Whether you’re a Bitcoin beginner or a crypto trading veteran of many cycles, crypto tax software is the easiest way to handle your tax calculations. Knowing which tax forms to fill out and how to calculate your capital gains on the blockchain can be a nightmare.

Fortunately, there are plenty of available solutions that can help you with your crypto tax reporting. Not only will crypto tax software simplify your tax preparation, but it will also reduce your tax liability. This leaves you with more time and energy to focus on more pressing matters, like following the market and making more crypto gains.

What Does Cryptocurrency Tax Software Do?

The ideal crypto tax software streamlines your yearly tax return. All you need to do is provide all your crypto transactions and taxable events and the tool automatically calculates your liability. Most tools will also offer comprehensive portfolio-tracking services that help you manage your digital assets, and calculate their market value in real time.

Sponsored

Whether you’re a full-time crypto trader, a diamond-hand investor or an airdrop farmer, the right software will take the pain and confusion out of your tax return.

What Important Features Should Crypto Tax Software Have?

The perfect crypto tax calculator and software tool needs to meet a few essential minimum requirements.

Interoperability and Integrations

If your crypto tax software is asking you to manually input your entire transaction history, it’s probably not the most efficient option. The best tools are interoperable with leading crypto exchanges like Binance and Coinbase. All you need to do is connect your account and the API will automate your data input.

Sponsored

Alternatively, some tools will ask you to import CSV files that contain your transaction history and record of your crypto assets. This adds a few extra steps but is still a smooth and easy process. Automatically uploading your data also calculates key metrics, like your cost basis.

Full coverage of the crypto market is important. While all crypto tax software will recognize assets like Bitcoin and Ethereum, there are thousands of smaller cryptocurrencies and stablecoins that need to be included in your tax return. If they’re not included in your tax files, you might find yourself in trouble with the IRS or your local regulator.

DeFi, NFT and Multi-Wallet Support

The blockchain industry is always expanding. NFT trading and DeFi profits need to be included in your return at the end of every tax year. Your crypto tax software should recognize additional income sources, such as staking rewards and airdrops when calculating your income tax.

Many crypto traders also use more than one wallet or crypto exchange. While Binance and Coinbase are top-tier exchanges, some smaller coins aren’t listed on their markets. What’s more, the realms of DeFi and NFT trading are plagued with dodgy contracts and wallet-drain links. For their own protection, it’s standard for users to have multiple wallets to guard the bulk of their portfolio.

Security

Your tax file contains sensitive information. If this data is mishandled or commingled, someone could gain access to your social security number and credit card information. When you file taxes, it’s imperative that the crypto tax software you’re using has strict security practices to protect your personal information.

Simple Interface

Ultimately if you’re using crypto tax software, it’s because you want to take the pain and guesswork out of your tax return. A simple interface makes it easier to manage your tax file, and can even make calculating your capital gains tax enjoyable.

Finally, attentive customer support and troubleshooting services make all the difference in the world. If you have any questions about any of the tools, or want to speak with a tax professional, customer support should always be just a message away.

What’s the Best Crypto Tax Software?

With so many crypto tax software tools out there, it can be hard to know which to choose. The world of cryptocurrency is diverse and constantly expanding. A buy-and-hold investor will have different tax needs than an NFT trader. Instead of ranking each option, we’ll provide a brief list of pros and cons for each tool to help you decide which is the best crypto tax software for you.

