- TechFlow report indicates a growing interest in crypto projects for China.

- China’s regulations prompt a shift from local to international platforms for Chinese-speaking users and influencers.

- The report emphasizes the importance of understanding China in crypto marketing.

More than a year after the Chinese crackdown on crypto, the industry is returning to mainland China. TechFlow’s latest report shows a noticeable shift in the geographic focus of the crypto industry.

On Monday, May 29, crypto analytics firm TechFlow published a report on the state of the Chinese crypto market. Despite China’s strict regulatory framework, global crypto projects have displayed a growing interest in navigating this challenging yet promising terrain.

Shifting Attitudes Towards the Chinese Market

In a significant shift, many global crypto projects have started considering the potential of the Chinese market more seriously. Since the crypto mining and trading crackdown, many overseas projects have opted to avoid the market.

Sponsored

Since Hong Kong developed a more crypto-friendly regulatory framework, the discourse over China and crypto has shifted dramatically. Many crypto projects are again looking to capitalize on the market, notwithstanding the regulatory hurdles they may face.

In particular, venture funds with Chinese backgrounds benefit most from this change in attitude. Thanks to the size of the Chinese market, these funds dominate the Asian-Pacific crypto scene.

Sponsored

Funds like HashKey Capital, Fenbushi, SNZ Holding, and Animoca Brands are some venture funds with Chinese founders. While these funds are numerous, the report highlights they are not consolidated. Consequently, the funds have less influence than they otherwise would have.

