Try to sign up for any major crypto exchange today, and you might be surprised when you’re running for your passport. But, thanks to ‘know your customer’ rules, that’s pretty likely to happen – or at least you’ll have to take a selfie.

If you thought that crypto was a decentralized utopia where anonymous transactions elude regulators and big financial institutions can’t track your bitcoin, NFTs, and more, this might feel like a betrayal. But this hasn’t always been the case; it’s a pretty new phenomenon.

Sponsored

But why? Why do Binance, KuCoin, Kraken, Coinbase, and Bitget suddenly require your personal data to buy crypto? And doesn’t that fly in the face of the whole idea of decentralization? The answer is regulation, specifically KYC regulations.

Table of Contents

What Is Crypto KYC?

‘Know your customer’ (KYC) means regulations and customer due diligence that financial institutions are compelled to follow regarding knowing their customers’ identities—simple, right?

Basically, anyone providing financial services has to know exactly who they’re providing them to in real-time. To do this, they have to prove that they have put KYC measures in place.

If you don’t meet these regulations, and you’re supposed to, exchanges run the risk of sanctions in whatever jurisdictions they operate in.

Sponsored

KYC has been introduced to the crypto world over the last few years. Regulators including the US’ SEC, and the UK’s FCA have broadened the scope of existing financial rules to include centralized cryptocurrency exchanges. To many, this may have gone unnoticed. But for those new to crypto assets, it’s especially noticeable since KYC compliance always takes place during the onboarding of new customers. Ultimately, KYC is supposed to prevent criminal activities like money laundering, terrorist financing, and fraud.

How Does Crypto KYC Work?

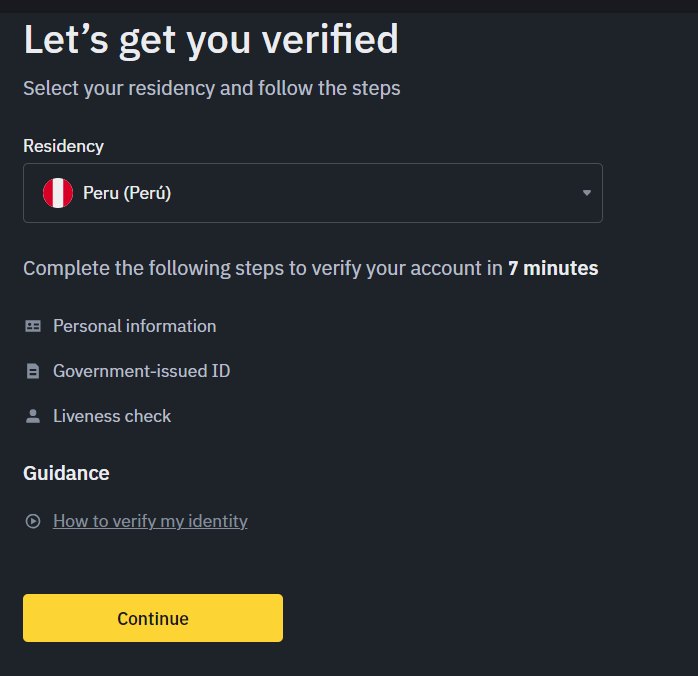

During KYC identity verification, users typically must provide personal information such as their full name, date of birth, address, government-issued identification (such as a passport or driver’s license), and sometimes additional documents or biometric data. The platform then verifies this information through automated checks or due diligence by compliance personnel.

Once the KYC process is complete and the user’s identity is verified, they are usually granted access to the platform’s full range of services. Once you’re in, you can buy and sell currencies, stake coins, and use your various crypto wallets. Just as long as you don’t commit any financial crimes, that should go without saying.

What Are the Types of Crypto KYC?

In crypto exchanges, KYC verification processes can vary in complexity and the level of information required from users. Specific KYC requirements and procedures depend on the exchange and factors such as regulatory compliance, risk management policies, and the platform’s target market. These are the major types:

- Basic KYC: Collecting basic information such as the user’s name, email address, and sometimes a phone number. Basic KYC may be sufficient for users who want to trade small amounts of cryptocurrency.

