The U.S. Securities and Exchange Commission (SEC) is coming for decentralized exchanges, and it’s started with Uniswap. After years of mulling over whether digital assets are securities, the regulator has initiated legal action against Uniswap, with potential ramifications far beyond the exchange.

What could this mean for Uniswap and DeFi more broadly? What might happen to holders of UNI and other cryptocurrencies? And what can we expect once the legal dust has settled?

Table of Contents

What Is the SEC vs Uniswap Case?

Uniswap executives have said that the SEC claims that Uniswap is a securities trader operating without proper permission.

Sponsored

The SEC has issued Uniswap Labs with a Wells notice, a document alerting the exchange that the regulator intends to take enforcement action against it.

As in its long-running case against Ripple. The Wells Notice to Uniswap, delivered on April 10 2024, seems to be substantively the same.

The heart of the matter is the different rules that apply in the U.S. regarding currency trading versus securities trading. Uniswap and other exchanges like it have been operating under the assumption that cryptocurrencies are considered currencies under the law.

Sponsored

However, the SEC has been pursuing the opposite idea, and that the stricter laws that apply to securities trading should apply to DeFi exchanges.

Although it is not clear, it seems that the SEC (under its head Gary Gensler) is going after Uniswap because the regulator believes it meets the legal definition of a securities trader.

Issuing and trading UNI – the Uniswap governance coin – seems enough to meet this definition. Thus, without the proper permissions to be a securities trader, Gensler believes that Uniswap has been operating outside the letter of the law.

But what’s the difference between a currency and a security? Why is issuing and selling UNI such a big deal? How do we even tell whether a company is a securities trader? Well, it comes down to one simple test.

How Will The SEC Decide if Uniswap Is Selling Securities?

The Howey Test

This isn’t the SEC’s first tango with the difficult definition of a securities broker. In fact, the regulator uses a robust exam known as the Howey Test to determine whether an entity falls within the legal definition that they seem to believe Uniswap does. Technically speaking, The Howey Test is used by courts (including the Supreme Court) in the U.S. to determine whether certain transactions qualify as “investment contracts” and thus fall under the definition of a security.

The Howey Test consists of four criteria:

- Investment of Money: This criterion requires the investment of money in a common enterprise. The investment can take various forms, including cash, cryptocurrencies, or other assets.

- Expectation of Profits: Investors must have a reasonable expectation of profits from their investments.

- Common Enterprise: The fortunes of investors must be linked to those of the investment scheme’s promoters or operators, indicating a common enterprise.

- Efforts of Others: If investors rely significantly on the efforts of others to generate profits, the investment may be deemed a security.

At its most basic form, your asset is a security if you make a financial investment in business and expect to profit from other people’s hard work. It seems likely that The Howey Test will be the framework used to judge the validity of the SEC’s case against Uniswap.

How Has Uniswap Responded to The Wells Notice?

