- Crypto fund outflows continued last week despite signs of optimism a week prior.

- Amid this streak, short Bitcoin products have seen record inflows.

- The negative market sentiment comes as the excitement surrounding the Grayscale win over the SEC has cooled.

Outflows from digital asset investment products have persisted for several weeks amid an extended lull in the crypto markets. While the flows indicated a break from the negative market sentiment might be in the cards two weeks ago, the most recent data suggests otherwise.

The Shorts Have It

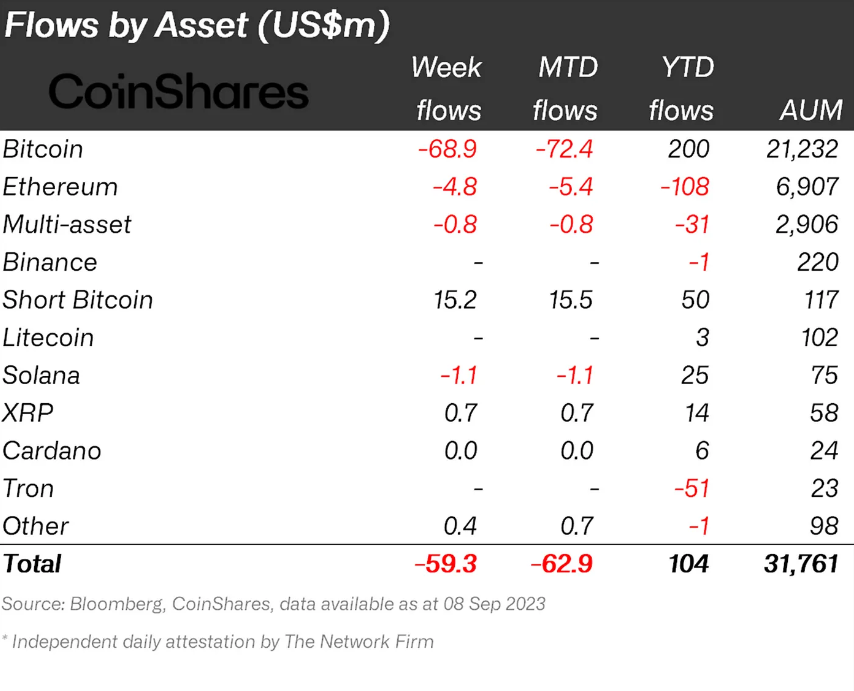

Digital asset funds saw outflows totaling $59 million in the past week, according to CoinShares’ report on Monday, September 11. Last week’s crypto fund flows represent the eighth consecutive week of outflows, with the total in the past four weeks reaching $294 million.

As is typically the case, Bitcoin investment products suffered the most significant outflows within the week, with $69 million. Ethereum investment products also saw outflows of $4.8 million.

On the other hand, short Bitcoin investment products saw $15 million in inflows, the largest since March 2023. As CoinShares Head of Research James Butterfill highlighted, the high inflows are remarkable as the comparable timeline was a period of “heightened regulatory uncertainty.” For one, the U.S. CFTC had just filed an enforcement action against Binance, the world’s largest exchange. Additionally, the SEC had also just issued a Wells Notice to Coinbase.

Sponsored

The recent outflows and significant short Bitcoin sentiment come after Grayscale’s legal win over the SEC sparked optimism the previous week, leading to a massive drop in crypto fund outflows.

Fleeting Excitement

Crypto funds recorded only $11.2 million in outflows in the week ending September 1, a 93% drop from the previous week. At the same time, Bitcoin also recorded inflows of $3.8 million.

Sponsored

The significantly reduced negative sentiment followed Grayscale’s legal win over the SEC, which sparked optimism about a spot Bitcoin ETF approval. However, the SEC’s move to delay its decision on multiple pending spot Bitcoin ETF applications, including BlackRock’s, till October 2023 quickly snuffed out any excitement.

At the same time, analysts remain divided on the chances of a Bitcoin ETF approval. While Bloomberg intelligence analysts James Seyffart and Eric Balchunas predict a 75% chance of a spot Bitcoin ETF approval in 2023, Blockchain Ireland founder Lory Kehoe has argued that an SEC approval will likely come in 2024.

On the Flipside

- Grayscale has tried to push its advantage, calling for a Bitcoin ETF approval meeting with the SEC.

- Concordium founder Lars Seier Christensen has argued that spot Bitcoin ETFs are insufficient to spark the next bull market cycle.

Why This Matters

Crypto fund flows typically indicate broad investor sentiments. Last week’s outflows suggest that investor sentiment remains significantly negative.

Read this to learn more about recent crypto fund flows:

Crypto Outflows Hit 7-Week Streak, But Sentiment May Be Turning

Learn more about how someone paid $500k in fees for a single Bitcoin transaction:

User Pays $500,000 for a Single Bitcoin Transaction: Details