Interoperability is a difficult speed bump to overcome in the cryptocurrency industry. In the same way you can’t install an Android app onto an iPhone, different blockchains can’t recognize native assets from other networks. Fortunately, wrapped crypto tokens offer a simple solution.

Wrapped crypto tokens are a creative way to liberate cross-chain DeFi. By wrapping cryptocurrency, users can integrate their Bitcoin (BTC) with dApps in other ecosystems, like the Ethereum blockchain.

How exactly do wrapped tokens work? What’s the point of using my precious BTC on the Ethereum network?

Sponsored

More importantly, what are the risks associated with wrapped tokens?

What are Wrapped Crypto Tokens?

Like tourists dressing in local clothes on vacation, these digital assets enable users to ‘wrap’ a native token in a virtual package. In this way, the wrapped token can interact with its new environment. This is useful for crypto enthusiasts who want to use their on-chain digital assets in DeFi protocols on different networks.

Wrapped tokens are pegged to the value of their underlying asset. For example, if you wrap native BTC on the Bitcoin blockchain, you will receive an equivalent amount of wBTC on the Ethereum or the Binance Smart Chain.

- 1 BTC = 1wBTC

- 1 ETH = 1wETH

- 1 BNB = 1wBNB

Get the idea?

Sponsored

While it’s not officially a wrapped token, stablecoins like Tether (USDT) are, in many ways, the wrapped version of fiat currency. By providing $1,000 US dollars to Tether, you can mint 1000 USDT.

What are the mechanics of this process?

How Does Wrapped Bitcoin (wBTC) Work?

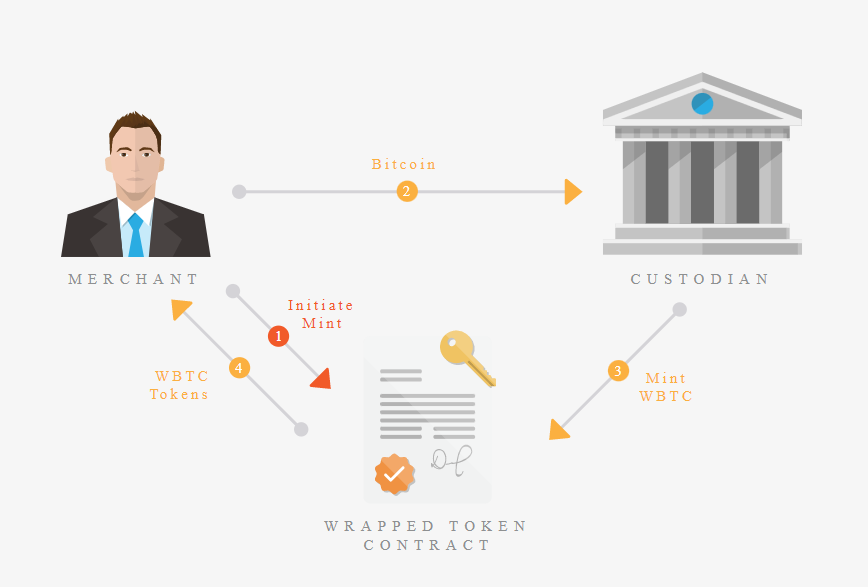

Wrapped Bitcoin is the most common example of how wrapped crypto assets work. In its most basic description, wBTC is an ERC-20 token representing an equivalent value of 1 native BTC on the bitcoin blockchain.

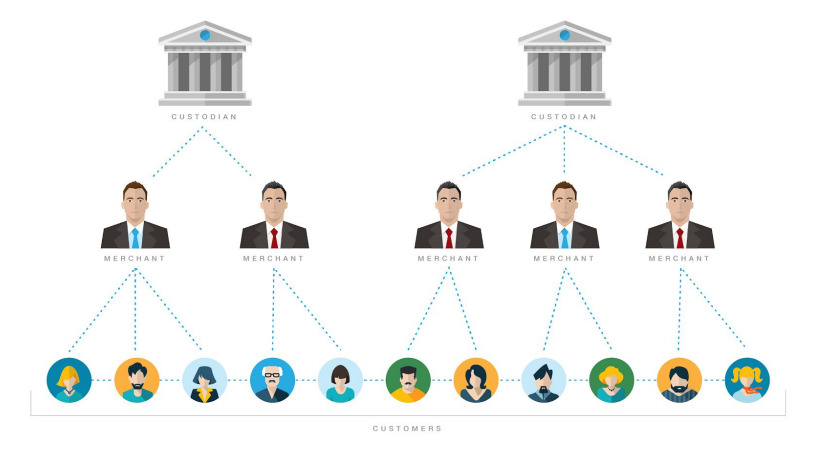

There are three different kinds of users within the wrapped bitcoin ecosystem. Custodians, merchants, and customers.

