- Bitcoin has surged in price recently, reaching within 10% of its all-time high.

- Analysts remain divided, with some warning of a potential correction, while others look toward the upcoming halving.

- The upcoming halving has emerged as a major factor influencing the current market sentiment and price increase.

Bitcoin has seen a significant upswing in recent weeks, surging over 20% since the last Bitcoin DailyCoin Regular two weeks ago. This bullish run has seen the cryptocurrency reclaim the crucial $60,000 support level, sparking excitement among investors and analysts alike. The question of “how long until all-time high?” lingers in the minds of many.

To keep our readers informed, the DailyCoin team is committed to providing comprehensive updates. In this Bi-Weekly DailyCoin Bitcoin Regular, compiled by our expert Kyle Calvert, we will explore recent developments surrounding the Bitcoin ETFs and explain the recent price fluctuations. Additionally, we will cover community sentiments and analyst predictions.

Table of Contents

News and Events: Understanding Impacts

BTC Price Prints Massive Monthly Candle

Bitcoin has yet to reach its highest point ever, even after its remarkable surge in February. Nonetheless, bullish investors have achieved a new milestone. The closing of February 29 marked a decisive victory for Bitcoin bulls. With a whopping increase of 43.55%, February has recorded the largest gains for BTC/USD since December 2020.

Bitcoin ETFs Break Records in Trading Volume

The recent surge in Bitcoin’s price has accompanied a significant investor interest in US Bitcoin ETFs. On February 28th, these ETFs achieved a new milestone, recording a staggering $7.69 billion in trading volume. This remarkable figure represents more than double the previous record of $4.66 billion set on the launch day of these ETFs in January.

Reddit Buys Bitcoin, Ethereum, and MATIC

Reddit has taken a major step towards going public. The company officially submitted its S-1 filing with the SEC, marking its intention to hold an IPO. Reddit disclosed that it had allocated some of its assets to the cryptocurrency market, holding Bitcoin (BTC), Ethereum (ETH), and Polygon’s MATIC token.

Community Sentiment

Independent analyst Ali has sparked discussion in the cryptocurrency community after sharing a chart suggesting Bitcoin’s price may encounter little resistance on its current upward trajectory.

Based on IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) metric, the chart indicates a significant support zone between $54,300 and $56,200, where nearly 900,000 addresses hold roughly 500,000 BTC. This suggests a large buying base at this price point, potentially acting as a buffer against price declines.

Sponsored

However, not all analysts share Ali’s optimism. Some have expressed concerns about the sustainability of the current rally, citing factors like the market structure and high funding rates as indicators of excessive leverage use. This, they warn, could lead to a sharp correction driven by forced liquidations.

Pseudonymous analyst Rekt Capital, for example, believes a “pre-halving retracement” is still a possibility. They argue that historical data suggests major Bitcoin price movements have typically occurred after halving events, not before. This implies that the market may not fully reflect the potential impact of the upcoming halving, scheduled for sometime in 2024.

Current Outlook

Bitcoin has seen a significant surge in price in recent months, climbing steadily since the beginning of February. After breaking above $52,000, the cryptocurrency has continued its upward trend, currently only 10% below its all-time high. This surge has sparked optimism among analysts, who believe 2024 could be a banner year for Bitcoin.

The recent price increase comes from a strong performance in February, where Bitcoin printed a nearly $20,000 monthly candle, signifying a significant price rise throughout the month. This momentum now looks to carry over into March, with the cryptocurrency still hovering around the $62,000 area.

Analysts point to several factors contributing to Bitcoin’s current bullish run. One key factor is the upcoming halving event, which is expected to occur in May 2024. The halving, which cuts the amount of Bitcoin rewarded to miners in half, is historically linked to price increases due to its impact on supply and demand dynamics.

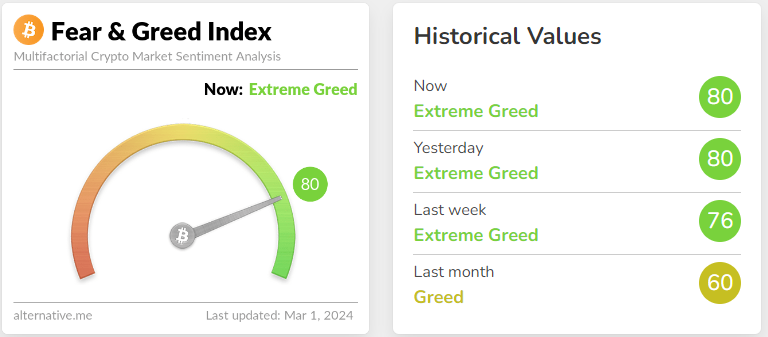

Fear and Greed

The way people feel significantly impacts the cryptocurrency market. The Fear and Greed Index plays a crucial role in navigating these emotions. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 80, indicating an increase of 8 points compared to the reading from two weeks ago. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- Bitcoin price trends demonstrate that repetitive patterns don’t guarantee future outcomes, indicating the need for cautious optimism amidst market speculation.

- While historically resulting in a price increase, the halving doesn’t guarantee it.

Why This Matters

This confluence of institutional adoption, accessible investment vehicles, and a potential supply shock paints a bullish picture for Bitcoin, potentially influencing the broader crypto market’s trajectory.

To learn more about the recent surge in Bitcoin ETF volumes and its potential impact on the price of Bitcoin, read here:

Bitcoin ETF Volumes Hit Record-Breaking $8B as BTC Taps $64K

To learn more about the recent volatility in Bitcoin’s price and the impact it had on traders, read here:

$736M Liquidated: Bitcoin Seesaw Gets Traders Rekt Both Ways