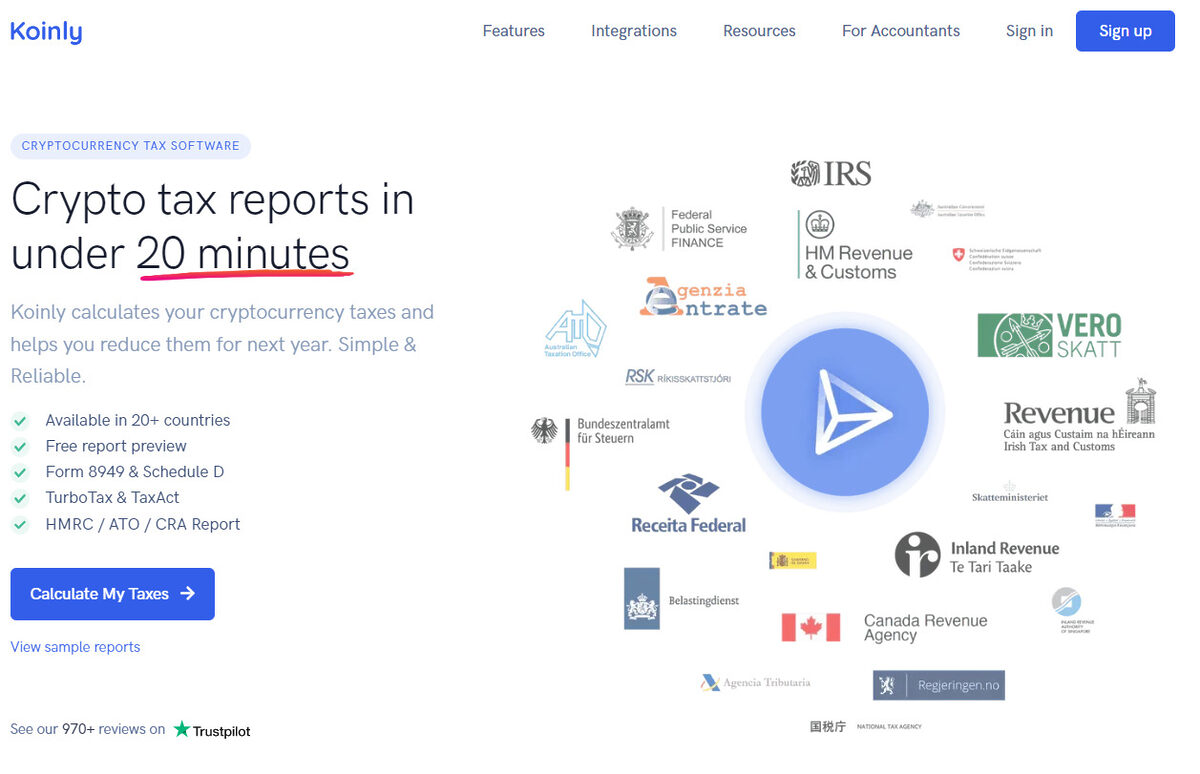

Koinly

Koinly is a market leader in terms of its simplicity and interoperability. It features a smooth and intuitive interface, and aims to complete your full tax report in under 20 minutes. What’s more, Koinly supports integrations with over 300 different crypto exchanges and wallet providers, making it a popular choice among crypto enthusiasts from all backgrounds.

The platform offers a wide variety of helpful features, including a capital gains tax calculator and a powerful tax-loss harvesting tool. This helps to reduce your tax liability and save you money in the long run.

Perhaps the best thing about Koinly is how easily it integrates with regulatory authorities. Koinly is available in over 20 countries. Whether you need IRS forms in the United States or IRD forms in New Zealand, Koinly has you covered.

