- Last week, inflows to crypto funds tapped a 15-month high.

- Bitcoin funds showed significant dominance.

- The surge comes amid recent spot Bitcoin ETF anticipation.

After a long period of uncertainty, crypto fund investor sentiment appears to have flipped firmly positive. Driven by hopes of a spot Bitcoin ETF approval in the U.S., crypto funds saw inflows continue for a fifth consecutive week and tap a 15-month high last week.

Bitcoin ETF Optimism Drives Record Inflows

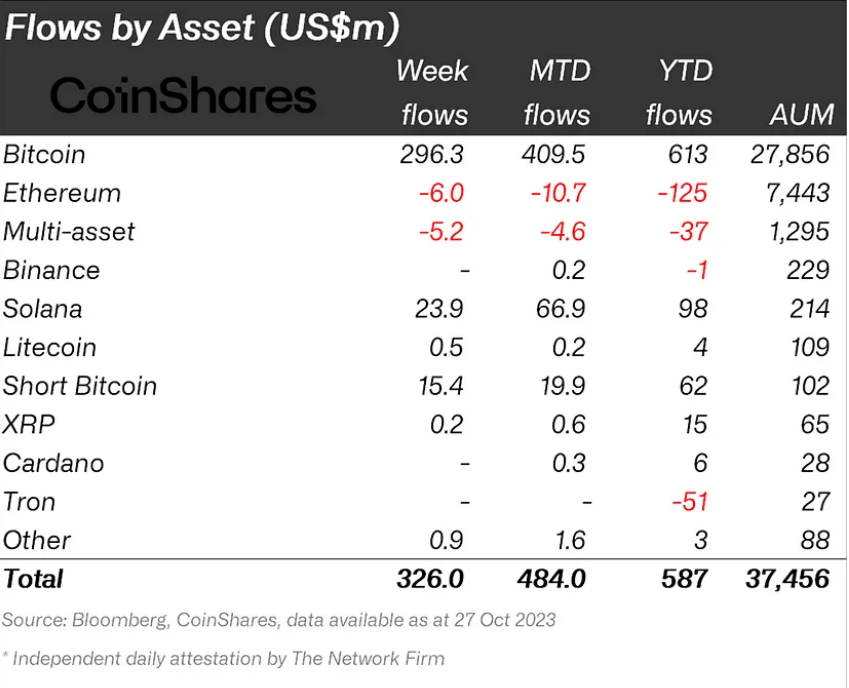

On Monday, October 30, CoinShares reported that crypto-based investment funds recorded inflows totaling $326 million last week. According to the firm, last week’s inflows are the highest digital asset investment products have seen since July 2022, marking a 15-month high. Bitcoin funds dominated with $296 million in inflows, representing 90% of the total received by all crypto funds.

CoinShares attributed last week’s inflows and Bitcoin’s significant investor appeal to rising optimism that the U.S. SEC would soon approve a spot Bitcoin ETF product.

Sponsored

In recent weeks, spot Bitcoin ETF anticipation has been the biggest market mover as investors wait on the edge of their seats for the SEC’s decision. Reports of the listing of BlackRock’s Bitcoin ETF product with the ticker $IBTC on the Deposit Trust & Clearing Commission (DTCC) stoked significant excitement in crypto circles that drove Bitcoin to a new yearly high above $35k last week.

Wen Spot Bitcoin ETF?

While the SEC reserves the right to deny recent spot Bitcoin ETF applications, JPMorgan has expressed optimism that the agency will greenlight multiple applications in the coming months.

This view has also been championed by Neel Maitra, a former member of the Gary Gensler-led SEC’s crypto division. Addressing the SEC’s market manipulation concerns, Maitra hinted that they might be exaggerated. The former SEC official highlighted similarities between futures products approved by the agency and the spot variant, which the regulator has continued to turn down.

Sponsored

Spot Bitcoin ETF proponents argue that the product will provide a familiar on-ramp for institutional investors that could see trillions of dollars flow into the asset and drive prices significantly higher.

On the Flipside

- CoinShares suggested that investors are still erring on the side of caution, as last week’s flows are only the 21st highest on record.

- It remains to be seen how long the excitement over the prospect of a spot Bitcoin ETF approval can be sustained.

- Solana investment funds also saw significant inflows totaling $24 million.

Why This Matters

Flows to crypto funds provide insight into investor sentiment. Last week’s flows suggest optimism is rising amid the market’s anticipation of a spot Bitcoin ETF approval.

Read this to learn more about the role of European investors in driving inflows to crypto funds:

Crypto Extends Inflow Streak as European Dominance Continues

Find out why a leading industry executive believes regulation is at the driver’s seat of the next bull run:

Crypto Bull Run Fueled by Regulations? Industry Exec Weighs In