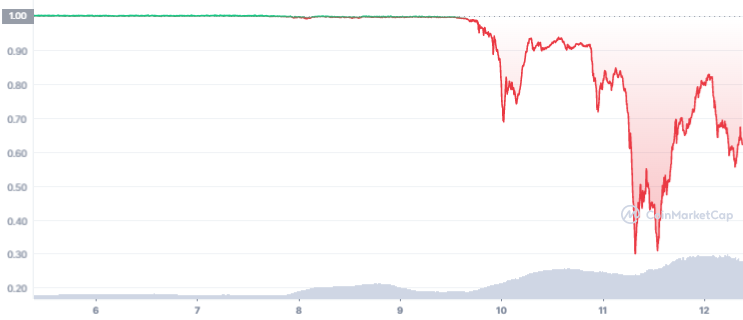

Terra blockchain’s stablecoin UST lost its peg this week, crashed, and brought the whole cryptocurrency market into a catastrophe long unseen.

Billions were wiped out of the digital asset market during the past 24 hours, while Terra’s native governance coin, LUNA. lost 99% of its value and nosedived from $24.14 to $0.1538 over the same time period.

What Happened?

To better understand the collapse of LUNA, it is important to know its relationship with blockchain’s stablecoin TerraUSD (UST). Both coins are created and guided by Terraform Labs and its co-founder and CEO Do Kwon.

TerraUSD (UST) is a decentralized algorithmic stablecoin, pegged 1:1 with the United States dollar. However, it is not backed by the dollar or any other fiat currency or commodity. Instead, UST relies on a smart contract algorithm that involves LUNA and helps to keep the UST value stable.

The algorithm tracks the demand for the TerraUSD (UST) and adjusts its supply accordingly to keep the value around $1. If the supply increases and the value of UST drops, the algorithm incentivizes users to burn UST to mint new LUNA coins and vice versa.

Sponsored

Do Kwon and his Luna Foundation Guard declared plans to back their algorithmic stablecoins with Bitcoin and thus have been accumulating their Bitcoin holdings intensely. During the past few weeks, LFG bought over $3.5 billion worth of the dominant crypto. The situation drastically changed on Sunday, May 8. The stablecoin UST started to go down substantially, losing 70% of its value and dropping to an all-time low of $0.029 on Wednesday.

To keep the price of UST as stable as possible, Terra’s algorithm initiated UST token burnings in exchange for the newly minted LUNA coins. The supply shock triggered the LUNA price fall, and the panic sales did the rest.

Where Did It All Start?

However, for any more visible price moves to happen, there must be an initial source that triggers it.

Rumors on crypto social media went wild, claiming that the world’s biggest asset manager, BlackRock, as well as Citadel Securities could be behind the collapse of TerraUSD and LUNA.

Supposedly, both whales manipulated the market and Terra’s Do Kwon to dump the price of Bitcoin.

As the theory says, they first borrowed 100K of BTC from Gemini and silently swapped 25% of them to UST. They later agreed with Do Kwon to sell him another part of borrowed Bitcoins for UST at a discounted price. Do Kwon agreed, resulting in a significant decrease in the UST supply.

According to the algorithm, this should have affected both coins, as when UST supply decreases, the price increases, and to maintain UST price stability, smart contracts burn TerraUSD stablecoins to mine more LUNA tokens, which automatically increases its supply and reduces the price.

However, at the time, both hedge funds supposedly made another move. They dumped their UST and Bitcoins, triggering the further price crash of Bitcoin and also LUNA.

A large part of LUNA’s reserve was at the time kept on Anchor lending and borrowing protocol accused of being a Ponzi scheme with 20% staking APY. According to the theory, BlackRock and Citadel knew this fact, that LUNA’s price crash would cause massive withdrawals from Anchor, panic selloffs, and thus further price drops.

As the broader market crash means the lower price of Bitcoin, both whales would be free to buy Bitcoins back for a cheaper price, repay the loan, and make some profit.

Both BlackRock and Citadel denied accusations of having a role in the collapse of UST, calling them “categorically false.” BlackRock stated that it does not trade UST. The world’s largest asset manager though has been exploring cryptos over the past year and has backed TerraUSD’s competitor, USDC.

The Aftermath

The crypto landscape looked grim today, with more and more new worries emerging. Multiple DeFi projects that had liquidity pools with LUNA and UST, including Anchor Protocol (ANC) and Mars Protocol (MARS), witnessed double-digit declines.

The competing stablecoin, Tether (USDT), briefly lost its 1:1 peg with the US dollar and dipped by 4% to $0.9508 today, reaching the lowest level during the past few years. Tether CTO Paolo Ardoino explained that Tether was continuing USDT redemptions to $1 and more than 300 million were redeemed in the past 24 hours without any price drop.

The founder of TRON, Justin Sun, warned that Tron (TRX) and its algorithmic stablecoin, USDD, might become the next manipulators’ target, as the latter uses the same algorithmic mechanism to maintain the USDD stability.

Short squeeze coming https://t.co/KEhBghXJDp

— H.E. Justin Sun 🅣🌞🇬🇩 (@justinsuntron) May 11, 2022

Tron DAO in advance deployed $2 billion to protect the price stability of its stablecoin and also of its native TRX. The same DAO later announced that the organization has bought 100 million USDT with an average price of $0.982.

In the meantime, Do Kwon’s earlier colleagues leaked some more spicy info, claiming that Terraform Labs CEO and co-founder was also the secret creator of previously failed stablecoin Basis Cash (BAC).