- 2023 marked a recovery for crypto markets.

- The US’ estimated crypto gains surpassed all other countries.

- Emerging markets rank highly for crypto gains.

After the brutal crypto winter, digital asset markets steadily recovered throughout 2023 as investor confidence gradually returned. As cryptocurrency prices regained significant ground, the estimated crypto gains by country showed an intriguing pattern.

While the US flexed its crypto muscle by dominating all other countries in profiting off the 2023 rebound, several emerging markets in the developing world also secured unexpectedly significant slices of the pie.

The US Tops Crypto Gains in 2023

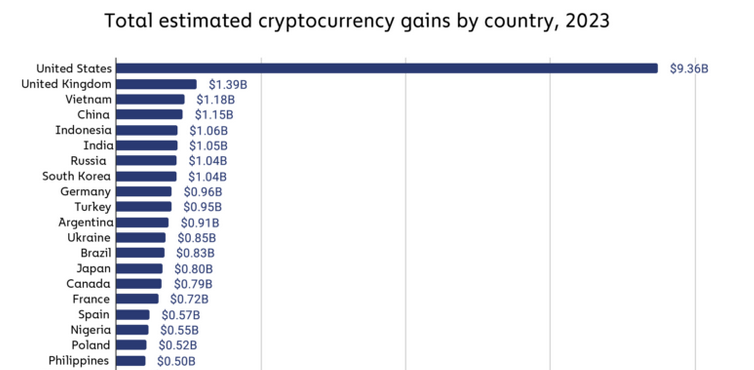

A report conducted by Chainalysis revealed the US accounted for a vast proportion of global crypto gains in 2023, at $9.36 billion, followed by the UK at $1.39 billion. Surprisingly, the “lower middle income” economies of Vietnam, China, Indonesia, and India rounded out the top six with $1.18 billion, $1.15 billion, $1.06 billion, and $1.05 billion, respectively.

The 2023 Geography of Cryptocurrency Report by Chainalysis noted that India topped the ranking for crypto adoption by country, with Vietnam placing third and Indonesia seventh. Chainalysis inferred that strong crypto adoption and resilience during the bear phase in those “lower middle income” countries were factors to ranking highly for crypto gains.

Sponsored

The total global crypto gains estimated across all countries came in at $37.6 billion, marking a strong improvement from 2022’s $127.1 billion loss but falling considerably short of the $159.7 billion gain made during 2021’s historic bull run.

Why Does The US Lead?

The US dominance of crypto gains last year should come as little surprise given its status as the world’s largest economy. With a GDP of $25.5 trillion, accounting for over a quarter of global output, America’s sheer economic might gives plenty of ground for crypto speculation.

Sponsored

Additionally, the US’ high GDP per capita and deep credit markets enable its population to allocate capital towards emerging investments like crypto far more readily than their lower-income counterparts in other nations.

This backdrop helps explain why roughly 1 in 5 American adults owned cryptocurrency as of 2022, according to NBC News. This equates to a sizeable 54 million individuals investing in cryptocurrency, according to US Census data, which puts the adult population at 258 million adults. The number of US retail investors aligns with a separate estimate from Coinbase suggesting over 50 million Americans currently hold cryptocurrency investments.

On the Flipside

- Chainalysis‘ methodology calculated estimated crypto gains using on-chain data from off-ramping services, excluding P2P channels, giving rise to a potential underestimation of gains.

- Regulatory uncertainty remains a wild card for the future crypto investing landscape by country.

- 2024’s bull market has spotlighted El Salvador, which has adopted crypto at the nation-state level and is actively using Bitcoin to solve the country’s socio-economic problems.

Why This Matters

The geographic distribution of 2023’s crypto investor profits holds significant implications. Nations like the US solidifying dominance could accelerate regulatory acceptance and institutional adoption. Emerging markets making crypto inroads may herald further wealth redistribution and novel investment opportunities.

Learn more about the IMF’s advice for countries to mitigate crypto risk here:

IMF Proposes Country-Level Crypto-Risk Assessment Matrix

Find out how VeChain’s new SDK makes dApp development easier here: