Digital assets markets are famous for their high price fluctuations. In volatile markets though, irrational sentiments come of extreme importance.

While there are numbers of emotions that we go through when trading, fear, and greed are the major ones that drive our hasty decisions. There are tools and techniques on how to control emotions. In this article, you’ll learn about Crypto Fear and Greed Index, an effective tool to keep calm and make emotions work for your benefit.

What is Crypto Fear and Greed Index?

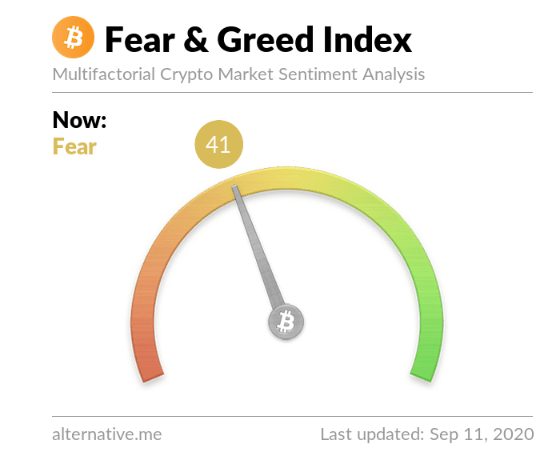

In general, the Crypto Fear and Greed Index shows what emotion is driving the cryptocurrency market at a specific time. It is a neutral statistical tool that helps to understand whether it is ready to rise or to correct.

Sponsored

Designed after the CNNMoney Fear and Greed Index, the crypto-related equivalent might help to have a better view on what’s going on in the digital asset markets, to keep the mind clearer and to save from expensive mistakes.

How Fear and Greed affect crypto markets?

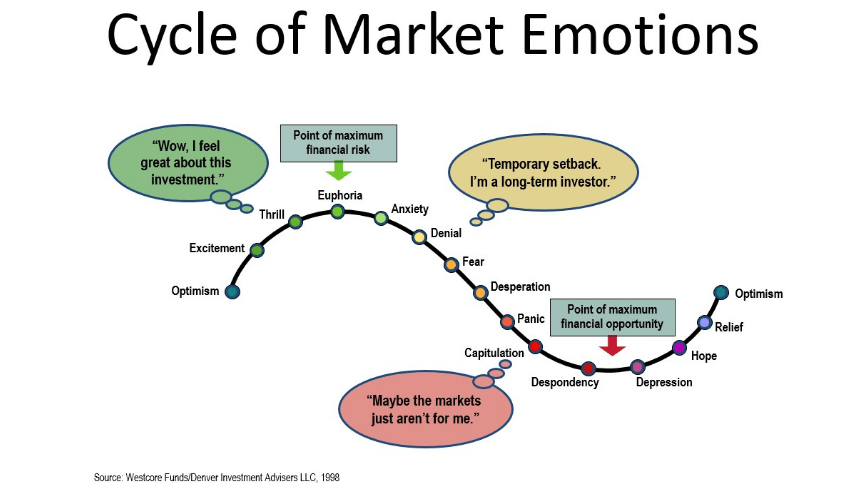

Emotions play an important role in how we think and behave. They have a significant influence on the decisions we make. But losing a clear mind might be a critical factor leading to mistakes when deciding whether to enter or exit financial markets.

Traders get greedy when prices skyrocket. They enter the market right before its correction. And on the contrary, they panic when prices begin to fall. Many of them close the positions just right before the best opportunities to buy into.

Greed or FOMO

Fear is one of the major emotions that makes the strongest impact when making decisions. While there are various types of fear in terms of trading, the Fear of Missing Out an opportunity (FOMO) is one of the most common issues.

FOMO appears when markets are greening. It stems from the greed of missing the possible profit, which you could make by buying digital assets impulsively, no matter what the price is or what other technical indicators show. The prices, however, are used to go through corrections after the bull runs. And thus greed brings a high risk of overpaying and losses.

