- Bitget’s user base surged on strong crypto market performance.

- BGB token reached its all-time high.

- Bitget study revealed that investors are bullish on the market.

The crypto markets have started the year strong, with Bitcoin breaking $60,000 for the first time since 2021. The positive shift in investor sentiment has seen investors flocking to crypto exchanges, which posted record growth.

Amid this, the crypto exchange Bitget revealed strong figures for February, both in user growth and in its native token, riding the surging market wave.

Bitget’s Surge Reveals Strong Crypto Market Momentum

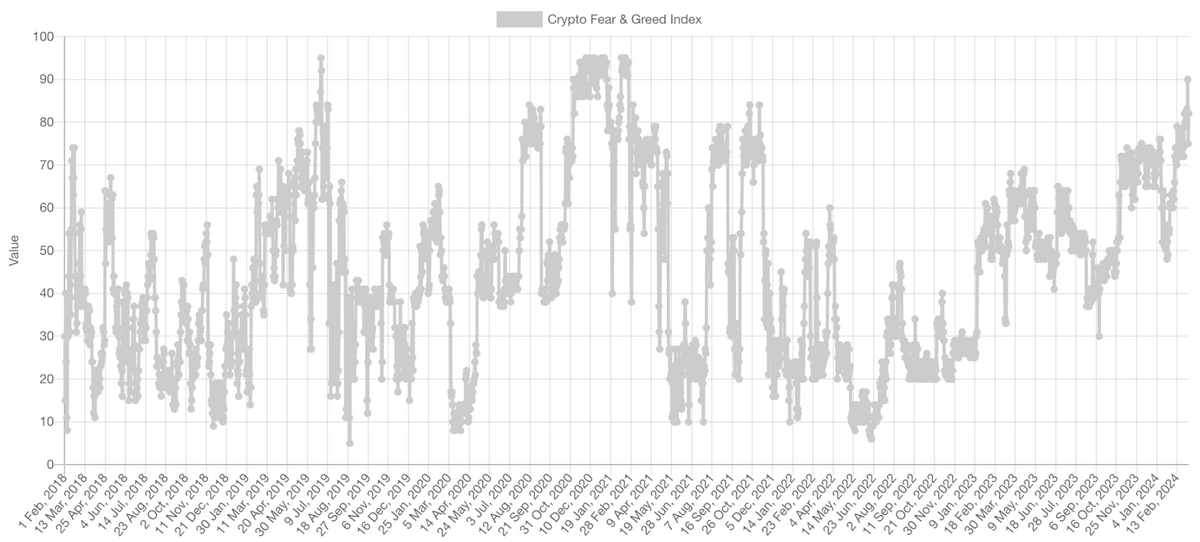

As the crypto markets raced upward, Bitget reported that its user base reached 25 million in February, according to its monthly report. With market leader Bitcoin breaking through to $60K once again, Bitget was able to ride the bullish wave to new heights as the crypto fear and greed index flashed extreme greed for the first time since 2021.

Taking advantage of the surge in February, Bitget introduced 39 new tokens on its platform. This led to significant trading interest and exceptional performance among the top five tokens, with price surges of over 1000%.

Sponsored

The exchange also capitalized on the AI token boom, as the trading volume in Bitget’s AI zone posted a 400% rise in February alone, largely fueled by the launch of OpenAI’s Sora model.

Bitget’s native token price also reflected this growth. BGB enjoyed a 64% increase in value over the same period, even reaching a new all-time high of $1.15 on February 17. As with many exchange tokens, BGB has a burn mechanism in which a portion of Bitget’s revenue is used to buy and burn the tokens, lowering supply and inflating prices.

Sponsored

Bitget’s performance reflected the positive market sentiment, also revealed by the exchange’s recent study. Analysts say retail interest and enthusiasm have been a particularly powerful driving force for the current cycle.

Investors Are Bullish on Crypto, Retail Interest Booming

According to Bitget’s investor sentiment study, investors expressed robust confidence in the cryptocurrency market’s future, especially anticipating the Bitcoin halving event. Most investors expressed intentions to increase their investments, predicting that Bitcoin would achieve new all-time highs.

According to JP Morgan analyst Nikolaos Panigirtzoglou, much of this February surge is driven by retail investors. This suggests that more investors are entering the market in hopes of taking advantage of the booming crypto prices. This aligns with the reported surge in Bitget’s user base, which is taking advantage of its retail-focused copy-trading features.

On the Flipside

- Like other exchanges, Bitget’s figures depend on the volatile crypto market.

- Surging retail interest is bullish for crypto but could reverse if the markets experience a bearish turn.

Why This Matters

Bitget’s performance reveals a bullish momentum in the overall crypto market. As prices soar, more investors are flocking in to take advantage of the performance.

Read more about Bitget’s report on investor sentiment:

Bitcoin Will Claim ATH after Halving, Investors Tell Bitget

Read more about Binance halting Solana withdrawals:

This Is Why Binance’s Solana Withdrawals Are on Extended Hold