- The SEC is still pursuing charges against Binance, CZ.

- The regulator opposed a motion by the defense to dismiss the lawsuit.

- Court filing reveals the “theatrical” side of both parties.

The crypto regulation landscape in the U.S. is rapidly evolving and sometimes opaque, especially when regulatory agencies are thought to be overreaching in their enforcement actions.

Despite a crypto law lacuna, the Securities and Exchange Commission (SEC) has demonstrated a relentless will to pursue Binance, its founder Changpeng “CZ” Zhao, and the exchange’s U.S. affiliate, Binance.US.

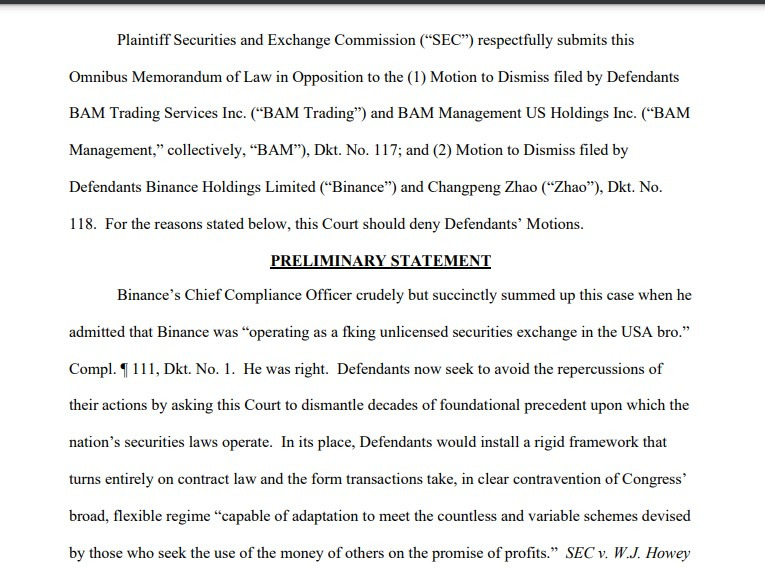

On November 7, the securities watchdog filed opposition to a motion to dismiss its lawsuit against the defendants, arguing that the charged parties are culpable of fraud and securities law violation.

SEC Filing Opposes Binance Motion to Dismiss Lawsuit

In a motion filed on September 21, the defendants asked the court to dismiss SEC’s lawsuit against them, arguing that the regulator had “overstepped its authority” and failed to plausibly demonstrate that the crypto assets contested in the case are securities.

Sponsored

According to the regulator, these arguments, among others submitted by the defendants, are mere “theatrics” and “elevate form over substance.”

Sponsored

Per the SEC’s filing, in a renewed bid to evade accountability, the arguments by the defense mostly ignore the regulator’s allegations that Binance and its U.S. affiliate offer crypto assets sold as securities. The regulator also noted the defense is trying to insert new requirements into Howey’s test.

“Defendants further engage in theatrics, casting the SEC’s application of Howey as “breathtaking,” BAM Mem. 12, and this action as an attempt to “regulate this trillion-dollar industry through enforcement,” the SEC submitted, adding, “Zhao and Binance even take the remarkable position that they are not subject to the federal securities laws at all.”

The regulator said the laws at issue suffice to sustain its claims against the defendants. Notably, the regulator stated that the defendants couldn’t escape their legal obligations by rewriting Howey.

On crypto law lacuna, the regulator argued that the defendants shouldn’t raise arguments based on legal uncertainty when, in fact, they admitted that they operated an “unlicensed securities exchange” in the U.S.

Read why the SEC is set to review Grayscale’s Bitcoin ETF application:

SEC Mandated to Review Grayscale’s Bitcoin ETF Application

Stay updated on the SEC vs. Ripple legal battle:

Is the SEC’s Case against Ripple Losing Ground?