- Bitfinex highlighted the fact that ETH validators are growing very fast.

- The exchange identified the main individuals and entities validating transactions on Ethereum.

- Bitfinex predicted that the demand for ETH will continue to rise.

The Ethereum Shapella upgrade in April finally allowed Ethereum validators to withdraw their ETH. Many see the upgrade as a major de-risking event since now validators can enter and exit the staking program any time they want.

And it seems that significantly more validators are looking to stake their ETH. According to Bitfinex, ETH staking participation can grow to 50% within a year.

ETH Staking Participation Can Rise to 50% Soon

Ethereum has never been more secure than it is now. Thousands of validators are entering the queue to start securing the network every day with no end in sight. For example, the current enter queue is 66,400, and the exit queue is 0, according to data from beaconcha.in.

Sponsored

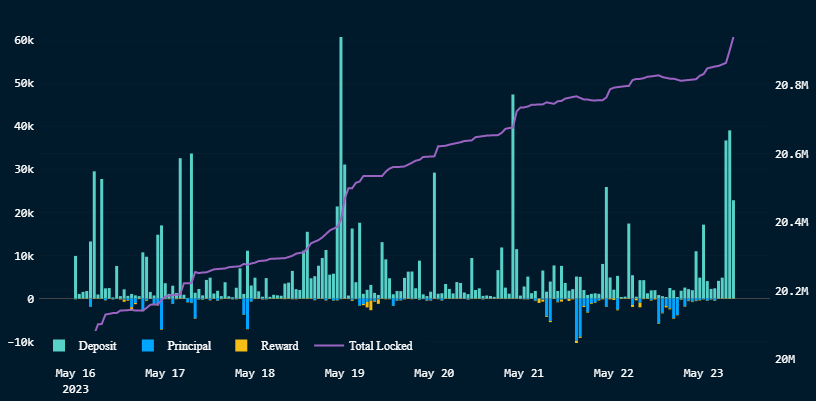

That’s why Bitfinex, a centralized crypto exchange, said in its newest report that ETH staking participation could soon grow to 50%. It currently stands at 15.4%, but Bitfinex pointed out that it’s growing by 3% per month and could grow exponentially next year.

“If such a rate is achieved, it will result in an additional 35 (or more) million ETH tokens being locked into the staking contract, thus reducing the liquidity of unstaked ETH. This scarcity could lead to price appreciation.”

Bitfinex also highlighted that ETH has undergone a “rapid deflation process.” According to data from ultrasound.money, the ETH supply shrank by 1.47% in the past 30 days.

ETH Whales Driving ETH Staking Participation

But who’re the entities driving ETH staking participation? According to Bitfinex, large ETH holders “prefer not to liquidate their holdings and instead seek to generate passive income.”

Sponsored

“This trend is anticipated to persist, particularly considering that deflationary forces are expected to propel the price of ether significantly. Large ether holders perceive staking as a lucrative opportunity to yield earnings while maintaining their crypto assets, thereby aligning with their long-term investment strategies.”

Bitfinex concluded that the demand for ETH is set to continue to “rise in the future” despite the long waiting period to become a validator (currently 27 days).

“This trend, coupled with the deflationary trends, suggests that the demand for ether is set to continue to rise in the future. This resilience among ether holders and the continued accumulation of ether despite market fluctuations demonstrate their belief in its long-term potential.”

ETH is currently trading at $1,853, according to data from CoinGecko.

On the Flipside

- There’s always the possibility that regulators like the SEC declare ETH a security. That would potentially spur a validator exodus.

Why This Matters

A rising ETH staking participation means a more secure network.

Read more about rising ETH deposits on Lido:

Lido Hits New All-Time High in ETH Deposits as stETH Withdrawals Flatten

Read more about why Hotbit has abruptly shut down:

Hotbit Abruptly Shuts Down: ‘CEXs Becoming Increasingly Cumbersome’