayerZero later agreed to resolve the loan via equity payments, which enabled the latter to buy back its stakes from the exchange. However, despite the agreement, the lawsuit claims that LayerZero initiated questionable business practices, stopping only after facing legal threats from debtors.

Sponsored

FTX detailed that acting on insider information, LayerZero, its advisors, and senior employees created accounts on the exchange and attempted to withdraw their funds in August 2022 before the company drowned a month later. Given the transfers were made within 90 days of the Chapter 11 filing, the exchange is leveraging the Bankruptcy Code to recover the funds.

On the Flipside

- Alameda Research’s former CEO, Caroline Ellison, attempted to sell 100 million STG tokens to LayerZero for $10 million to repay the loan; however, the agreement fell through.

- FTX recently filed a lawsuit to claw back the millions of dollars paid in celebrity endorsements and sponsorship.

- LayerZero reportedly raised $175 million from investors, including Andreessen Horowitz, Alameda Research, and more.

Why This Matters

FTX’s collapse had a very lasting impact on the crypto landscape. Aftershocks from the exchange’s downfall still affect the industry as regulators use stricter measures against crypto platforms in the US. The new board’s drive to recoup as much funds could make its debtors and users whole again and ease tensions.

Sponsored

Find out how FTX’s former CEO is doing in jail:

SBF Unhappy With Jail WiFi, Demands Pretrial Release

Read who FTX is targeting in its lawsuit:

FTX Advisors Seek Refunds on Celebrity Endorsements and Sponsorships