- Cardano Bulls have made a triumphant return after weeks of absence.

- Cardano Community stirs controversies and debate over network developments.

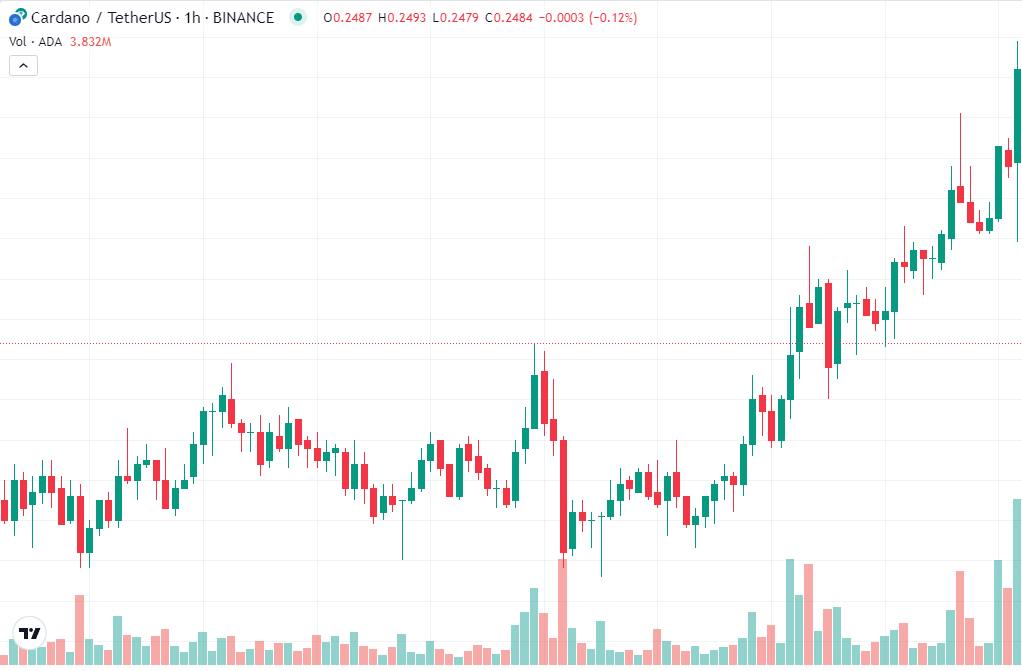

- Cardano’s recent price performance is shaping up a positive trend for the token.

September has been an eventful month for the Cardano ecosystem, marked by drama, reactions, and a bullish resurgence. In this edition of our bi-weekly update on Cardano, we turn to our expert, Insha Zia, to provide insights into these developments.

Table of Contents

News and Events: Understanding the Impacts

ADA Bulls Slip Through Bears’ Claws

Since Cardano lost its grip on the critical $0.3 price level in August, every bullish momentum has proved to be fleeting, with the Bears consistently driving ADA back into their territory.

Sponsored

Nevertheless, Cardano Bulls have staged a remarkable resurgence in the knick of time. Despite ADA’s prolonged period of underwhelming price performance and the prevailing bearish sentiment, the Bulls have successfully propelled ADA beyond $0.25, temporarily blemishing hopes of registering a new yearly low.

The following weeks are crucial for the Bulls to hold the momentum, or the Bears will once again take control and push ADA further into the depths.

Charles Hoskinson Rekindles Feud with XRP Community

Cardano Founder Charles Hoskinson is no stranger to receiving heat from the XRP community for his bold opinions on their ongoing case with the US Securities and Exchange Commission (SEC).

After mending bridges with the XRP community, the crypto pundit has once again complicated his already contentious relationship with them by pulling apart their claims of the SEC being bribed by Ethereum developers, labeling their opinions on the matter as ‘conspiracy theories.’

Catalyst Fund Sparks Mixed Reactions

Project Catalyst, Cardano’s engine for grassroots innovation and growth, recently concluded its largest funding round after an intense two-month period of proposal submissions and voting.

Sponsored

Out of a staggering 1,467 proposals received, only 192 projects secured approval, with an astounding 408,000 votes cast during the process—a record-breaking turnout in the program’s history. Despite being heralded as Cardano’s most successful funding round to date, it was not without its controversies and challenges.

