- A Bitget survey has shown that 78% of investors believe the next halving could push Bitcoin beyond its record high.

- 70% of the surveyed individuals have planned to increase their crypto holdings.

- Investors have targeted a new comfort zone of $50,000-$100,000, with some envisioning a future +$150,000 BTC.

Cryptocurrency investors worldwide are holding their breath for the next big trade and a seismic event in Bitcoin’s digital DNA: the upcoming halving. This preordained reduction in miner rewards, happening roughly every four years, has a history of igniting bull markets.

A new study by Bitget, a leading crypto exchange, dives deep into investor sentiment around this pivotal moment, revealing a cocktail of cautious optimism and sky-high aspirations. The research, surveying nearly 10,000 investors across continents, paints a fascinating picture.

Bullish Bets and Regional Variations

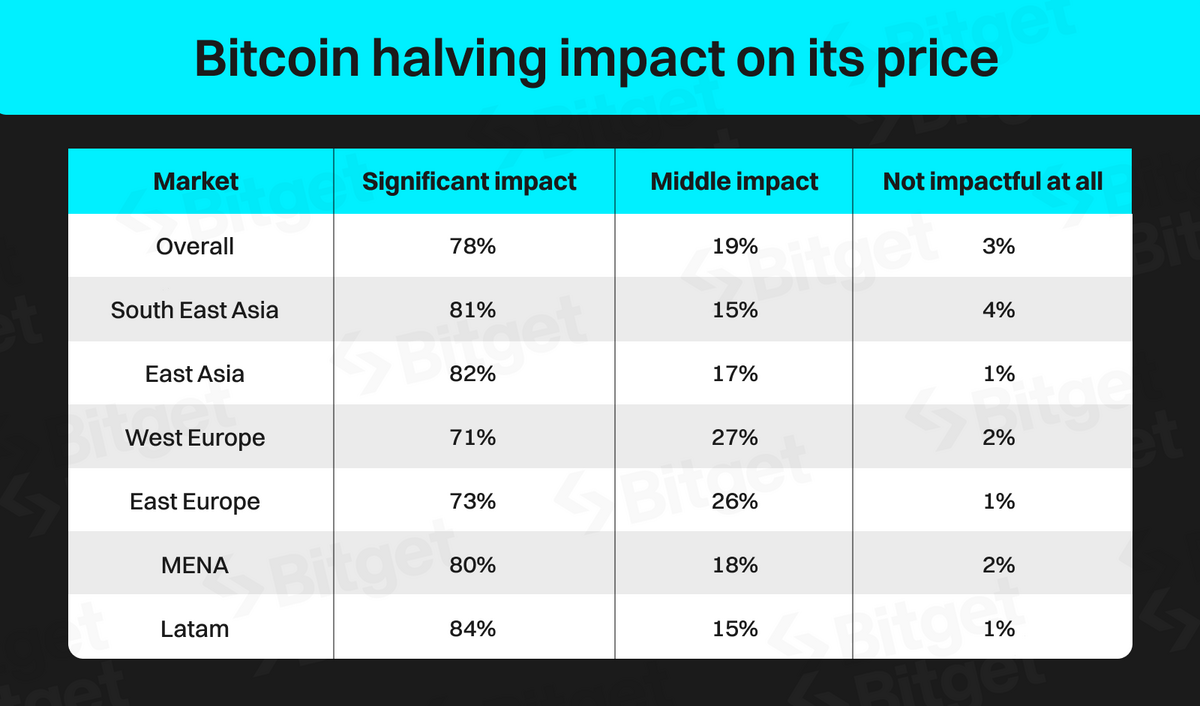

A resounding 84% believe the halving will send Bitcoin soaring past its all-time high of $69,000, with optimism particularly buoyant in Latin America, East Asia, and South East Asia. Even regions like West Europe and East Europe, exhibiting short-term caution, ultimately subscribe to the long-term bullish outlook.