In a situation when the market is ripe for a correction, the crypto Fear & Greed Index would indicate greed. The higher the greed level, the higher chances of the upcoming sell-offs.

Fear of Losing

On the other hand, another form of fear, a Fear of Losing, signals the nervousness and uncertainty across the market. The fear of losing money triggers a few classical models of behavior: avoidance or overreacting.

In the first case, it paralyzes traders from exiting the positions when the markets are falling. They delay the realization that loss is already happening and remain inactive, which finally leads to much higher losses and bigger damage.

Meanwhile, in terms of overreaction, the fear of losses activates extreme cautiousness. The traders worry about possible trend reverses, they hesitate their trading strategies and close their positions too soon, when the markets are still green.

Nevertheless, when crypto Fear & Greed Index indicates fear, it usually means the prices of digital assets are falling. On the other hand, the ongoing sell-offs suggest there are good buy-in opportunities. The higher the fear index, the higher chances to enter the market successfully.

How the Crypto Fear and Greed Index is measured?

In order to calculate the crypto Fear and Greed Index, the experts gather specific data from separate sources, each of which has a different percentage of influence on the overall result. The sources include data of:

- Volatility

- Volume

- Social media

- Surveys

- Dominance

- Searches

1. Volatility

The coin’s current price fluctuations are compared to historical price volatility, which is mainly the average values of 30 / 90 days Moving Average (MA). If the recent price fluctuations are higher than the historical ones, the fact indicates fear in the market.

2. Volume

The recent trading volume of the certain cryptocurrency is compared to its historical volume data (mainly to the value of 30/90 days Moving Average). In case the current volume of buy-ins is higher than the historical one, it indicates greed or bullish sentiments.

3. Social media

Mentions on social networks like Twitter or Reddit also come as a source. The more positive and bullish posts, comments, hashtags relating to a certain cryptocurrency appear on the social networks, the higher the chances of greed and vice versa.

4. Surveys

Alternative.me, the Crypto Fear & Greed Index publisher, conducts cryptocurrency related surveys among various crypto communities. Although temporarily paused, the polls gather 2-3k votes per survey and are also counted into the calculation of the market sentiment index.

5. Dominance

The size of the total market value plays as leverage among Bitcoin and altcoins. The BTC dominance increases when altcoin markets witness a higher fear index and thus the decrease in prices. On the opposite, when Bitcoin loses power, the market turns to other digital assets as a more profitable option.

6. Searches

The monthly Google Trends’ search volume, related to a certain digital asset also works as an indicator of the market’s interest. In this case, however, the keywords related to the asset are most important. The more positive searches indicate growing greed, the more pessimistic ones reveal the strengthening fear.

What does the Crypto Fear & Greed Index look like?

