- The crypto market experienced a slump post-Bitcoin ETF approval.

- Crypto market inflows topped $51B over the past day.

- Market sentiment saw an uptick.

The crypto market has endured its fair share of volatility since its inception, but few rollercoasters matched the whiplash of the last month. Expectations ran high that the approval of Bitcoin ETF products by the US Securities Exchange Commission (SEC) on January 10 would soar to new heights for the industry.

Contrary to expectations, cryptocurrency prices experienced a sharp decline, leading to a significant downshift in market sentiment. However, in the past 24 hours, an influx of $51 billion into the crypto market has brought welcome relief to weary investors.

$51B Crypto Market Boost

The $51 billion boost has pushed the total crypto market capitalization from $1.65 trillion to $1.71 trillion over the last 24 hours, per CoinMarketCap, representing a 3.6% increase.

Sponsored

Examining the movement in the total crypto market capitalization since the Bitcoin ETF approvals, the total valuation of all coins peaked at $1.81 trillion on January 11, the day after approvals. However, the market tumbled shortly after, leading to a local bottom of $1.51 trillion by January 23rd, equating to a 16.6% drawdown in value.

Since bottoming, the crypto market has charted a gradual upward trajectory leading into the $51 billion injection over the last 24 hours.

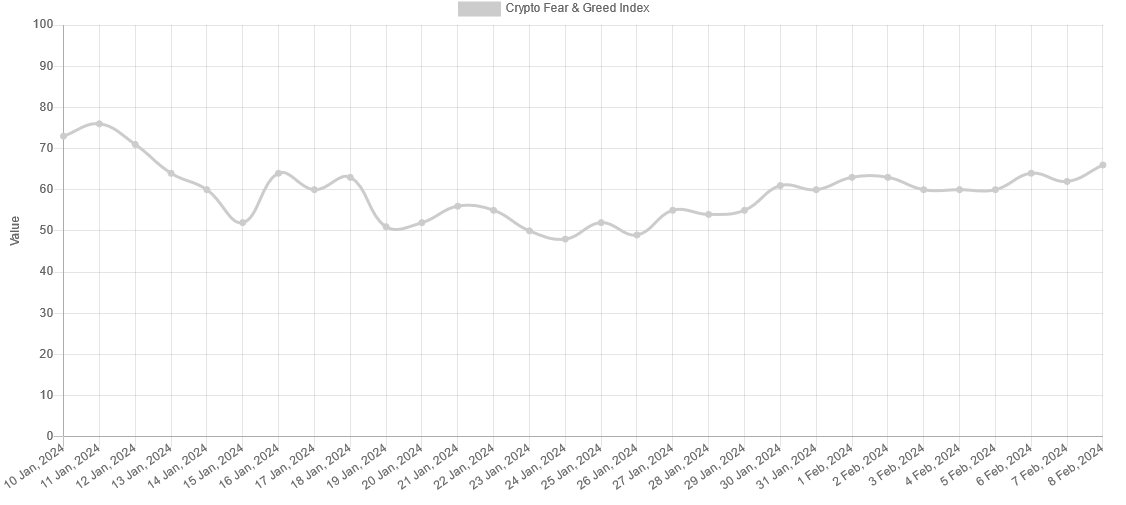

Meanwhile, market sentiment has also lifted, with crypto prices seemingly bottoming. The Crypto Fear and Greed Index (CFGI) has shifted further into greed territory over the past day, indicating increased expectations of further short-term price rises.

Market Sentiment Edges Higher

The CFGI saw a four-point increase on February 8 to a reading of 66, from 62 yesterday. The past month saw a rollercoaster of market sentiment, nudging into extreme greed with a reading of 76 the day after Bitcoin ETF approvals, sinking as low as 48 on January 24, shortly after BTC lost $40,000 support.

The CFGI is a metric compiling data from sources that cover factors such as volatility, market momentum, and social media to gauge market sentiment. It operates on a scale of 0 to 100, corresponding to the four zones of extreme fear, fear, greed, and extreme greed. 0 represents extreme fear, while 100 equates to extreme greed.

On the Flipside

- The dive in market sentiment post-SEC ETF approval was attributed to sustained outflows from Grayscale‘s Bitcoin Trust.

- Bitcoin influence continues to dominate the crypto market, with BTC dominance increasing to 52.8% during the past day.

- The Bitcoin halving, a historically bullish event for the entire industry, is set to occur on April 17.

Why This Matters

The recent cryptocurrency market rally indicates a renewed resurgence in enthusiasm and interest in digital assets following a month of pessimism. Although the BTC ETF approval did not result in an immediate “God candle,” it is important to note that the US SEC provided regulatory clarity on BTC, paving the way for institutional and mainstream adoption.

Read more about the post-Bitcoin ETF market slump here:

Why the Crypto Markets Are Struggling Against Expectations

Find out about the growing ties between China and the Hong Kong crypto market here:

Hong Kong Crypto Intrigued by “Virtual Asset Connect Scheme”