YouTube influencers have the power to push the prices of small market-cap cryptocurrencies up. However, their impact is immediate and does not last long, says Alexander Brauneis, Professor of Finance and Innovation at Nottingham Business School (NBS).

With his Ph.D. student Stefanie Moser, Professor Brauneis researched over 1,000 videos of crypto-focused YouTubers in their extensive research on social media’s role in modern society.

Professor Brauneis talked to DailyCoin about the research and its findings and shared his insights on where such tendencies may lead us.

Small Coins on Big Channels

With new digital currencies released daily, the industry already counts more than 20,000 altcoins. Even experienced investors struggle to keep up with every potentially promising coin.

Sponsored

Therefore it is reasonable to assume that many retail investors rely on information from specialized YouTube channels, says Professor Brauneis.

“Especially with crypto, such media plays a way more important role than it would for stock markets or traditional financial markets.”

The professor and his student focused on big YouTube influencers and low-market-value altcoins to explore how crypto influencers affect investment decisions and cryptocurrency prices.

Sponsored

“We set a threshold of $100 million market cap at the time of the video’s release because the bigger projects are assumed to be very liquid. If a couple of thousand people see a YouTube video, they will not move the price in any direction,” the professor explains.

The researchers spent months watching hundreds of videos of crypto YouTubers covering low-value altcoins or mentioning them at least once. They focused on big YouTube channels with more than 200K subscriber base to reduce the risk of exposure to rug-pull coins.

The professor believes that such channels value their name and cannot afford to cover any dubious project. These criteria left them with seven YouTube channels covering smaller crypto projects at least once.

Source: ScienceDirect

The study explored 305 YouTube videos from influencers like Bitboy Crypto, Alex Becker’s Channel, Max Maher, Crypto Banter, Lark Davis, Altcoin Buzz, and Crypto Love. Half of the coverage was done solely by Crypto Banter, a major channel in their research.

Influencers Push Altcoins Up

Every time YouTubers mentioned a new small-cap altcoin, the researchers investigated its trading behavior 45 days before the video was released and followed its performance five days after the publication.

Their findings confirmed the hypothesis that YouTube influencers impact cryptos with small market value. Coin prices that had not shown significant movements before video mentions spiked 7% on average a day after videos were released.

The effect was even higher on the tiniest market cap coins, which increased by 9% on average. Meanwhile, middle- and bigger-size small-cap altcoins grew 7.5% and 3.7%, respectively.

The altcoin prices returned to the pre-release levels on the third day after the video publication. Professor Brauneis explains this is a result of hype:

“After a couple of days, people simply find out that there is no new information, nothing specific happening to the project. The only thing that happened was a YouTube video. People realize there is no reason to trade it for a higher price. And then it corrects.”

On the other hand, some buyers might simply be trying to exploit hype sentiment and make money from it.

“If any anonymous creator knows that the price jumps whenever a YouTube video on a tiny coin is released, then those people will start buying early. After a day when, on average, price peak is reached, they start selling again, thereby driving the price down.”

Influencers Save Investors Time

Professor Brauneis has his own arguments on why crypto investors rely on what YouTube influencers say.

According to him, with so many new altcoins released, studying their white papers becomes a problem of time and resources.

“If you turn back to traditional financial markets like equity markets, you have all these big investment banks that do due diligence on companies and then come up with a recommendation, buy or sell or hold.

It’s basically the same with relying on crypto guys on the internet. They distill information, they gather information, and that’s their job. They deliver on that to present interesting and reliable content. And people simply rely on that because they don’t have the time to do it [themselves – DailyCoin’s note],” claims Professor Brauneis.

Young Generation Prefers Social Media

Despite a load of information and a busy life schedule, retail investors trust crypto social media influencers because they represent their preferred way of getting information, not only restricted to crypto.