- Intermediate KYC: In addition to basic information, intermediate KYC may require users to provide more detailed personal information such as their address, date of birth, and government-issued identification (e.g., passport, driver’s license, etc.). This level is typically required for users who want to trade higher volumes.

- Enhanced KYC: Enhanced KYC involves more thorough verification processes, which may include submitting additional documents or undergoing more extensive identity checks. This is for users who want to access advanced trading features, withdraw large amounts of funds, or engage in certain high-risk activities.

- Corporate KYC: Some crypto exchanges offer KYC procedures specifically tailored for corporate entities or institutional clients. This may involve verifying the company’s legal status, identifying beneficial owners, and providing corporate documents such as registration certificates and incorporation papers.

- Geographic-specific KYC: In compliance with local regulations, some crypto exchanges may implement KYC procedures specific to users from certain geographies. These will be different depending on where you are; for example, they’re more likely to be stricter in the US, the UK, or Japan than in the Middle East.

- Tiered KYC: Tiered KYC systems involve different levels of verification based on the user’s intended activity level or the services they wish to access on the platform. Users may need to complete additional verification steps to unlock higher tiers with increased account limits or access to more features.

Why Does Crypto Regulation Now Include KYC?

Financial regulators around the world have been tightening up on the crypto industry for the last few years. Concerns about money laundering, funding for terrorism, and the lack of taxability have pushed lawmakers (and ex-presidents) to call for stricter rules. Regulatory authorities often mandate KYC verification in many jurisdictions to ensure that cryptocurrency exchanges and other platforms comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

It’s also a sign of a maturing industry, as cryptocurrency exchanges are being seen more and more as legitimate financial institutions. Gone are the days when crypto was the ‘wild west’ of finance (though some of its more niche corners could still be described as such); we’re now living in the era of serious clout for crypto’s major players. While crypto’s total market cap value counts in trillions, that’s as much, if not more, than many significant banks.

The net is tightening around crypto, that’s true, and some see it as a betrayal of some of the fundamental promises of blockchain technology. However, the flip side is that crypto has to abide by the same rules as other institutions, which means it is being seen as legitimate, which could be a step along the road to adoption in a much broader sense.

Why Choose an Exchange with KYC?

- Enhanced Security: Verifying users’ identities through KYC procedures ensures that the platform they use is secure. It helps prevent unauthorized access to accounts and reduces the likelihood of fraud, identity theft, and other scams.

- Risk Mitigation: Robust KYC helps exchanges assess the risk associated with individual users and crypto transactions. By collecting and verifying user information, exchanges can more effectively identify suspicious activity, such as large cryptocurrency transactions or unusual patterns. The exchanges can then use this information to lower their risk profile and increase functionality, providing a smoother, more secure experience.

- Access to Financial Services: KYC verification enables users to access a wider range of financial services and features offered by crypto exchanges. Users who complete the KYC process may have higher transaction limits, access to advanced trading features, and the ability to participate in initial coin offerings (ICOs) and token sales.

- Legal Protection: Implementing KYC procedures can provide legal protection for crypto exchanges by demonstrating their efforts to comply with regulations. During audits or investigations, exchanges with KYC processes are better positioned to avoid sanctions or penalties. This means anything you have to do with the exchange isn’t hampered by sudden legal troubles.

- Reduced Fraud and Chargebacks: KYC procedures help exchanges verify the identity of users before they can deposit funds or execute transactions. This reduces the risk of fraudulent activities, such as unauthorized account access, stolen credit cards, and chargebacks, which can result in losses for both the exchange and its users (you).

What Are The Cons of Crypto KYC?

- Data Breaches: Storing large amounts of user data for KYC purposes increases the risk of data breaches. If exchanges’ databases are compromised, users’ personal information could be exposed to hackers, leading to identity theft, fraud, or other nasties.