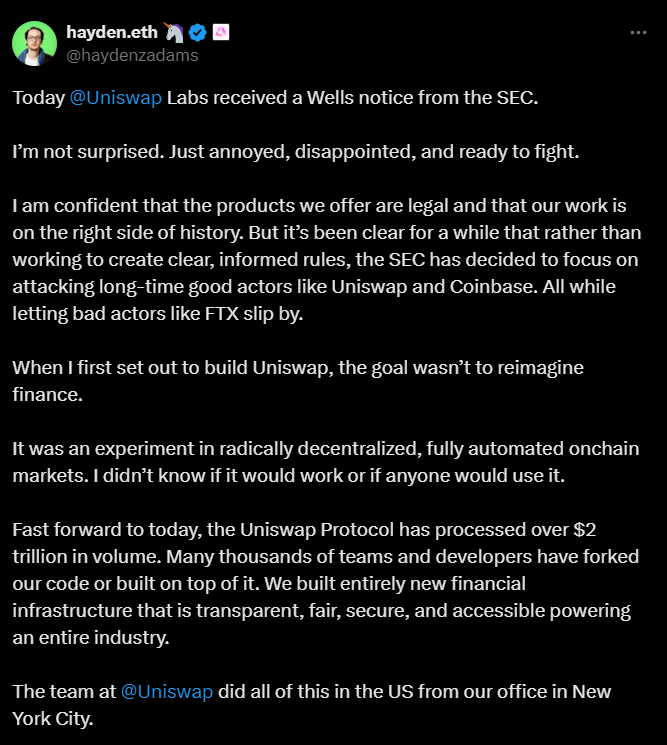

Hayden Adams, the inventor of the Uniswap Protocol, took to X and promised he was ‘ready to fight’. He also said that he was confident in the legality of the products and called Uniswap and Coinbase “long-time good actors.” There was also a subtle nod to the FTX fiasco, which he implied was at least partly a failure of the regulator to spot “bad actors.”

At the same time, Uniswap’s official blog carried a message that directly questioned the SEC’s notion that digital assets are securities. It said that “despite the SEC’s rhetoric that most tokens are securities, the reality is that tokens are a digital file format, such as a PDF or spreadsheet, and can store many types of value. They are not intrinsically values.”

Do not expect a quick result here. Ripple’s case with the SEC has been rumbling on for years. The SEC’s bureaucratic nature, as well as the labyrinthine twists of the American legal system, means there is likely to be uncertainty hanging over Uniswap for some time to come.

What Happens If The SEC Wins?

- If Uniswap was proven by Gensler’s SEC to be acting as a securities dealer without proper registration or compliance, there would be grave consequences for the platform. First, the SEC could take legal action against Uniswap, including issuing cease-and-desist orders, imposing fines or penalties, and pursuing civil litigation.

- Secondly, the SEC could take enforcement actions to enforce securities laws and regulations, including those related to the operation of securities dealers. Enforcement actions could target individuals or entities involved in operating Uniswap, including its founders, developers, operators, and liquidity providers.

- Third, there’s the possibility of asset freezes or seizures. This would only occur if there was found to be a serious case of non-compliance or fraud, but potentially the SEC dould seek asset freezes or seizures to prevent further harm to investors which would hugely disrupt Uniswap’s operations and lead to the loss of user funds.

If the SEC’s case were proven, there would almost certainly be a change to Uniswap’s operations. This could be as simple as a reorganization or as severe as a total exit or shutdown. This could happen because the regulatory burden and potential liabilities associated with operating as an unregistered securities dealer may lead Uniswap’s leaders to shut down the platform or seek alternative business models voluntarily. This would result in the loss of user services and the closure of associated projects and initiatives.

Finally, regardless of the specific legal ramifications, if the SEC won its case against Uniswap, there would undoubtedly be a market impact. UNI already fell following the news, and such a ruling would likely hit the wider crypto ecosystem. Bitcoin, Ethereum, and all other associated digital assets would be at risk of contagion as the threat of stricter regulation hit the industry.

What Happens If Uniswap Wins?

It would be a day of jubilation for DeFi tech fans everywhere, especially those with more than a little invested in UNI. If Uniswap were to win its case, proving it does not meet the legal definition of a securities trader, it would signal Crypto’s future worldwide.

It would suggest that crypto would not be treated as a security in one of the most significant legal jurisdictions in the world. This would allow for much more flexible regulations in the U.S., potentially setting the standard for how to deal with DeFi around the world.

Of course, UNI and the wider crypto industry would benefit from this. BTC, Ripple, ETH, and the wider world of decentralized finance would likely rise significantly.

It would be easier for a crypto exchange to operate without the constriction of regulation, leading to more competition in the space. The freedom given would probably increase innovation, too, ultimately leading to more choices for the consumer and wider adoption of blockchain technology.

Why Is the SEC Even Trying to Regulate Decentralised Exchanges?

The SEC’s interest in regulating decentralized exchanges stems from its mandate to protect investors and ensure fair, orderly, and efficient markets. While decentralized exchanges like Uniswap offer several benefits, such as increased accessibility, censorship resistance, and reduced reliance on intermediaries, they also pose risks, including:

- Protecting Investors: Decentralized exchanges may lack the investor protections that traditional exchanges provide, such as disclosure requirements, investor education, and safeguards against fraud and market manipulation.