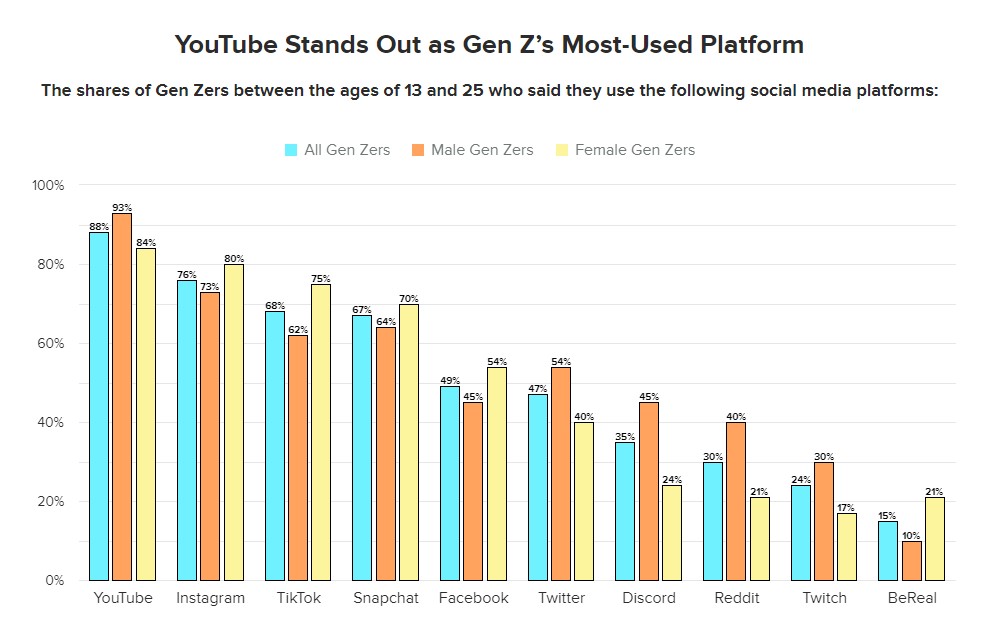

“If you look at what young people use to gather information on anything, it’s social media. It’s Facebook, Instagram, TikTok, and stuff like that. There is simply a shift in what sources of information we use.

Young people won’t read the Financial Times but try to get the information they want in media that is more sexy and simple and more suitable for young people,” says Professor Brauneis.

Source: MorningConsult

According to online research surveys, YouTube is Generation Z’s most popular information channel. 88% of GenZ respondents spend time on the platform, including 38% for more than four hours daily.

In addition to being the first completely digital generation, GenZ is also the second most active generation investing in digital currencies after Millenials, according to 2022 statistics from STILT.

According to their report, Millennials (25-40) comprised more than 76.46% of crypto investors, with 17.40% coming from GenZ. However, an average GenZer tended to spend more than Millenials.

“If you look at statistics, it’s mainly young people investing in crypto. So that’s why they rely on these sources. I think this will not change anytime soon,” notes Professor Brauneis.

Will Not Replace DYOR

Crypto-focused YouTube influencers give information on market-moving news, altcoin trends, price chart analysis, or investment tips. Legally they can’t provide financial advice without having a license for that.

“This is why every video you see on YouTube regarding this starts with disclaimer “I’m not a financial adviser, do your own research. Whatever follows may be considered investment advice by the recipients, even if they are told that it’s not.”

Professor Brauneis admits that YouTube influencers do not have the authority of a financial expert with a related background. However, they know more about crypto than the average retail investor.

“If you run a channel for four years, then you will definitely have more knowledge of what's happening than the average person. That doesn't mean that they have hot hands in picking the best projects all the time,” he says.

Processes in the cryptocurrency market are often related to what is happening in the equity markets, and understanding them requires equity market research. There is no such thing as predictability, claims Professor Brauneis, adding that even Warren Buffett, a very successful investor, did not know that Walmart was an excellent investment back in the 1960s.

“I wouldn’t per se say that it’s a bad thing to listen to YouTube influencers. But it shouldn’t replace Do Your Own Research,” concludes Professor Alexander Brauneis.

Find out more about decentralized social media:

Centralized Socials Sell Our Data. Will Decentralized Social Media Apps Change This?

Learn about what’s going on in the KYC and due diligence space:

GlobalPass CEO on Compliance Industry Challenges and the Role of AI