- A stablecoin trend has defied expectations, leaving industry players pondering its trajectory in 2023.

- Amid 2023’s challenges, the adoption rate of stablecoins has soared.

- Stablecoins have carved a niche, yet their transactional weight remains a small fraction of traditional networks.

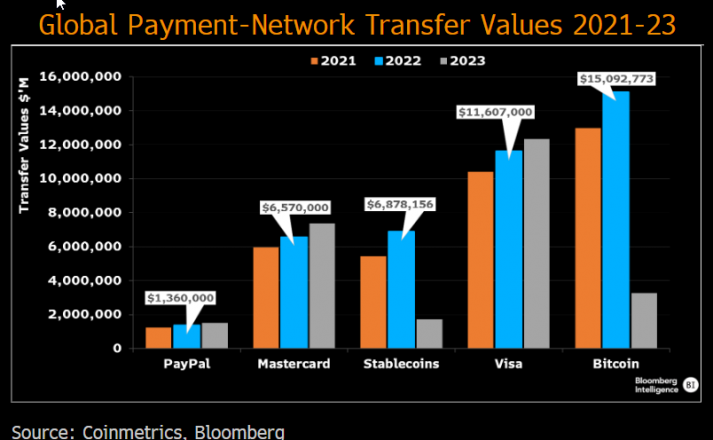

Digital currencies known as stablecoins operating on various foundational blockchain networks achieved an impressive transaction volume of $6.87 trillion in 2022. This notable sum surpassed the transactional prowess of well-established financial entities like Mastercard and PayPal. That leaves us with one question: Has this trend continued into 2023?

Stablecoins Show Remarkable Growth Despite Market Challenges

Comparative data from the same year elucidates that Mastercard facilitated transactions amounting to $6.57 trillion. In contrast, PayPal handled transactions valued at $1.3 trillion, as reported by reputable sources such as Coinmetrics and Bloomberg.

Despite the intricate challenges that pervaded the wider cryptocurrency market throughout 2023, the adoption rate for stablecoins such as USDT and USDC has surged to surpass Ethereum’s. However, indications have suggested a deceleration in their momentum against traditional financial giants during 2023.

Sponsored

Starting from 2021, the count of stablecoin-linked digital addresses holding a balance exceeding $1 has experienced a sevenfold acceleration compared to Ethereum addresses exhibiting the same financial threshold.

Stablecoin Transactions Sluggish Despite Increased Adoption

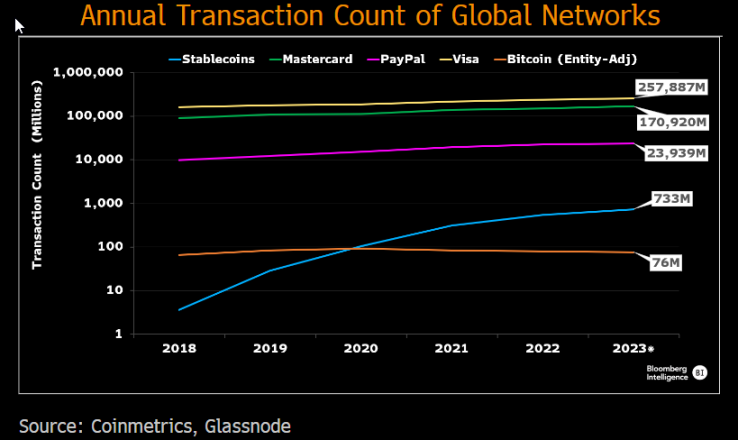

Although stablecoins have witnessed a substantial upsurge in adoption, their annual transactional frequency remains relatively modest, accounting for merely 0.5% to 3% of the comparable metrics observed within traditional payment networks, as outlined by comprehensive insights from Coinmetrics and Glassnode.

One probable explanation for the relatively subdued embrace of decentralized networks could be attributed to the considerable transactional fees and limitations in throughput inherent to platforms like Ethereum.

On the Flipside

- Although stablecoins’ transactional frequency is rising, their modest share of traditional payment networks suggests they have yet to fundamentally disrupt the established financial ecosystem.

- The transactional fees and limitations on platforms like Ethereum, which impact stablecoin use, could negatively affect the adoption rate.

- 2023 has witnessed an unparalleled absence of volatility in the cryptocurrency market, potentially contributing to the diminished transactional significance of stablecoins during the same period.

Why This Matters

Stablecoins, often overlooked, wield substantial influence in facilitating frictionless transactions within the cryptocurrency realm. Their unassuming nature belies their indispensable role as they grease the wheels of the crypto market’s daily operations, ensuring a smoother path for traders and investors alike.

Sponsored

To learn more about Tether’s transparency report and its $3.29 billion liquidity buffer, click here:

Tether Transparency Report Highlights $3.29B Liquidity Cushion

To delve into how USDC plays a pivotal role in the Solana-pay integration with Shopify, read here:

USDC Takes Center Stage in Solana Pay’s Integration with Shopify