Pros

- Comprehensive suite of tools and calculators

- Accurate portfolio-tracking software

- Intuitive dashboard, highlighting your overall PnL and ROI in real time

- Automated data importing and exporting

- Compatible with regulatory bodies in over 20 countries

- Supports over 300 different crypto exchanges and over 70 wallet providers

Cons

- Free tax reports are not included

- Limited NFT support

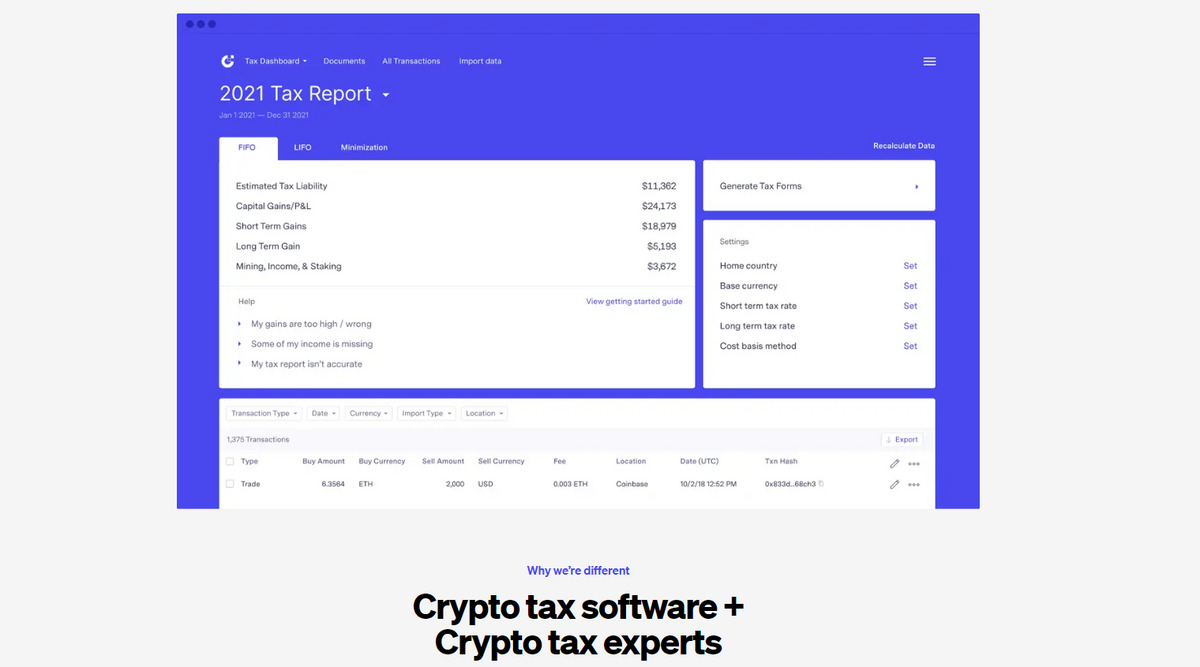

CoinTracker

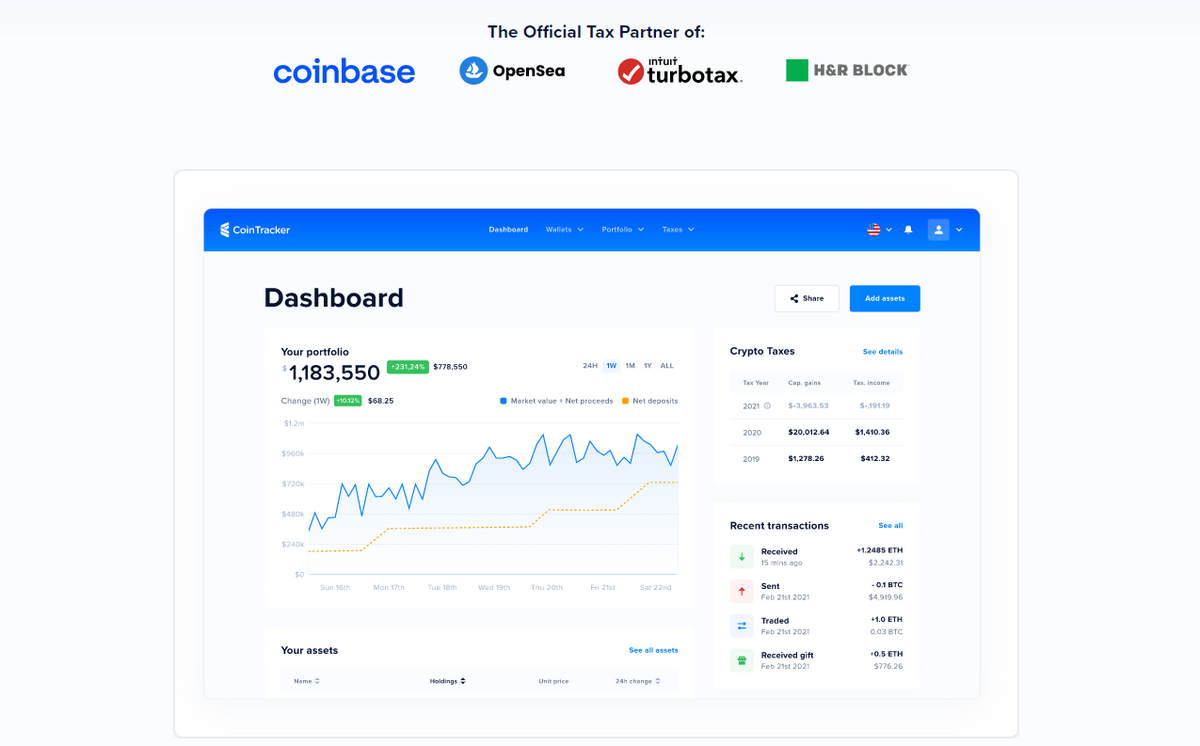

CoinTracker boasts over a million users worldwide, thanks to its focus on convenience and customer-first experience. The platform ticks all the boxes that a crypto tax software provider should. It offers an excellent range of tools and features a clean and simple user interface.

It’s no wonder that leading businesses like Coinbase, Opensea and TurboTax have chosen CoinTracker as their official partner. Their mobile app and intuitive dashboard make onboarding easy, while their tax calculators and portfolio management tools help you track your investments confidently.

What’s more, the top pricing tier gives you access to a CPA (Certified Personal Accountant) who can help you reach your financial goals.

CoinTracker offers full support for tax services in the United States, the United Kingdom, Canada, Australia and India. The platform recognizes over 10,000 different crypto assets.

