- Salvadorians at the grassroots level have little confidence in Bitcoin.

- Bitcoin price volatility is seen as “robbery” by some.

- El Salvador’s economy has grown stronger.

For years, El Salvador struggled with rampant gang crime, economic stagnation, and a lack of financial access for its citizens. In an ambitious bid to address these problems, President Nayib Bukele spearheaded a progressive modernization program that included the adoption of Bitcoin as legal tender in September 2021.

Two years on, El Salvador’s grand experiment appears to have fallen largely short of the mark. Despite Bitcoin’s legal tender status, most Salvadorans have shunned it in favor of cash.

Salvadorians Stick with Cash

The adoption of Bitcoin as legal tender was intended to spur financial inclusion and economic growth. However, the country’s former Reserve Bank governor, Carlos Acevedo, conceded that uptake has been slow and lawmakers had failed to fulfill these objectives. The former central bank governor blamed the lack of trust in Bitcoin among the general public.

Sponsored

“the goals that were pursued... have not been achieved, people hardly use it, they don't have much trust [in crypto]”. Acevedo told AFP.

Acevedo drew attention to the ongoing bear market and the associated price depression for explanation. Since the legal tender bill passed, BTC’s value has approximately halved in dollar terms, falling from a price of $51,300 in the week beginning September 6, 2021, to approximately $25,800 at press time.

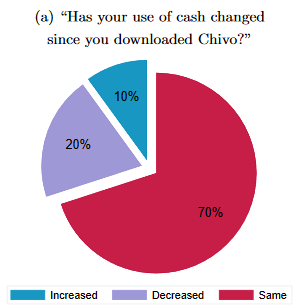

Bitcoin’s struggles in replacing cash were further reflected in a recent study by the National Bureau of Economic Research, where researchers interviewed 1,800 Salvadorian households to assess Bitcoin’s viability as a medium of exchange. Analysis of Bitcoin’s impact on other payment methods revealed that 70% of individuals who downloaded the Chivo wallet continue to use cash.

The study detailed that the number one reason individuals don’t use Bitcoin is because they “do not understand it.” While high fees and volatility are often assumed to be the primary reasons for non-use, these two responses ranked lowest among respondents.

Sponsored

President Bukele has affirmed his commitment to stick with the program despite the population clinging to cash over Bitcoin.

Bitcoin Celebrates 2 Years as Legal Tender

September 7 marked two years since El Salvador passed the Bitcoin legal tender bill. Unfazed by the skeptics, President Bukele proudly christened the “Bitcoin Day” day, hailing it as a historic milestone.

Joining in with the celebrations, co-founder of El Zonte Capital, Stacy Herbert, expressed gratitude for being involved with the country’s “bold policy of economic liberty.” Herbert listed multiple achievements to support this claim, including attracting big-name companies to set up shop in the country and implementing a Bitcoin education program in all public schools.

On the Flipside

- Tourism in El Salvador is booming, with 2.5 million visitors in 2022, up 96% from 2019.

- A 2022 survey showed President Bukele has an 87% approval rating.

- El Salvdor’s gross domestic product grew 10.3% in 2022 to $32.49 billion.

Why This Matters

El Salvador’s Bitcoin experiment has been perceived as a litmus test for the practical application of cryptocurrency at a national level. To date, the grassroots response has been underwhelming. However, a resurgence in Bitcoin’s value could potentially spark a significant shift in public interest and usage.

Discover the latest on El Salvador’s ambitious Volcano Bonds project here:

El Salvador’s Bonds Attract Wall Street: Volcano Bonds Next?

Read about Anthony Pompliano’s expectations for the Bitcoin bull market here:

Pompliano: Bitcoin Primed for Parabolic Rally Akin to 2020