- Dogecoin battles a key psychological price level of around $0.20.

- Top cryptocurrency analyst warns of Dogecoin’s luring bull trap.

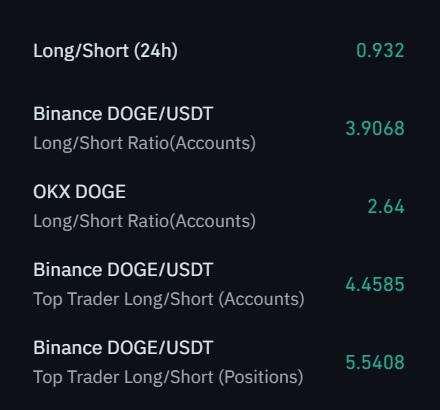

- Derivatives data unveils which traders are most bullish on Dogecoin.

Dogecoin’s journey to a new yearly high at $0.224 on March 31 revitalized hopes of a repeat of the 2021 pattern to its all-time peak at $0.73. Zooming into the token’s monthly trading curve, the way up is challenged by a confluent sell wall above $0.20, a price range where DOGE was rejected thrice over the past 30 days.

Dogecoin Gets Static on Derivatives

Besides the piling sell pressure on the Spot markets, a notable decrease in Open Interest (OI) shaped Dogecoin’s Derivatives trading volume below $4 billion over the past 24 hours. While the overall long versus short daily ratio is bearish at 0.932, Binance’s customers are bullish on DOGE with a 5.54 long versus short position ratio.

As DOGE is now going through a market correction after claiming a weekly top of $0.207 yesterday, $4.55 million long positions were liquidated over 24 hours, according to the latest CoinGlass data. Short liquidations were kept below $1 million.

Bull Trap or Sustainable Bull Run?

This raises the question of whether the mixed signals are a rough market correction of the pre-claimed $0.17 key support levels or whether DOGE can attempt a new yearly high. According to crypto analyst DOGE Coach, there were hints of a bull trap on Monday when DOGE claimed $0.207 as its weekly top.

The veteran trader sees the support cluster depicted in orange as a make-or-break moment for Dogecoin’s price trend. Judging from the status of Dogecoin’s combined liquidity books, the bull trap theory is even more plausible due to $137.59 million in pending sales, in contrast to $93 million in bids.

Meanwhile, three key on-chain metrics turned red for Dogecoin, including slight concentration and decreases in net network growth. The double-digit drop in transactions over $100,000 implies that whales are undecided about DOGE’s forthcoming price trajectory.

At press time, Dogecoin is exchanging hands at $0.1969 with a 5% downturn over the past 24 hours. DOGE is still 5.4% up weekly, while the latest 30-day period sums up Dogecoin’s gains to 11.8%.

On the Flipside

- The price movement of Dogecoin also heavily depends on the developments on X, as the crypto-friendly social network is speculated to integrate Dogecoin into their Peer to Peer (P2P) payment system.

Why This Matters

Despite its satirical status, Dogecoin is the second largest Proof of Work (PoW) mechanism besides Bitcoin.

Sponsored

Discover DailyCoin’s trending crypto stories:

Bitcoin Pioneer El Salvador Is Offering 5,000 Free Passports

Why Are Solana Transactions Failing? Devs Scramble to Fix it