- Crypto investment funds have extended their inflows streak.

- Bitcoin funds continue to lead the pack, bolstered by economic data.

- U.S. investors are back in the driver’s seat.

Amid increasing optimism that the U.S. SEC will approve a spot Bitcoin exchange-traded fund, crypto investment products have continued to see inflows in recent weeks. These inflows continued last week, extending the streak for a sixth consecutive week.

Crypto Funds Rake in $767M in Six Weeks

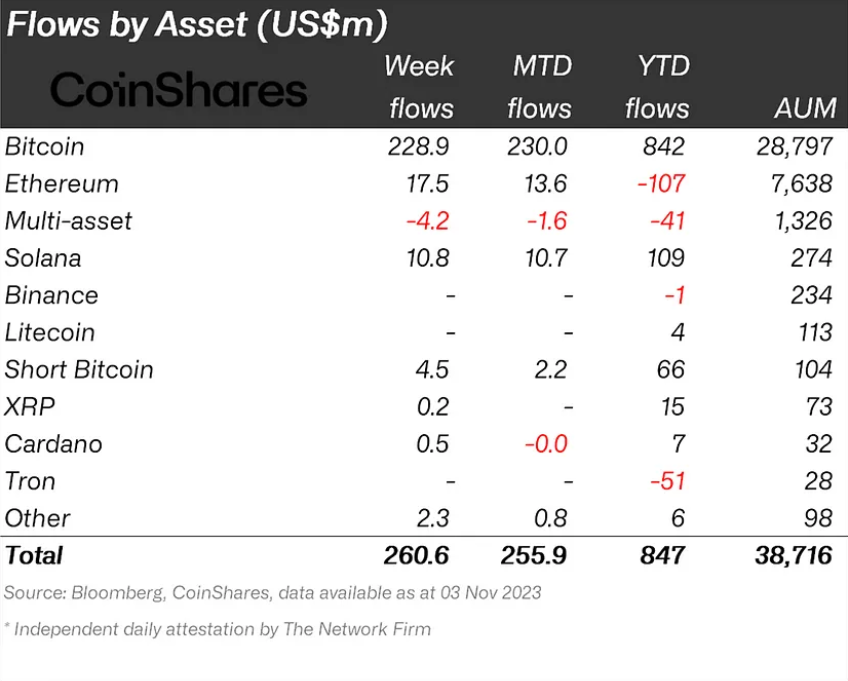

Last week, crypto investment funds saw inflows totaling $261 million, bringing the total inflows in the last six weeks to $767 million, according to CoinShares’ latest report released on Monday, November 6.

The asset manager highlighted that the recent streak of inflows surpassed the $736 million total inflows seen in 2022 and replicates the run of inflows experienced in July 2023. At the same time, they pointed out that the streak is the largest since the end of the 2021 bull run.

Sponsored

Bitcoin funds again led the pack with $229 million inflows last week, bolstered by underwhelming U.S. macroeconomic data. Among altcoins, Ethereum funds finally broke their extended outflows streak to record $17.5 million in inflows, the largest amongst altcoins during the week and the largest for the asset since August 2022. Solana funds meanwhile continued their positive run as the most beloved altcoin by investors, raking in $11 million.

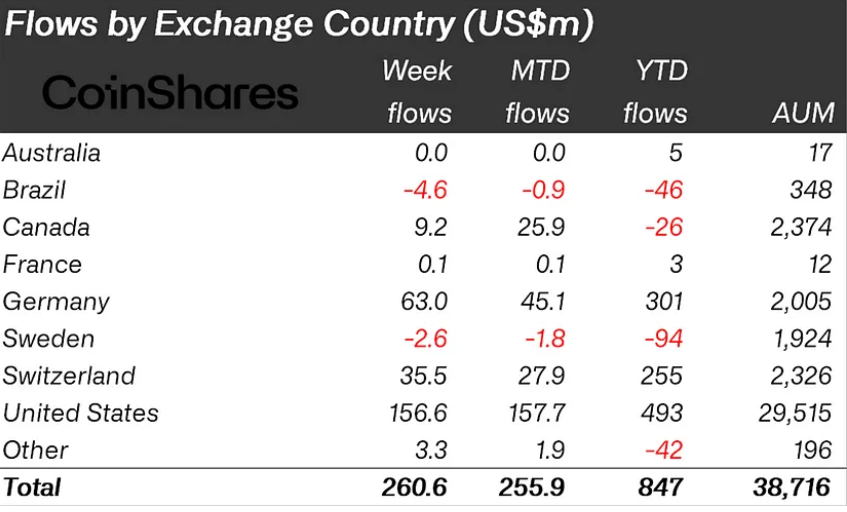

While European investors have typically driven crypto fund inflows in recent weeks, CoinShares highlighted that last week marked a change as U.S. investors were in the driver’s seat.

U.S. Investors Take the Wheel

According to CoinShares, U.S. investors were the largest contributors to last week’s inflows, with $157 million. In comparison, German investors, the second-largest contributors, brought in $63 million.

When asked about the reason for the recent surge in U.S. inflows, CoinShares Head of Research James Butterfill told DailyCoin that it was difficult to pinpoint while also hinting that these investors are yet to dive in fully.

Sponsored

"This [the reason for the recent rise in U.S. inflows] is actually quite a tricky one to pin down. It may be a delayed response to the DTCC listing BlackRock's ticker for its spot ETF. Aside from that, there hasn't been any new news to attribute to these inflows. Ultimately, I think these inflows, from a U.S. perspective, are relatively small, and I expect U.S. investors to continue to hold out for the listing of spot-based ETFs," Butterfill noted.

Still, the recent surge in U.S. inflows suggests increasing bullish sentiment.

On the Flipside

- Analysts have suggested that the U.S. SEC will unlikely approve a spot Bitcoin ETF till 2024.

Why This Matters

Crypto fund flows provide insight into market sentiment. Last week’s data suggests that investors remain pretty bullish, with U.S. investors also ramping up bets.

Read this to learn more about last week’s record inflows:

Crypto Inflows Skyrocket Amid Bitcoin ETF Optimism

Learn about Elon Musk’s Grok:

What Is Grok and Why Has It Inspired Over 400 Crypto Tokens?