As Project Catalyst prepares to welcome its next cohort of projects, the community felt that the results were bittersweet. They raised several concerns about the funding round, particularly regarding the influence of Whales and the lack of diversity in applicants. Several users alleged that larger wallets consistently downvoted proposals not associated with existing Cardano infrastructure.

Some members even pointed out that 63% of the 50 million ADA ended up with only ten teams, labeling them as the de facto gatekeepers of Cardano. The lack of diversity in applicants was particularly noticeable in Catalyst’s voting data, with this year’s most voted projects coming from Paima Studios and other established development teams.

Community Strikes at Researcher’s Cardano TPS Critique

Cardano’s upcoming Input Endorsers, a Layer-1 solution promising a 20x increase in transaction per second (TPS), faced scrutiny from crypto researcher Justin Bons, who questioned the accuracy of this claim and highlighted that it was insufficient for competing with existing systems.

Bons’ comments landed him in hot waters, with many Cardano community members attacking the researcher’s credibility. Still, despite the backlash, Bons stood his ground, revisited his initial calculations, and recalculated a more accurate estimate for the network, suggesting it could reach speeds of up to 400 TPS, stirring drama.

While many Cardano community members dismissed the TPS metric as overly simplistic, labeling it a lazy system, several developers and influencers had interesting takes. Cardano Yoda shed light on many inaccuracies in Justin Bons’ calculations, underscoring that the researcher missed the mark by a few zeros.

The influencer emphasized that Input Endorsers create transactions exceptionally faster than current rates, potentially reaching 1,500 TPS.

Cardano Joins in on Zero-Knowledge Privacy Hype

Zero-knowledge cryptography has emerged as a solid trend for blockchain privacy, with major platforms like Ethereum and Polygon exploring innovative solutions. Soon joining the growing cohort is Cardano with its privacy sidechain, Midnight.

Cardano privacy blockchain, Midnight, is an exciting solution developers have been working on this year. Months after being introduced in November 2022, the protocol, along with its native token DUST, is set to make its DevNet debut soon.

Powered by zero-knowledge proofs, Midnight will usher in a new era of secure, private, and efficient blockchain applications on Cardano. The protocol will offer the means to verify transactions without exposing the underlying data, setting it apart from many existing platforms, including the Cardano mainnet.

Current Outlook

At the time of writing, ADA exchanged hands at $0.252, surging 5% over the past week. Cardano’s recovery has instilled investors with a fresh wave of optimism. This was particularly evident in investor sentiment, which at the time of writing remained predominantly bullish across exchange, derivatives, and on-chain markets.

This enthusiasm was also reflected in Cardano’s long-to-short ratio flipping from negative to positive, signaling a considerable surge in investor interest.

With the Bulls currently steering the ship, ADA could move toward the next liquidity range at $0.26 in the following weeks. However, should the Bears regain control, they could drive ADA back under $0.25 and potentially toward the demand zone at $0.21.

As the battle for dominance over ADA’s price action continues, the community is on the edge of its seats, eagerly awaiting the next candle.

On the Flipside

- Cardano has only grown by 1% this year, whereas its rivals Ethereum and Bitcoin have an average of 47% gain.

- IntotheBlock reports that over 95% of ADA holders remain in losses.

- Polygon and Ethereum are years ahead of Cardano in the Zero-knowledge-based solutions landscape.

- Although robust in security and privacy, Zk-proofs can be computationally expensive.

- Market dynamics can be unpredictable, so it is essential to consider alternative perspectives and opinions when evaluating the potential future performance of ADA.

Why This Matters

ADA’s recent performance is shaping up a positive trajectory for Cardano. With the Bears sidelined and the macro conditions leaning towards a Bullish narrative, things are looking suitable for Cardano investors.

Will the SEC face consequences for consistently delaying BTC ETF proposals?

SEC Plays Hardball with Bitcoin ETF Proposals, Sets New Deadlines

Find out why Euro Services on Binance were suddenly suspended:

Binance’s Troubles Brew as Euro Service Is Suddenly Suspended