Pros

- User-friendly interface

- Convenient dashboard and portfolio tracker

- Support for NFT trading and NFT-related taxable events

- Recognizes over 10,000 different cryptos

- Mobile app

- Supports over 500 different crypto exchanges and wallet providers

Cons

- Expensive pricing at basic tiers compared to other providers

- Free plan is limited to 25 transactions

- Limited support outside of a select few countries

ZenLedger

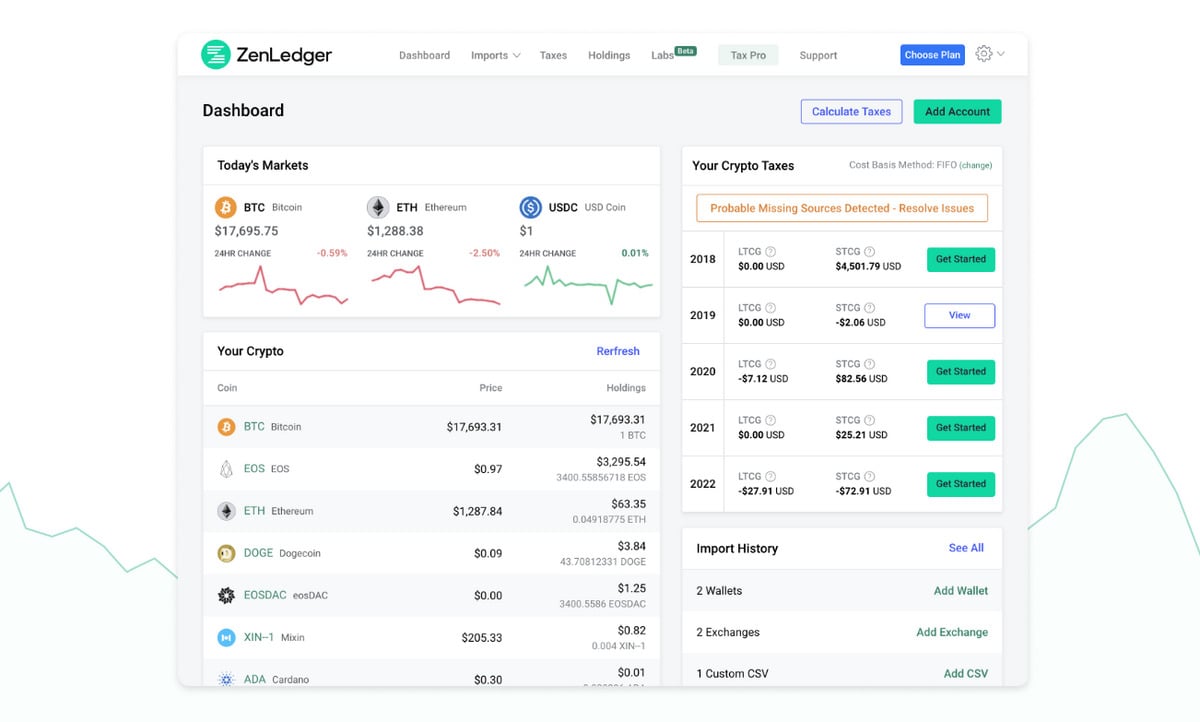

ZenLedger is a US-exclusive crypto tax software provider. They want your tax return to be as seamless and accurate as it can possibly be. As the name would suggest, using ZenLedger should leave you feeling, well, zen.

One of the things that sets ZenLedger aside from the competition is its Grand Unified Accounting Tool. This lets users combine all their different wallets into one single report, making tax preparation easier for those involved in deeper realms of DeFi. ZenLedger also supports NFT tax services and has a helpful tax-loss harvesting tool.

ZenLedger supports over 400 crypto exchanges. What’s more, they’ve also integrated over 100 different DeFi services and 10 NFT trading platforms.