- Bad Actors: Decentralized exchanges operate without central oversight, making it challenging to detect and prevent abusive trading practices, scams, insider trading, and other market manipulations.

- Compliance: Decentralized exchanges often allow users to trade assets anonymously, which can facilitate money laundering, terrorist financing, and other illicit activities. Regulating DEXs could involve implementing anti-money laundering (AML) and know-your-customer (KYC) measures to mitigate these risks and ensure compliance with regulatory requirements.

- Tax Laws: The decentralized nature of DEXs can make it difficult for tax authorities to track and enforce tax obligations on cryptocurrency transactions. Regulating DEXs could involve implementing reporting and taxation requirements to ensure users comply with tax laws.

- Systemic Risks: Decentralized exchanges are interconnected with the broader cryptocurrency ecosystem, and disruptions or failures in DEXs could have systemic implications for the economy.

Overall, the SEC’s interest in regulating decentralized exchanges is driven by its responsibility to protect investors, maintain fair and efficient markets, and mitigate systemic risks. It’s also keen to future-proof the U.S. economy by getting ahead of emerging trends, such as blockchain tech and digital assets.

So What’s Special About Uniswap Labs?

The SEC is coming for decentralized exchanges; Uniswap is just the first. Existing outside of the regulator’s grasp, exchanges like Uniswap have been a thorn in its side for years now. Big platforms like Binance and Coinbase have capitulated to regulators’ requirements, such as KYC (know your customer) ID checks. Log into Uniswap, however, and the DeFi dream will remain alive and kicking- you’ll never have to submit a passport or take an awkward selfie.

Regarding KYC, both parties argue that their way is secure. For the SEC, knowing the identities of those using Uniswap would help it establish that it’s not being used for money laundering (AML regulations) or illegal financing such as terrorism or drugs. From Uniswap’s point of view, not knowing the identities of those on its platform provides them with security from the authorities themselves and the financial systems at large. Both are probably right, but the SEC considers the two takes incompatible.

Another aspect of Uniswap that causes Gensler to gnash his teeth is its role as an Automated Market Maker (AMM). This boils down to Uniswap using an algorithmic pricing mechanism that adjusts token prices based on supply and demand. This means that trades can be executed instantly at a price determined by the current ratio of tokens in the liquidity pool.

The SEC has been tussling with AMMs for a while, trying to include them in its broad (and highly criticized) definition of ‘exchange’. Uniswap’s blend of decentralization and its role as an AMM have made it just too tempting of a target for the SEC.

On the Flipside

- The outcome of this legal battle will be a long time coming. The upshot, ultimately, is a lack of clarity on cryptocurrency regulation. Are digital assets securities or something else? What’s needed is a solid, consistent definition so exchanges can get on and work within the legal parameters set by regulators. Without that, the industry will always exist under a cloud of doubt, discouraging people from becoming part of the space.

Why This Matters

When we eventually get to a verdict in Uniswap’s case, it will have a huge ripple effect on the cryptosphere. The SEC only has jurisdiction over the U.S., but as with so many things, it is likely to at least influence (if not dictate) how other countries treat digital assets. Expect the U.S. to bear the torch and the rest of the world to follow.

FAQs

The SEC seems to believe that Uniswap meets the legal criteria to be considered a securities broker. However, as Uniswap does not have the right permissions to be a securities broker, the SEC believes it may be breaking the law.

Uniswap has promised to ‘fight’ the SEC. Executives have taken to X to vent their frustration and begin the long battle against the regulator. It seems that Uniswap does not intend to capitulate and will pursue its legal options.

Uniswap’s main competitors are: SushiSwap, which was initially a fork of Uniswap but has evolved into its own decentralized exchange. Balance, which automated portfolio management and liquidity provision services. Curve Finance is another of Uniswap’s competitors focusing on stablecoin trading and low-slippage swaps. Finally, PancakeSwap is a decentralized exchange built on the Binance Smart Chain (BSC) and is often seen as a competitor to Uniswap in the Binance ecosystem.