- Crypto markets see a strong Q1 performance.

- VC interest in crypto firms ticked up in Q1.

- Large players are reportedly raising funding.

2024 has seen a strong recovery for cryptocurrencies following a brutal bear market that saw prices tumble and sentiment plunge. With market confidence returning, data indicates that venture capital (VC) firms have renewed their faith in the digital asset sector, increasing their exposure to crypto companies in the first quarter.

Crypto VCs Turn on the Money Tap

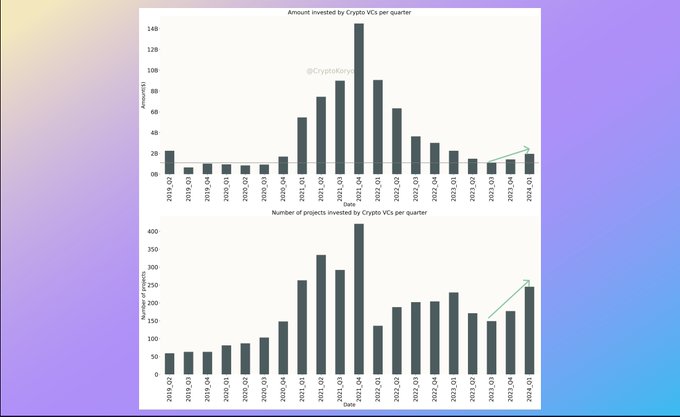

In a show of renewed faith in the crypto sector, VC firms invested a total of $2 billion into digital asset companies in Q1, marking the second successive quarter of increase since bottoming out at $1 billion in Q3 2023, according to X account Crypto Koryo.

In line with more VC money coming into the space in Q1, the number of investments also surged higher. Around 240 crypto deals were backed by VCs in Q1, up around 50% from just 160 investments in the prior quarter. Both the amount invested and the number of investments have been trending higher after finding a local bottom in Q3 2023.

Crypto Koryo noted that Q1’s amount invested is one-seventh the level seen during Q4 2021’s peak. But the current uptrend pattern is strikingly similar to Q4 2020 which preceded the previous bull cycle, and may signal the start of a new VC uptrend this time around.

Sponsored

Hot on the heels of the VC uptrend, reports indicate that prominent VC firms such as Galaxy Digital and Paradigm are wasting no time deploying fresh capital.

Here Come the Big Players

With VC crypto interest ticking up, reports indicate that Galaxy Digital is currently recruiting investors for a new $100 million Galaxy Ventures Fund to invest in early-stage crypto startups.

Sponsored

The fund will target companies developing financial applications, software infrastructure, and protocols within the digital asset ecosystem. Galaxy Digital aims to back around 30 such firms over the next three years, underscoring the firm’s renewed optimism in the space as crypto markets rebound strongly in 2024.

Another major firm betting big on crypto is Paradigm, which is reportedly in talks to raise between $750 million and $850 million for its latest fund. If successful, this fund would be the largest raise since the brutal crypto winter.

Paradigm was a leading investor in the ill-fated FTX exchange but has continued backing innovative Web3 projects like Farcaster.

On the Flipside

- Ethereum is the most popular chain for the number of VC investments in Q1, followed by Solana, then Arbitrum.

- There is a notable absence of Cardano within VC circles, which ADA supporters claim is due to the project‘s fair launch and token distribution that excluded VC firms.

- The amounts being floated by Galaxy Digital and Paradigm are below 2021 levels, suggesting a degree of caution on the part of VCs at this stage.

Why This Matters

The resurgence of VC interest and capital in the crypto space is a pivotal development that could catalyze this bull cycle. Flush with funding; promising projects are better able to go mainstream and onboard the next wave of new users.

Discover the latest twist in Ethereum’s bid to launch ETF products here:

SEC Requests Comments on Ethereum ETFs as May Deadline Looms

Read about one rancher’s bid to counter inflation using Bitcoin here:

US Rancher Turns to Bitcoin to Fight Spiraling Rearing Costs