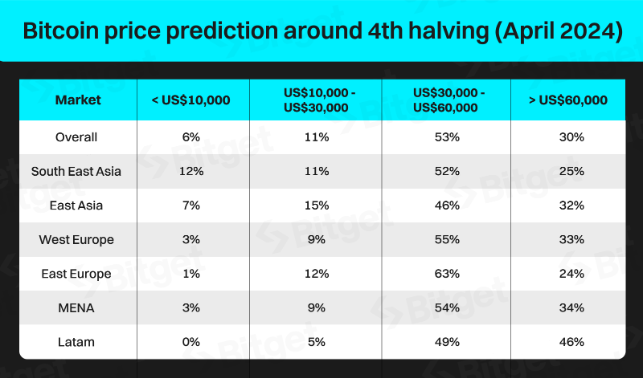

But within this shared confidence, price expectations during the halving itself diverge. While the global average suggests Bitcoin will stay between $30,000 and $60,000, a significant 30% envision a price break above $60,000. Latin America, ever the optimist, leads the charge, with nearly half predicting a price stratosphere north of $60,000.

This bullish sentiment translates into action. A remarkable 70% of investors plan to increase their crypto holdings in 2024, with MENA and East Europe showing the strongest appetite for upping the ante. In contrast, regions like Southeast and East Asia prefer to hold steady, perhaps waiting for the post-halving dust to settle before diving deeper.

Global Faith in Bitcoin’s Future

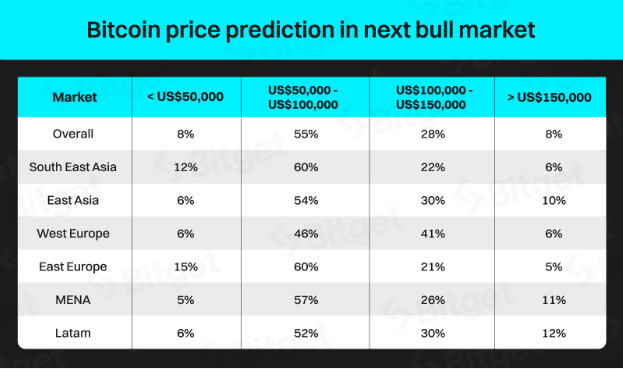

The study also delves into the next bull market, a future most investors (55%) believe will see Bitcoin comfortably nestled between $50,000 and $100,000. A daring 8% even dare to dream of prices exceeding $150,000, with pockets of this extreme optimism residing in Latin America and MENA, regions already gung-ho about the upcoming halving.

Interestingly, West Europe emerges as a curious case. While relatively cautious about the immediate impact of the halving, they project the highest prices for the next bull market, suggesting a “short-term cautious, long-term optimistic” mindset. Perhaps they see the halving as a catalyst for future Bitcoin dominance, but not the sole driver.

Sponsored

The Bitget study offers a valuable snapshot of global investor sentiment on the cusp of a pivotal moment for Bitcoin. While nuances and regional variations exist, one resounding message rings through: investors overwhelmingly believe in Bitcoin’s bright future, fueled by the halving’s potential to usher in a new era of price growth and mainstream adoption.

On the Flipside

- While past halvings coincided with bull markets, it’s crucial to remember correlation doesn’t equal causation.

- The reduced rewards post-halving might incentivize some miners to leave the network, potentially impacting its security and transaction processing speed.

Why This Matters

As the countdown to April 2024 continues, Bitget’s research serves as a reminder that amidst the market’s unpredictable gyrations, one thing remains constant: the whispers of a Bitcoin boom are growing louder by the day.

If you’re curious about the rising popularity of Bitcoin ETFs and how they’re challenging Grayscale’s dominance, check out this article:

Bitcoin ETFs Gather 150K BTC as Grayscale’s Dominance Wavers

Want to know more about the first crypto ads appearing on Google and what it means for the future of cryptocurrency? Read this article:

First Crypto Ads Debut on Google as ETFs Boost Acceptance