- Privacy: KYC requires users to provide sensitive personal information to cryptocurrency exchanges. You might be concerned about this from a privacy perspective, as some users are uncomfortable sharing such information.

- Centralization: KYC procedures introduce a level of centralization to the decentralized ethos of cryptocurrencies. Users must rely on centralized exchanges to verify their identities, which goes against the principles of decentralization and censorship resistance that many cryptocurrencies aim to uphold.

- Slower Onboarding: Completing KYC verification can be time-consuming and may delay access to exchanges and their services. You might have to face a lengthy onboarding process, which can be especially annoying if you’re eager to start.

- Increased Cost: Implementing and maintaining KYC procedures can be costly for cryptocurrency exchanges. It requires investment in compliance staff, technology infrastructure, and other aspects of compliance. These costs may ultimately be passed on to you as higher trading fees or account maintenance fees.

- Entry Barriers: Robust KYC requirements may act as barriers to entry for people who are unable or unwilling to provide the necessary documentation. This can end up excluding individuals from certain places, marginalized communities, or those without access to ID from participating in the cryptocurrency ecosystem.

- Potential for Exploitation: Despite KYC procedures, malicious actors may still attempt to circumvent identity verification requirements through identity theft, fake documents, or other fraudulent means. This poses a challenge for exchanges in detecting and preventing illicit activities despite their efforts to implement KYC controls.

Top Tips For Passing Crypto KYC Checks

Passing crypto KYC checks can be a nightmare, but it doesn’t have to be. As long as you’re prepared, accurate, and not secretly funding anything illegal, you should be fine. It’s probably a good idea to have your documents prepared before you begin tackling KYC, which is likely to include a form of government ID. Crucially, these documents need to be legible. Even a tiny bit of blurring or poor choice of cropping can lead to rejection, putting you right back where you started.

Also important is to make sure your information actually matches. Don’t put in your current address if your old address is on your documents, and definitely don’t spell your name differently. Be precise and you’ll save yourself a headache later on.

If a selfie is required, make sure it’s clear. You want a well-lit photo taken on a neutral background without anything obscuring your features. Take off that hat and those glasses; they won’t help you here. Think of the biometric selfie as a passport photo and take it just as seriously.

The final step in passing your crypto KYCs is simply to be patient. If you’ve followed all the instructions carefully, submitted clear documents, and taken a stunning (if serious) selfie, you’ll have to wait. Some exchanges use automated processes, which are quicker but can be frustratingly robotic about details. Others use human eyes to assess their applicants, which takes longer but tends to be more forgiving. If you’ve done everything right, there’s no reason you should be rejected, so just put your feet up and dream of how secure all your transactions will be.

On the Flipside

- Some believe that KYCs fly in the face of the central tenets of decentralization. Detractors say that far from providing extra security, KYCs are simply states attempting to take control of something that was always supposed to be outside of their mandate. The true DeFi heads in the community believe in the perfect freedom that anonymity allows. As such, there are plenty of no-KYC exchanges operating in 2024.

Why This Matters

If you’re a new or experienced cryptonaut, you’re going to come up against KYCs. Anytime you sign up to a new exchange you’re likely to have to provide some degree of personal information. With proper understanding and preparation, this shouldn’t be a problem, but a rushed, uninformed job leads down a highly frustrating path.

FAQs

AML stands for Anti-Money Laundering. In crypto, AML regulations refer to laws designed to prevent and detect illegal activities related to money laundering and terrorist financing.

No, cryptocurrency wallets themselves generally do not require KYC verification. However, you may encounter KYC requirements when interacting with cryptocurrency exchanges or other service providers, especially if you want to make fiat deposits and withdrawals, engage in trading, or participate in token sales.

It totally depends on the provider, but typical requirements include personal information (name, DoB), government-issued identification, proof of address (e.g. a bill or a bank statement), selfie verification (often biometric), and source of funds information (e.g. your income, your employment). Few exchanges are strict enough to require all of these, but expect at least a combination of a few when you sign up.