- The Bitcoin halving occurred on April 20.

- Miners’ revenue has tanked significantly since the halving.

- The short-term outlook for miners turns negative.

The highly-anticipated Bitcoin halving took place on April 20, ushering in a new era of tightening supply for the leading cryptocurrency. The halving slashed the block reward miners receive for validating transactions from 6.25 to 3.125 BTC. While miners also earn transaction fees on top of block rewards, many assumed rising fee revenue would subsidize the cut in block rewards.

Sponsored

However, while miners enjoyed an initial jump in transaction fees post-halving, transaction fees have since dropped sharply stoking concerns over the long-term viability of Bitcoin mining.

Bitcoin Mining Done For?

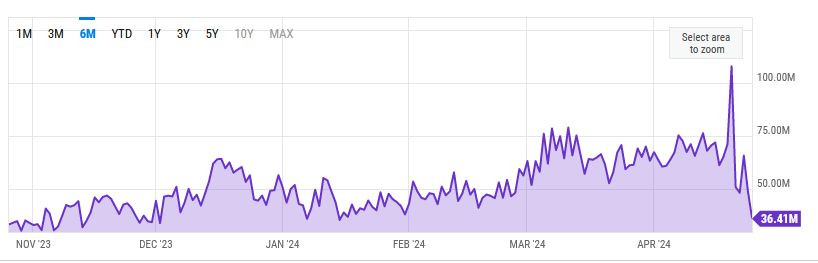

The long-term viability of Bitcoin mining is under the spotlight following a sharp decline in miners’ revenue post-halving. Daily Bitcoin mining revenue sank to $36.4 million on April 25 marking a 14-week low, according to data from YCharts.

The drop is in stark contrast to halving day, April 20, when daily revenue topped a staggering $107.8 million. The jump in revenue was attributed to the launch of the Runes protocol, a BRC-20 alternative, which intends to bring meme coins to the BTC base layer.

Andrew O’Neil, managing director at S&P Global’s Digital Assets Research Lab, previously stated that he expected miner consolidation post-halving, as the reduced block rewards make it increasingly unprofitable for smaller, less efficient miners to sustain their operations.

However, with the double-whammy of dwindling block rewards and tanking transaction fees, the mining industry may see an acceleration of miner consolidation as transaction fees fail to make up for the shortfall in block rewards.

Sponsored

Despite the mounting economic pressures on the Bitcoin mining industry, current data showed little change from the status quo.

Hash Rate Continues Climbing

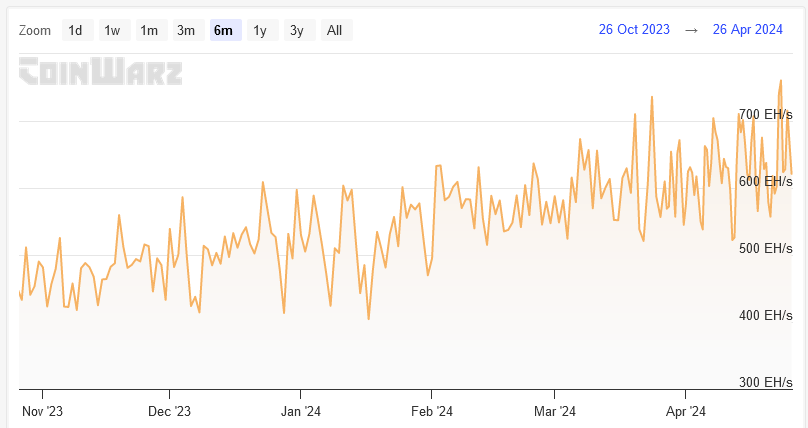

While Bitcoin miners come under increasing economic pressure, there is currently no indication of miner capitulation yet. The Bitcoin hash rate continues trending higher, having hit a new all-time high of 760.6 EH/s on April 23, according to CoinWarz, signaling that miners remain confident despite the halving of block rewards.

In line with expectations of increasing hash rate, mining difficulty also increased to a new all-time high of 88.10 T on April 25.

Although mining revenue has dropped sharply post-halving, the price of Bitcoin remains relatively steady, ranging between $62,700 and $67,000 since the halving. This price stability may be emboldening inefficient miners to lump short-term losses in hopes of an upturn in the price.

On the Flipside

- The cost of electricity is a significant factor in mining profitability, which varies greatly across different power sources and jurisdictions.

- Block recently announced the development of a new 3nm mining chip to bring greater hashing efficiency in the future.

- Consolidating mining operations will lead to greater miner centralization.

Why This Matters

The majority of Bitcoin miners are publicly traded companies running huge operations. A sustained fall in mining revenue will likely see upheaval for these companies and those that invest in mining stock.

Morgan Stanley mulls over Bitcoin ETF policy change.

Morgan Stanley To Supercharge Bitcoin ETF Demand: Here’s How

Coinbase marketing campaign targets the everyday sports fan.

Coinbase Ad Serves Up Crypto with Pizza Pizazz