- Financial markets, including cryptocurrencies, have been range-bound for quite some time.

- The upcoming FOMC meeting could introduce some volatility into the markets.

- Despite Fed Chair hinting at a potential pause, investors’ eyes remain fixed on the outcome of the meeting.

September, historically referred to as ‘Redtember’ in the crypto community, has proven to be a sluggish month for markets this year, with Bitcoin and most altcoins remaining range-bound despite bearish news.

However, the market could be poised for strong turbulence with the FOMC policy meeting looming. Investors across traditional markets and the crypto sphere now remain on edge, wondering if the US Federal Reserve will opt to raise interest rates once more.

FOMC Decides: Rate Hike or Skip?

After eleven consecutive rate hikes since March 2022, the US Federal funds rate currently stands at 5.5%. With the US projecting an annual inflation rate of 3.2%, significantly exceeding the Federal Reserve’s target of 2%, the FOMC could be determined to continue raising rates until inflation is under control, further pushing the first rate cut down to next year.

Sponsored

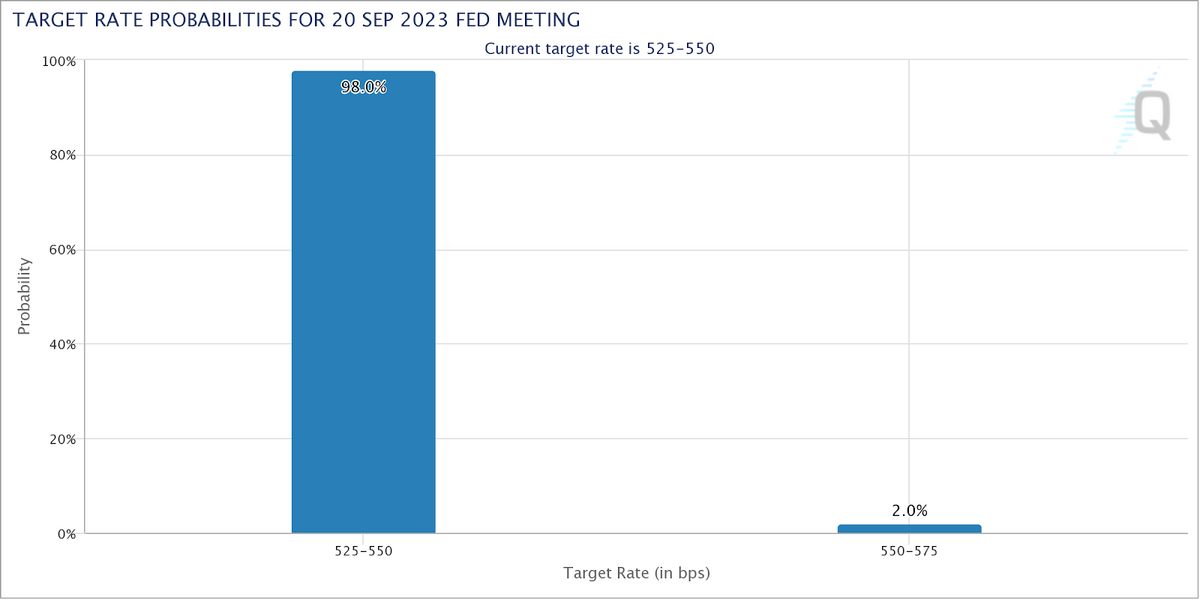

Although analysts anticipate that the Federal Reserve will maintain rates in September, recent data, including August’s Consumer Price Index (CPI), which exceeded expectations by jumping to 3.7% from 3.2% in July, could lead the policymaker to consider another 25 bps rate hike by year-end.

Nevertheless, Fed Chair Jerome Powell and his colleagues have hinted at a potential pause in rate hikes for September as they approach peak interest rates and the US economy shows subtle signs of recovery.

Investors remain firmly fixed on the upcoming FOMC meeting on September 20 as they await results for direction.

How Will FOMC Rate Hikes Impact Crypto?

The FOMC’s decisions have historically had a significant impact on financial markets, including crypto. This is because raising interest rates influences market sentiment as borrowing becomes more expensive, leading investors to withdraw their investments, resulting in increased sell pressure or sustained buying pressure.

Sponsored

Should the Federal Reserve raise interest rates in the next three meetings, the crypto sector could face a market-wide crash, with many assets expected to register new yearly lows. However, if the FOMC chooses not to raise rates, the market could respond positively, potentially sparking a short-term rally.

The following meetings are crucial, as the FOMC monitors inflation and assesses whether raising rates or maintaining its current stance is appropriate.

On the Flipside

- While the economy exhibits robust activity levels, experts caution that Powell’s non-committal stance on future rate hikes might create uncertainty and hinder long-term planning for businesses and investors.

- Over 98% of analysts predict the FOMC will remain hawkish until May 2024.

Why This Matters

FOMC meetings provide crucial insights into the economic market’s health, making them highly relevant for the cryptocurrency community. The Federal Reserve’s interest rate decision could shape the market’s trajectory for the rest of the year.

FTX Customer Claim portal goes back online:

FTX Back to Normal Operation After Freezing User Accounts

Find out how Mark Cuban lost over $900,000:

Billionaire Mark Cuban’s Wallet Hacked For $900K