Custodians

The Custodian is like a bank that holds native BTC assets. After receiving BTC, the custodian will mint an equivalent amount of wBTC. Custodians take care of BTC and wBTC assets and ensure they are backed and authenticated on-chain. BitGo is one of the most reputable custodians of BTC.

The Wrapped Bitcoin DAO (Decentralized Autonomous Organization) decides who will be a trusted custodian of native Bitcoins.

Merchants

Wrapped asset merchants regulate the distribution of wBTC. Merchants like Ren Protocol and Kyber are the means of exchange between the native Bitcoin blockchain and other networks.

Merchants ensure that native BTC always backs wBTC at a 1:1 ratio by redeeming WBTC for BTC depending on customer supply and demand. This ensures that the Wrapped Bitcoin price is pegged to the same price as BTC.

Customers

Customers are regular end users of wBTC and BTC tokens, like traders and DeFi enthusiasts. It’s worth mentioning that if you want to acquire wBTC, you don’t need to request it through a merchant. Decentralized exchanges like UniSwap host liquidity pools you can easily trade with to buy wrapped assets.

What’s the Difference Between Ether (ETH) and Wrapped Ether (wETH)

While it makes sense that native BTC tokens aren’t compatible with Ethereum DeFi applications, wrapped Ether is less obvious. Ironically, native Ether is different from most tokens on the Ethereum network because ETH itself is simply for paying gas fees and securing the blockchain.

The ERC-20 token standard is a kind of cryptocurrency that can integrate and communicate with smart contracts, like trading and DeFi staking. Before we can unlock the capital efficiency of ETH, it needs to be wrapped into the ERC-20 standard. Token standards are like a set of rules and conditions that govern what a token can do on-chain.

Why Would I Want to Wrap my Cryptocurrency?

Wrapping your tokens is helpful because it lets you do more with your cryptocurrency. If you hold ten native BTC in a bitcoin wallet, there’s not much you do with those assets on the bitcoin network apart from watching your portfolio swing with the market.

However, if you wrap those crypto assets into a digital vault and deploy it on a different network, you can borrow against its value on a lending market like AAVE or trade it for wETH to buy NFTs on OpenSea. The full functionality of the Web3 world is at your fingertips.

However, like anything in the cryptocurrency world, there are risks you need to take into account.

Pros

- Wrapped crypto tokens let you move and store your digital assets across different blockchains.

- You can use tokens like wBTC in DeFi applications to trade, stake, or borrow against their USD value.

- Almost any digital asset can be wrapped. For example, XRP, PolkaDot, and Dogecoin can all be wrapped and minted on other networks.

Cons

- Wrapping services are still fairly centralized. If a wBTC custodian collapses unexpectedly, it might be difficult to redeem wBTC. If wBTC can’t be redeemed for BTC, it’s effectively useless. This could destabilize the peg and devalue wBTC.

- If the blockchain you’ve wrapped tokens on suffers an outage, your tokens are stuck until the network restarts. Last time the Solana blockchain paused, millions of dollars worth of sBTC and Solana-wrapped USDC got periodically trapped.

Can Traditional Stocks Be Wrapped Crypto Tokens?

In the same way cryptocurrency can be wrapped and deployed on the blockchain, traditional assets like gold and stocks can also be wrapped. DeFi applications like Poison Finance support tokenized stocks like Apple, Microsoft, and Tesla on their trading platform.

On the Flipside

- While wrapped crypto tokens give you greater utility for your digital assets, you should be careful holding tokens on unreliable networks. Following the Harmony blockchain bridge exploit, stablecoins like USDC have lost all their value on the Harmony network and cannot be redeemed to other chains.

Why You Should Care

Wrapped assets are useful tools for DeFi enthusiasts and, when used strategically, can help optimize yield strategies and unlock deeper liquidity in your crypto holdings.

FAQs

Yes, you can sell wrapped crypto on decentralized exchanges; some larger tokens, like wBTC, are also tradable on leading exchanges like Binance.

Yes, you can unwrap wBTC by requesting the service from a custodian. Alternatively, you could simply sell your wBTC for BTC on a crypto exchange that supports both assets.

While the smart contracts behind the wBTC are secure, wBTC itself is at risk of centralized points of failure. For example, if a particular blockchain or custodian goes down, it might affect the value of any tokens wrapped within its ecosystem.

You can check up-to-date information regarding the circulating supply and market cap of wrapped bitcoin on sites like CoinMarketCap and CoinGecko. At the time of writing, there are around 150,000 wBTC tokens in circulation.