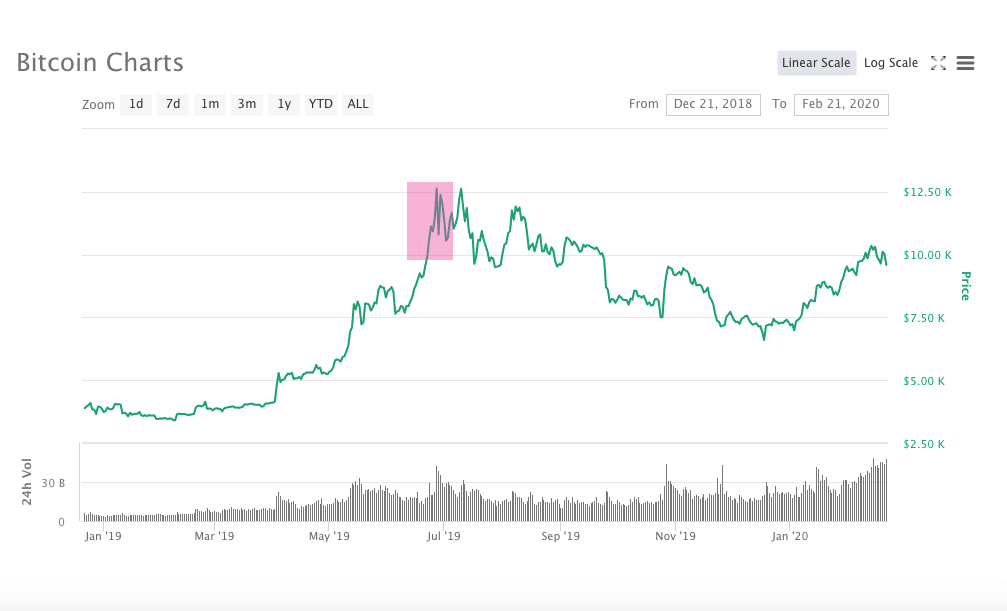

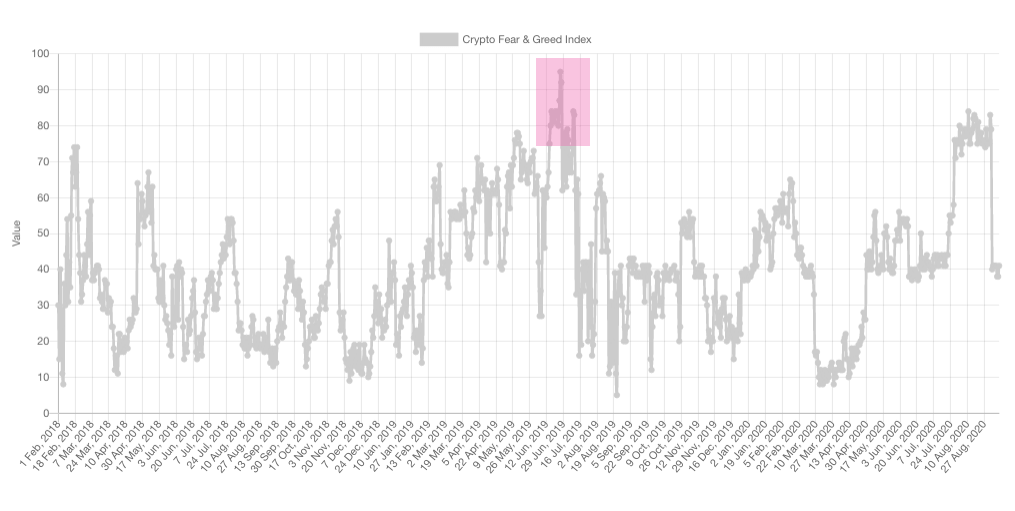

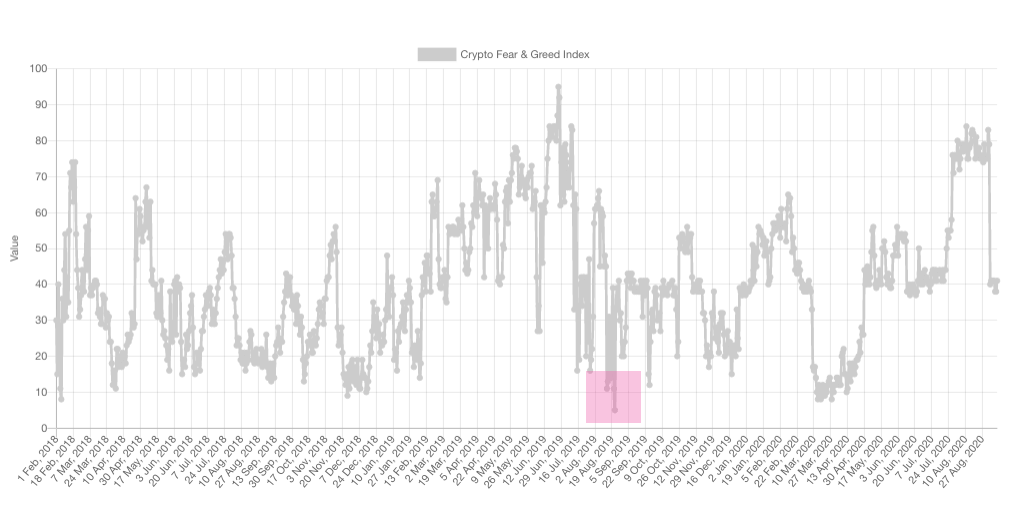

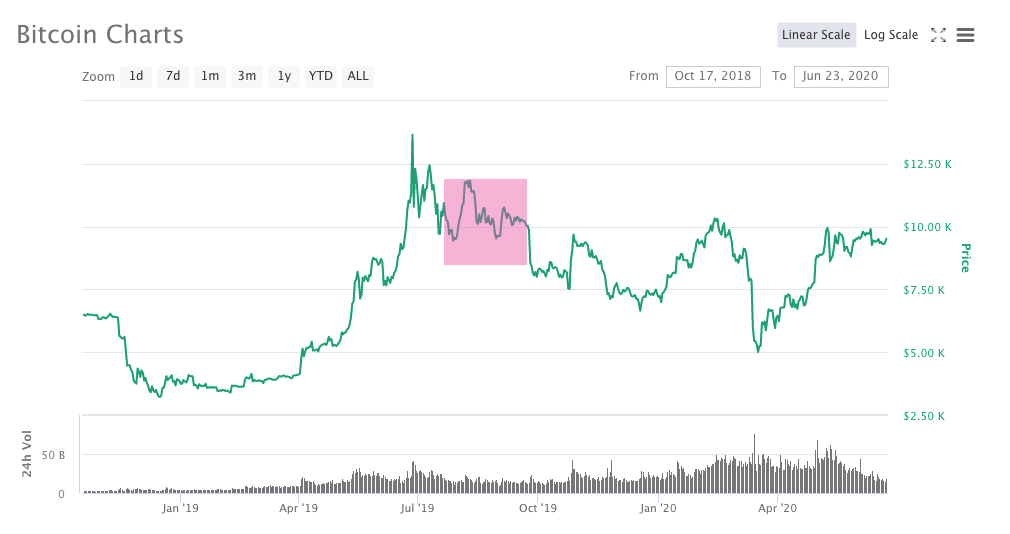

One of the best examples of the greedy markets is June 2019. Bitcoin’s price charts of the time illustrate the impressive bull run. The world’s leading cryptocurrency then was on a four-month rally for the first time since the prolonged “crypto winter”. BTC price increased three-fold from February and approached $13.000 on June 27, according to CoinMarketCap.

Respectively the Crypto Fear & Greed Index rose to an extremely high (over 80) greed zone at a time and stayed there for several weeks. It even reached its record highs of 95 on June 26, as shown in the chart of Alternative.me.

As both the charts reveal, the market correction doesn’t take long to come. The extreme greed exhausted and began to decline. The cautious Bitcoin investors and traders took profits, the sell-offs triggered price drops and further downtrend, that brought the bears back to the market.

And here comes another example of the extremes in the Crypto Fear and Greed Index. This time, extreme fear. According to the chart, the index fell to the lowest point of 5 on August 22, indicating the biggest fear ever recorded.

In the meantime Bitcoin sat at a $10.000 price at a time, however, it also was on a bigger downtrend. The extremely high fear level and lower BTC price does not trigger bulls to buy back into the asset. The BTC price has not changed significantly and continued to drop until January 2020.

Why Crypto Fear and Greed Index is a useful tool?

As well as any other market, the cryptocurrency industry is full of success and loss stories. Trading profitably requires knowledge and skills. However, even the best fundamentals and technical strategies might fall when the trader’s emotions come into play.

Keeping emotions under control and out of the way might contribute to profitable trading. The thing is, this is not easy to do even to experienced traders.

However, objective market sentiments’ data might help. Using the tools like Crypto Fear and Greed Index provides traders with clues of what emotions are driving the volatile digital asset markets. The knowledge of the upcoming correction or bull run might help to take advantage of the emotions and become a profitable trader.