The Importance of the Non-Mainland Chinese Market

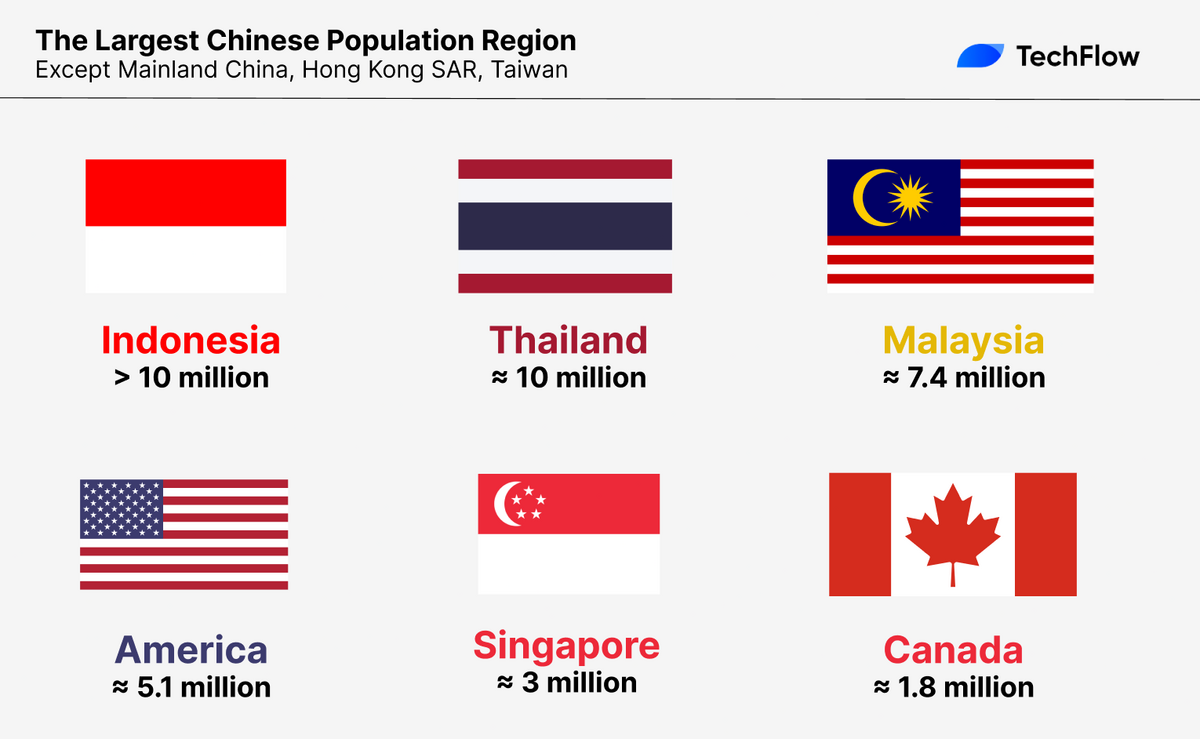

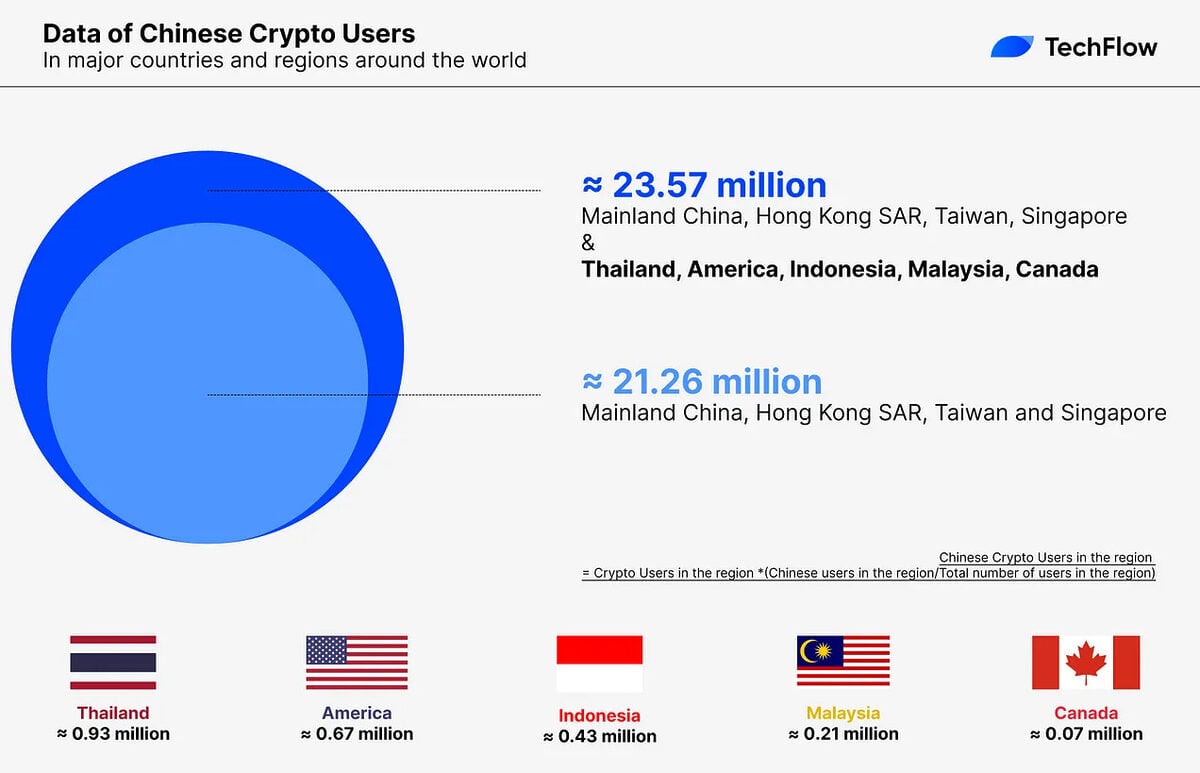

China is not the only country that crypto firms are targeting. Beyond mainland China, the report highlights regions with significant Chinese-speaking populations, such as Hong Kong, Taiwan, Singapore, and Malaysia. Chinese communities in North America and Europe are also a significant market.

These regions demonstrate strong purchasing power and a significant number of developers, making them attractive for various Layer1 ecosystems. In addition, offshore regions also have a large number of Chinese-speaking crypto users.

Social Media Trends in the Chinese Crypto Market

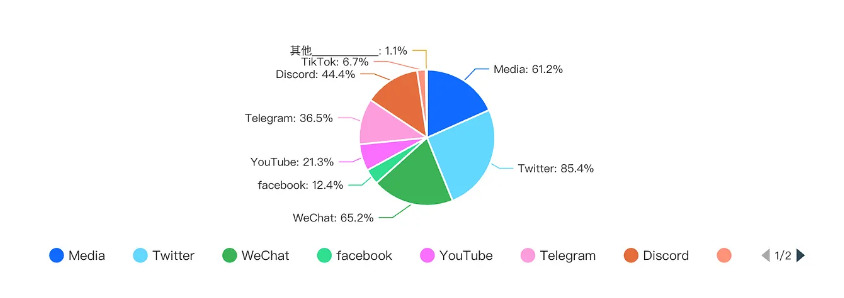

In light of China’s stringent policies, local platforms like WeChat and Weibo have seen a decline in user activity. This has prompted Chinese users to shift to international platforms like Twitter and YouTube.

Consequently, crypto projects targeting the Chinese audience must realign their marketing strategies to accommodate this shift.

Still, despite the reliance on international media, the Chinese audience has unique preferences. The report suggests that crypto projects aiming to tap into that market need to understand these preferences and attitudes to succeed.

On the Flipside

- Despite the positive momentum, China’s regulatory stance remains a significant challenge for crypto projects. Understanding and navigating these hurdles is critical for success.

- Before the crypto crackdown, China used to dominate Bitcoin mining. Environmental concerns were one of the cited reasons for the mining ban.

Why This Matters

The shift in focus toward the Chinese market by global crypto projects represents a considerable change in the crypto landscape. Thanks to the size of the Chinese economy.

Read more about the Chinese take on crypto regulation:

China to Strengthen Cryptocurrency Supervision in New State Administration Proposal

Read about the ongoing debate on CBDCs as a potential threat to liberties: