- Sam Bankman-Fried faces multiple criminal charges for his alleged role in the FTX collapse.

- The disgraced FTX founder sought to wriggle out of most of the charges.

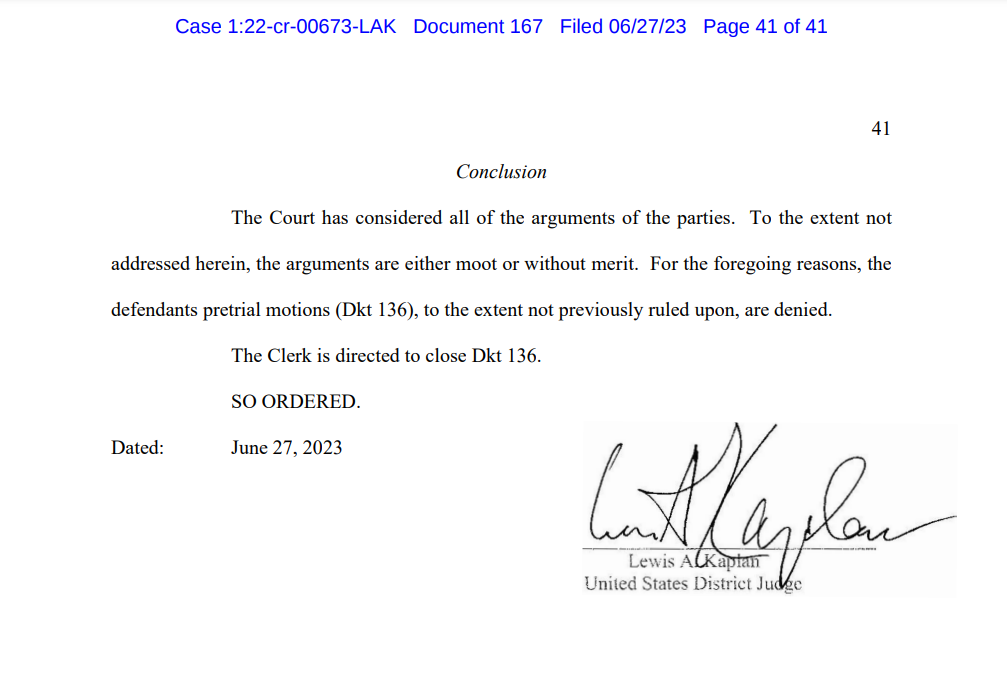

- The judge has made a crucial decision in the case.

FTX’s collapse sent tremors through the crypto and finance world that are still being felt today. Following the exchange’s collapse, its disgraced founder Sam Bankman-Fried (SBF), was slapped with multiple criminal charges, including wire fraud, securities fraud, money laundering, and bribery.

Facing a cumulative jail term of over 115 years if convicted, Bankman-Fried moved to dismiss ten out of the 13 charges against him in May. However, per a recent court decision, these efforts have failed, ensuring that the FTX founder faces life in prison.

SBF’s Motions to Dismiss Denied

On May 8, Bankman-Fried’s attorneys filed several motions to dismiss ten of the 13 criminal charges against the disgraced FTX founder. They argued that some of these charges were duplicative, vague, or violating Bankman-Fried’s extraction treaty with the Bahamas.

Sponsored

A federal judge has, however, denied these motions to dismiss in a ruling on Tuesday, June 27. Judge Lewis A. Kaplan of the United States District Court of the Southern District of New York slammed the motions argued by Bankman-Fried’s lawyers as “moot or without merit.

“Ultimately, ‘[a]n indictment need not be perfect, and common sense and reason are more important than technicalities,”‘ Judge Kaplan wrote in response to claims of vague charges, adding that the charges were in keeping with established legal standards.

Similarly, in response to arguments that charges brought against the FTX founder after his extraction from the Bahamas violated the extradition treaty, Judge Kaplan highlighted that Bankman-Fried lacked the standing to raise this issue, arguing that it is reserved for the extraditing country.

Sponsored

The recent ruling is the latest in a growing line of losses that the disgraced FTX founder has taken in the case.

SBF’s Losses Pile Up

On June 23, Judge Kaplan denied Bankman-Fried’s motion to subpoena former FTX law firm Fenwick & West LLC documents.

"Neither Fenwick nor the FTX Debtors1 are part of the 'prosecution team,' and the government has no obligation to produce materials that are not within its possession, custody, or control. Furthermore, the defendant's proposed subpoena, if enforced, would serve as a fishing expedition and does not meet the specificity, relevance, and admissibility requirements set forth in United States v. Nixon, 418 U.S. 683 (1974)," the judge wrote.

On May 30, the disgraced FTX founder’s lawyers requested permission to subpoena these documents contending that they were critical to the defense. They alleged that the law firm’s advice guided many actions at the core of the criminal charges against the FTX founder.

Bankman-Fried will stand trial for pre-extradition charges in October, while the trial for post-extradition charges requiring consent from the Bahamas has been set for March 2024. The former FTX chief has pleaded not guilty to all charges.

On the Flipside

- Former FTX executive Gary Wang and former Alameda Chief Executive Officer Caroline Ellison have pleaded guilty to similar fraud charges and are cooperating with authorities.

- Restructuring officers are considering an FTX reboot.

Why This Matters

The judge’s decision to deny Sam Bankman-Fried’s motion to dismiss ensures that the disgraced FTX founder faces the possibility of life imprisonment.

Read this deep dive to learn more about Bankman-Fried’s motion to dismiss:

Here’s How SBF’s Daring Appeal for Court Dismissal Works

Coinbase‘s Brian Armstrong claims the U.S. is in a precarious position because policymakers have failed to move on from the FTX debacle. Find out more:

Coinbase CEO Brian Armstrong Suggests The U.S. Is Fumbling an Early Lead Over SBF Embarrassment