- friend.tech’s initial success points to demand for direct contact with influential figures.

- The concept of “shares” on friend.tech could be deemed as a securities offering.

- The US crypto industry has no clarity on what constitutes a security.

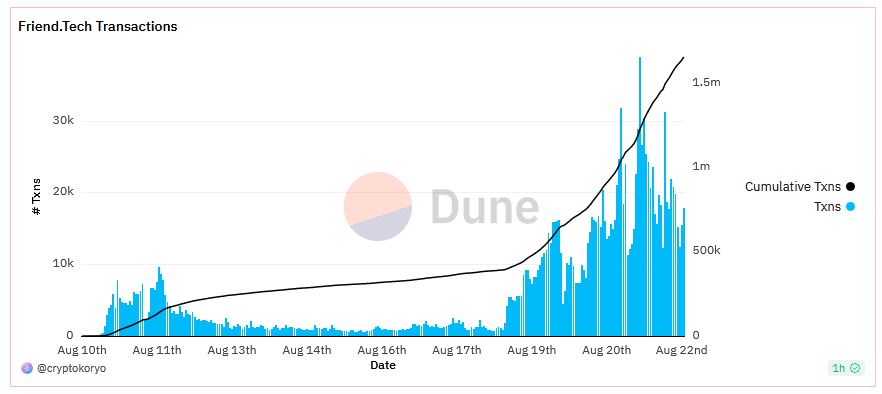

Since launching on August 10, decentralized social app friend.tech has emerged as the latest sensation in the ever-evolving world of cryptocurrency. At press time, the platform has gained over 100,000 users, with transaction count and inflows also skyrocketing, according to Dune. However, despite its impressive start, concerns have begun to mount over its potential securities status.

Friend.tech Rides Popularity Wave

The friend.tech app is built on Coinbase’s Layer-2 Base and enables users to tokenize their profile by selling “shares” of themselves. Acquiring shares in a user unlocks the function to private message said user.

Given the apparent demand to directly connect with influential people, Circle CEO Jeremy Allaire wondered whether the concept could be transposed to a business capacity, via a LinkedIn version of the app.

The platform has attracted a wave of big names, including NBA star Grayson Allen, and X influencers such as Frank DeGods and gainzy222, according to TechCrunch.

Sponsored

Although it was launched less than two weeks ago, friend.tech’s on-chain metrics show that the ecosystem is thriving. At the time of writing, the number of cumulative transactions has reached 1.6 million, with August 18 being a turning point in accelerating transactions, according to Dune.

Sponsored

Similarly, the platform has generated 1.777k ETH ($3.01 million USD) in protocol fees to date – making it the second biggest revenue-generating app over the last 24 hours across all chains, per DeFiLlama.

friend.tech has drawn its fair share of doubts, however. With the SEC’s history of crypto litigations, questions have been raised as to the project’s security status.

Securities Allegations

friend.tech’s booming popularity has sparked conversations on whether it can build on its initial success to dominate the social media landscape. However, in a move that stoked chatter around the platform’s securities status, the team announced renaming “shares” to “keys.” The tweet read:

“We've renamed Shares to 𝗞𝗲𝘆𝘀. The original name was a placeholder during development and we think Keys better illustrates their purpose as in-app items used to unlock your friends' chatrooms.”

Despite renaming its “shares,” Seedstarter Founder Jesse Haynes opined that influencers that have already profited from selling “shares” may still be embroiled in the act of offering unregistered securities, and could therefore become subject to any potential litigation by the Securities Exchange Commission.

On the Flipside

- friend.tech was caught up in an apparent user data leak on August 21.

- The platform’s long-term sustainability has yet to be proven.

Why It Matters

Uncertainty over friend.tech’s securities status shows the ambiguity of the classification. This situation highlights that the crypto industry still lacks regulatory clarity on what constitutes a security.

Read more on Friend.tech’s privacy concerns:

Base’s friend.tech Sparks Arkham Comparisons Amid Scraped Data Debacle

Find out how long-term Bitcoin holders reacted to the recent market sell-off:

Bitcoin’s Flash Crash to $25k: Long-Term Holders Unfazed by Market Panic