Pros

- Convenient tools and services

- Grand Unified Accounting makes multi-wallet reporting easy

- Supports over 400 crypto exchanges

- A variety of DeFi and NFT integrations

- Accurate portfolio tracking software

- 24/7 customer support available through live chat, email, and phone calls

Cons

- Only available in the United States

- Free plan limited to 25 transactions

- DeFi and NFT services only available for Premium users

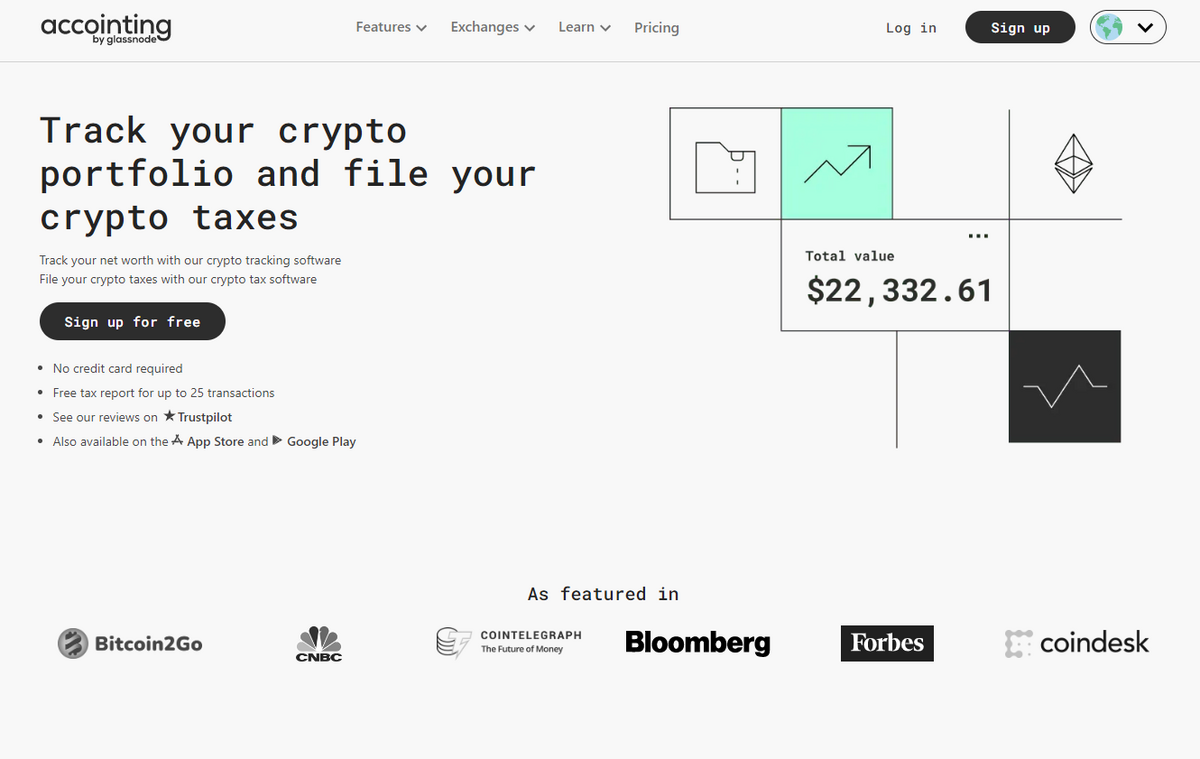

Accointing

Accointing has been designed with crypto beginners in mind. The Swiss-based platform does the basics well and helps guide newcomers without overloading them with additional features they don’t need.

The platform offers all the simple features crypto enthusiasts need to complete their tax return. It will help you file your reports, and integrates easily with popular crypto exchanges. Accointing will generate accurate tax reports for customers in the United States, Switzerland, Germany, Austria, Australia, and the United Kingdom.

However, compared to other crypto tax software providers in this list, Accointing pricing is relatively expensive. Their basic tier is a bit more expensive than their competitors, without offering helpful extra tools like NFT and DeFi reporting.

