- Bitcoin closed above $28,000 on Sunday.

- Bullish moves have reinvigorated market optimism.

- Traders still doubt that bullish momentum will be sustained.

The pain of the crypto bear market continues to test the faith of even the most zealous Bitcoin believers. Yet, glimmers of hope emerged on Sunday as Bitcoin posted its strongest daily performance since August, gaining over 4% to close the day just above the psychologically crucial $28,000 level.

This long-awaited breakout wreaked havoc on Bitcoin shorters, liquidating their positions and signaling a dramatic shift in market sentiment, igniting hopes for the potential start of a new cycle in the run-up to April 2024’s halving event.

Shorters Get REKT

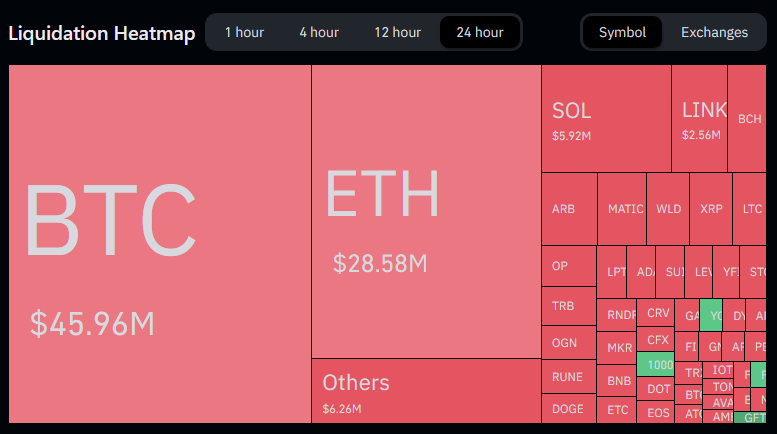

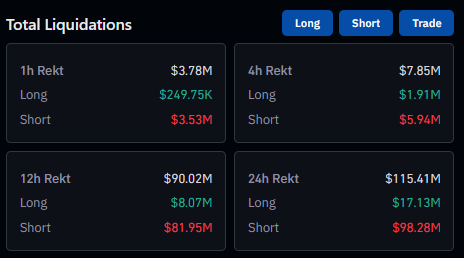

Bitcoin closed October 1 priced at $28.030, marking a 34-day high and flooding the market with renewed optimism. Data from Coinglass showed Bitcoin positions were liquidated to the tune of $45.96 million over the last 24 hours as the market surged.

Sponsored

The ratio of liquidations was split between $41.68 million shorts and $4.28 million longs, with 85% of the short liquidations occurring on Huobi, OKX, and Binance.

Zooming out to the rest of the market, Ethereum and Solana traders also suffered liquidations amounting to $28.58 million and $5.92 million, respectively, culminating in $115.4 million worth of forced liquidations across all tokens over the last 24 hours. At the time of writing, the 24-hour price performance of Ethereum saw 2.4% gains to $1,732, while Solana jumped 4.7% to $24.10 over the same period.

The massive short squeeze comes as Bitcoin is at the cusp of Q4, which has historically been the leading digital asset’s best-performing quarter of the year.

Bitcoin Optimism Returns

Analyst Miles Deutscher posted a chart of the average monthly performance of Bitcoin that showed October and November as the top two performing months of the year, typically yielding gains of 15% and 43% on average, respectively.

This newfound optimism was reflected in the Fear & Greed Index, which rose to a reading of 50 for the first time since August 31, signaling a neutral market sentiment that is neither fearful nor greedy.

Chiming in, the CEO of MN Trading Michaël van de Poppe warned that Bitcoin’s move above $28,000 “might fully retrace”. Yet van de Poppe still let slip his optimism of the prevailing market conditions by stating that “the trend is clearly upwards” and “this quarter will be fun!”.

On the Flipside

- Sunday’s rally did little to recapture Bitcoin’s all-time high, and the asset remains 59% down from that level at the time of writing.

- Regulatory and macroeconomic uncertainty continue to weigh heavily on crypto markets.

- The 24-hour Bitcoin Long Short Ratio shows shorts just ahead at 49.95%/50.05%. The marginal bias towards shorts suggests that traders do not expect the bullish momentum to sustain.

Why This Matters

Sunday’s rally brought welcome relief to a market battered by uncertainty and tribulation. However, Bitcoin has yet to build on these gains amid continuing regulatory and macroeconomic uncertainty, making calls for the end of the bear market premature.

Learn more about the SEC’s decision to delay spot Bitcoin ETFs here:

SEC Plays Hardball with Bitcoin ETF Proposals, Sets New Deadlines

Find out more about the Frankie Candles’ departure from the BitBoy network here:

BitSquad Member Bails as BitBoy Drama Boils Over