- Bitcoin reaches a new all-time price.

- Retail investors remain sidelined.

- There are signs retail investors may be returning.

Bitcoin’s meteoric rise to a new all-time high (ATH) of $73,000 on Monday has sparked jubilant celebrations among long-term holders who endured the pain of crypto winter. However, amidst the euphoria, industry observers have noted retail investors’ distinct lack of interest despite Bitcoin’s monumental new milestone.

Bitcoin Booms, But Where Is Retail?

The conspicuous lack of retail interest surrounding Bitcoin’s new milestone ATH has become a topic of intense discussion within the crypto community. The founder of Trading Dojo, “KJ Crypto,” remarked that this has been the “least celebrated” ATH in his personal experience. KJ Crypto asked his followers, “What does it mean[?]”

Adding to the chorus of voices acknowledging this phenomenon, crypto YouTuber Scott Melker stated that the speed at which crypto winter dissipated was very surprising, possibly inducing a lack of conviction from sidelined retail investors. Nonetheless, Melker struggled to explain why he was “not getting any calls about Bitcoin” from his circle, which wasn’t the case in prior cycles.

Sponsored

Chartered financial analyst Rajat Soni offered a potential explanation for low retail participation, stating that retail investors generally feel more comfortable with “tried and true” assets like stocks and real estate. However, Soni predicted that this sentiment will shift as Bitcoin’s market cap grows exponentially relative to traditional asset classes.

While Soni’s assessment highlighted the preference for traditional asset classes among retail investors, recent developments suggest that this narrative may shift, with emerging indicators pointing towards a potential resurgence of individual market participants.

Retail Investors Return?

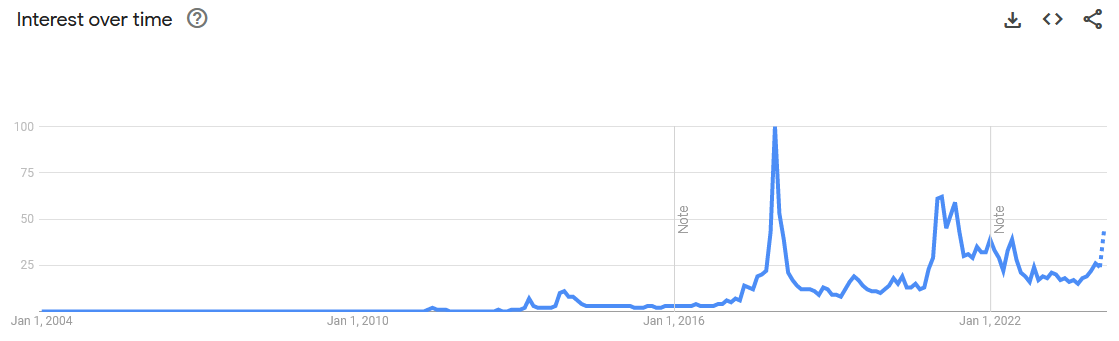

While the recent price rally has failed to ignite widespread retail fervor, there are indications that individual investors may be gradually returning to the crypto space. Google Trends data reveals a strong uptick in searches for Bitcoin in March, reaching a value of 46, marking the highest volume of searches since June 2022, when the Terra LUNA implosion severely dented crypto market confidence.

Adding further weight to the narrative of a potential retail resurgence is the re-emergence of the so-called “kimchi premium” in South Korea. CryptoQuant founder Ki Yung Ju noted that the kimchi premium has risen to 10% to record a two-year high.

Sponsored

The kimchi premium refers to the Bitcoin price difference between Korean exchanges and the rest of the world. This results from the lack of high-return investment opportunities in the region, which spurs a willingness to max bid, consequently driving the price of BTC higher than the rest of the market. The kimchi premium serves as a potential indicator of retail FOMO.

On the Flipside

- Retail investors have historically driven bull markets.

- Current retail apathy may signal a maturing market where institutional investors exert more influence over price dynamics.

- The booming memecoin sector is drawing attention away from Bitcoin and other fundamentally based projects.

Why This Matters

The lack of retail excitement towards Bitcoin’s record-breaking prices indicates broader shifts in investment behavior and risk appetite. When considering retail investor reluctance, macroeconomic factors and bear market trauma cannot be discounted.

MicroStrategy continues stacking Bitcoin in the bull market. Read more here:

MicroStrategy Bitcoin Bag Nears Key Milestone with $822M Buy

Bitcoin miners respond to the renewal of tax proposals to curb mining activity. Read more here:

Bitcoin Miners Brace as Biden Renews 30% Energy Tax Proposal