- The SEC has once again deferred its decision on Bitcoin ETF approvals.

- Some experts suggest it is routine for the regulator to delay proposals until 240 days.

- Still, the SEC could face consequences for its continuous delays.

In a high-stakes race for Bitcoin ETF approval in the US, major players, including BlackRock, 21 Shares, and Grayscale, are locked in a fierce battle. Their pursuit, however, is strewn with challenges, primarily from the US Securities and Exchange Commission (SEC), which isn’t making their mission any easier by handing out more deadlines and leaving everyone in suspense.

The SEC Hands Out More Deadlines

On Tuesday, the SEC rescheduled its decision on a set of Bitcoins spot ETF approvals, causing growing frustration among concerned parties, who now find themselves in a holding pattern, awaiting the SEC’s verdict.

Sponsored

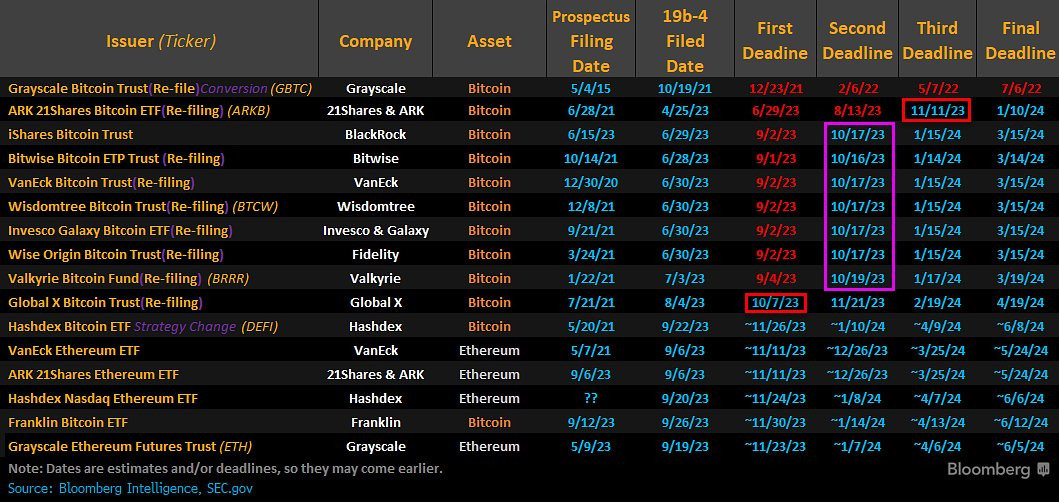

In the new filing, the commission pushed back its final deadline on Cathie Wood’s Ark 21 Shares and GlobalX’s Bitcoin ETF filing to January 2024, citing the need for more time. Interestingly, neither firm had foreseen these delays, as 21 Shares’ decision was initially slated for November 11 and GlobalX’s for October 7.

Adding to the complexity, given the SEC’s track record of delays, proposals slated for October could face similar setbacks, with expert analysts now speculating that these delays could dim hopes for approvals before year-end.

The upcoming deadlines for the SEC to share its decision on seven other planned Bitcoin ETF proposals – BlackRock, Fidelity, Invesco, Bitwise, VanEck, WisdomTree, and Valkyrie – fall between October 16 and 19, with their final deadline set for mid-March.

Normal for the SEC to Delay Rulings

Industry experts emphasized that it’s routine for the SEC to delay its rulings until the end of the 240-day periods, often making waiting for these deadlines anticlimactic. However, with major institutions like BlackRock and Fidelity joining the race, market participants are on the edge of their seats, closely monitoring each deadline.

Sponsored

With Grayscale recently prevailing against the SEC, experts suggest the regulator is under pressure and could face consequences for its consistent delays. In particular, US lawmakers recently scrutinized SEC chairman Gary Gensler, urging immediate approval of the spot Bitcoin ETF proposals, especially after the court deemed the commission arbitrary, capricious, and discriminating.

On the Flipside

- At press time, Bitcoin exchanged hands at $26,215 with a daily trading volume exceeding $11 billion.

- Bitwise recently applied to withdraw its pending Bitcoin and Ethereum market cap ETF approval.

Why This Matters

With the clock ticking on the SEC, the regulator’s decision could be pivotal for crypto investing. The verdict could reshape the landscape for crypto trading in the US and mark a decisive step toward mainstream recognition and adoption.

Read how the IRS is helping Ukraine to combat crypto-related crimes:

IRS and Ukraine Join Forces to Combat Crypto-Related Crime

Find out how hackers flooded Upbit with fake APT tokens:

Fake APT Tokens Flood Upbit Accounts: Exchange Seeks Refunds