Pros

- Accurate crypto tax reporting

- Supports tax services in multiple countries

- Simple UI and portfolio tracker

Cons

- Expensive when compared to other crypto tax software options

- No support for DeFi and NFT tax services

- Less integrations with crypto exchanges than other providers

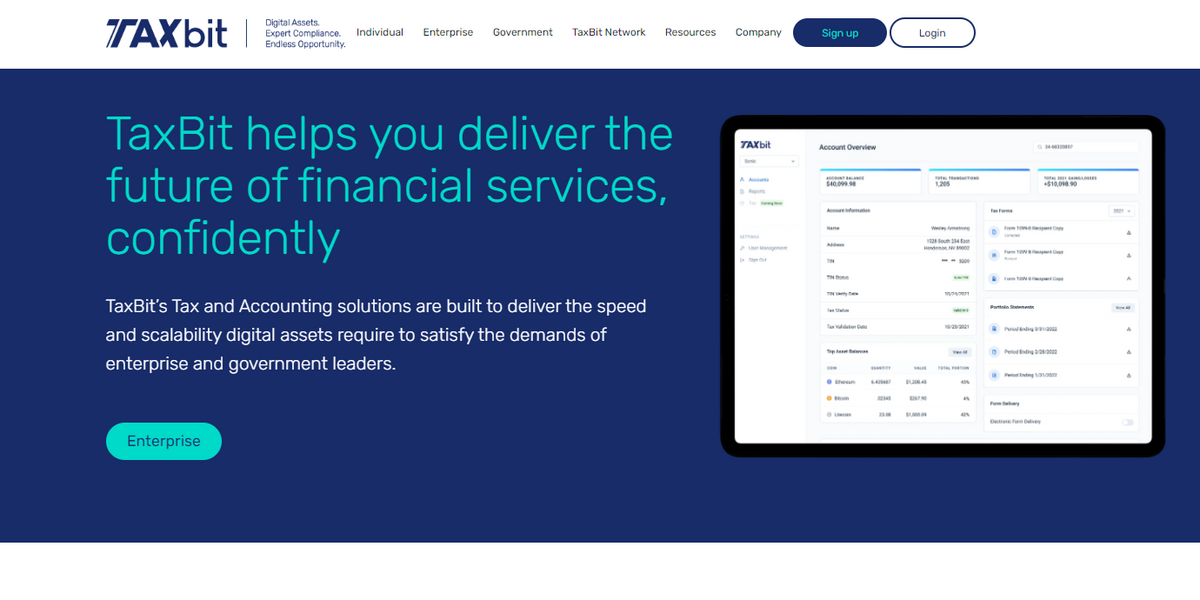

TaxBit

TaxBit is something of a wildcard in this list. While most crypto tax software is aimed at individuals, TaxBit offers powerful tools for institutional and entreprise-level crypto traders and investors.

The platform is designed to scale and features powerful and accurate tax reporting. TaxBit has been built from the ground up by CPAs and tax professionals, making it a thorough and robust tool for your tax preparation.

Customer satisfaction is paramount at TaxBit. The firm has attracted and retained over five million taxpayers in the United States alone. TaxBit also integrates with popular exchanges. Most importantly, TaxBit offers basic services completely free, with no caps on transactions.

Pros

- Powerful, scalable solution for institutional-grade customers

- Basic crypto tax reporting services and forms for free

- Easy integrations with top exchanges

Cons

- Complex user-experience geared for professionals

- Limited DeFi and NFT tax services

- Limited support outside the United States

TokenTax

Rounding out our list of crypto tax software tools is TokenTax. TokenTax doubles as both a software provider and a fully-fledged crypto tax accounting firm. The platform offers all the standard services and features like portfolio trackers and capital gains tax calculators, but provides a human touch as well.

TokenTax goes the extra mile by giving users access to genuine human tax professionals to guide them through their tax return. This helps users make informed decisions and reduce their tax liability. The platform also provides detailed guides on how DeFi and NFTs are taxed. This helps to bring clarity to these complex topics.

Where TokenTax falls short is in its accessibility. The platform doesn’t offer any free tax services and only supports users in the United States. On top of that, pricing tiers are expensive, when compared to other providers in this list.

Pros

- Extra support available from human tax professionals and CPAs

- Comprehensive features and tools, including calculators and portfolio tracking

- Detailed guides on DeFi and NFT taxation

Cons

- All services are behind a paywall

- Only available in the United States

- Expensive pricing tiers

On The Flipside

While undeniably helpful, crypto tax software does not guarantee that your tax return will be fully compliant. The regulations around how crypto is taxed are constantly changing and vary from country to country, so you should always double-check your report with a tax professional.

Why You Should Care

Failing to declare your crypto gains to your local tax department could find you a lot of avoidable trouble. Crypto tax software makes this process easier and could save you from a more expensive fine in the future.

F.A.Q.S.

Most crypto tax software providers offer some form of free tax services. However, if you are a high volume trader or have exposure to DeFi or NFT markets you will likely need a paid subscription.

If you don’t file your crypto taxes, you risk being fined or prosecuted by your local tax regulator. You should always pay your crypto taxes, or you might find yourself in legal trouble in the future.

Yes, you can do your own crypto taxes. Please bear in mind that cryptocurrency taxation is a complex and dynamic field that is difficult to navigate correctly. To ensure you don’t make any mistakes, it’s recommended to consult a tax professional.

In theory, all crypto tax software is accurate and will give you a correct tax report. However, you will need to make sure that you correctly input your transaction history, or the automated calculations may be inaccurate. If you have any doubts about your tax report, it is recommended to contact a tax professional.