The Ripple (XRP) vs. Bitcoin (BTC) debate has captivated the cryptocurrency community for over a decade. Yet despite their similarities, these global payment networks have starkly different visions and use cases.

While Bitcoin is undoubtedly the champion of the common folk and the crypto that kick-started the revolution, Ripple found a way to improve upon the Bitcoin blockchain and provide a far more efficient cross-border payments processor.

But that’s just the tip of the iceberg. There’s far more to this titanic cryptocurrency match-up than meets the eye. Let’s explore the ins and outs of cryptocurrency’s biggest payment networks and see who is on top.

Table of Contents

Ripple vs. Bitcoin Overview

Created by Satoshi Nakamoto in 2008, Bitcoin is the world’s first blockchain. It provided a direct peer-to-peer payments network and self-custody system, meaning users enjoyed full ownership of their digital assets.

Sponsored

The idea itself was revolutionary and birthed the crypto world as we know it today. However, as time passes, Bitcoin’s technology is starting to look a little outdated. Transaction times are agonizingly slow, and gas fees make the Bitcoin network impractical to use regularly, especially during periods of high activity.

Ripple’s XRP, on the other hand, came a few years later in 2012. Founded by Jed McCaleb, Arthur Britto, and Chris Larsen, Ripple Labs took the idea of Bitcoin and improved it. They designed a network that was faster, cheaper, and better equipped for the high volumes of transactions required by the global finance circuit.

Sponsored

While Ripple might look like a new and improved version of the Bitcoin network, it’s important to understand the motivations and vision behind each project.

Bitcoin’s Vision

Bitcoin aims to reinvent our financial future based on the principles of decentralization and self-custody. Unlike fiat currencies, it has a capped supply and is anti-inflationary. It’s a peer-to-peer electronic cash system, a hedge against inflation, and a personal bank account all rolled into one.

At its core, Bitcoin’s ethos is rooted in autonomy and freedom from central authority and financial institutions, removing the need for intermediaries who aim to profit from the transfer of assets between parties.

This is achieved through blockchain technology, a decentralized ledger that records all transactions across a network of computers. Bitcoin’s design ensures that each transaction is secure, transparent, and immutable, establishing and maintaining trust in a system where no single entity has control.

Bitcoin’s appeal lies in its potential to provide a universal currency accessible to anyone with an internet connection, free from the constraints and regulations of traditional banking systems.

This vision of a decentralized, accessible, and secure financial system has resonated with millions of users worldwide, driving Bitcoin’s growth and positioning it at the head of the cryptocurrency movement.

Ripple Labs’ Vision

While Bitcoin aimed to replace the existing financial system, Ripple set out with a different objective. Founded in 2012, Ripple Labs is a centralized entity that seeks to improve existing financial infrastructure using blockchain technology.

Ripple Labs envisions a more efficient global payment system. The cryptocurrency powerhouse aims to connect financial institutions like banks, payment providers, and corporations via RippleNet and the XRP Ledger, a network designed to provide a seamless experience for global money transfers.

Ripple’s strategy involves working within the regulatory frameworks and partnering with established financial institutions. The goal is to address the inefficiencies of the current banking systems, particularly in cross-border payments and remittances. Think of Ripple as a faster, more affordable SWIFT payment processor capable of streamlining international transactions.

Key Differences

Despite being cut from the same cloth, each crypto boasts several distinguishing features that must be considered in the Ripple vs Bitcoin clash.

Available to anyone with an internet connection, Bitcoin helps everyday people exercise greater control over their wealth and provides a shield against inflationary, centralized fiat currencies.

Conversely, Ripple is designed to facilitate faster and more affordable transactions for the financial institutions at the top of the food chain, helping money move across the globe faster.

Let’s take a closer look at what separates these blockchain behemoths.

Speed

Transaction speeds are one of the most critical features of any payment network. One of the biggest criticisms of the existing financial system is that it can take days to spend funds internationally.

Bitcoin’s Speed – Bitcoin transactions are known for their unrivaled security, but this comes at a cost. The time it takes to confirm a Bitcoin transaction depends on several factors, including network congestion and the transaction fees a user is willing to pay.

On average, a Bitcoin transaction takes around 10 minutes to finalize. This can be even longer during high network activity, with some transactions failing entirely. While 10 minutes is a significant improvement compared to existing standards, it’s nowhere near fast enough to compete with emerging networks like Ripple.

Ripple’s Speed – Transactions on the Ripple network can be settled in just a few seconds, making it a popular choice amongst financial institutions handling high volumes of cross-border payments.

This speed is attributed to Ripple’s unique consensus protocol, which does not require the intensive mining process used by Bitcoin. Instead, it utilizes a network of validating servers and unique distributed ledger technology, allowing for rapid transaction validation and payment settlement.

On top of being faster, Ripple is also far more scalable. The modern network can process over 3,000 transactions per second (TPS), a significantly more impressive achievement than Bitcoin’s cumbersome 7 TPS.

Cost

If you’ve tried using Ethereum (ETH) during high activity, you’ll know just how expensive blockchain transactions can be. Bitcoin and Ripple are no different, with each network providing vastly different transaction fees.

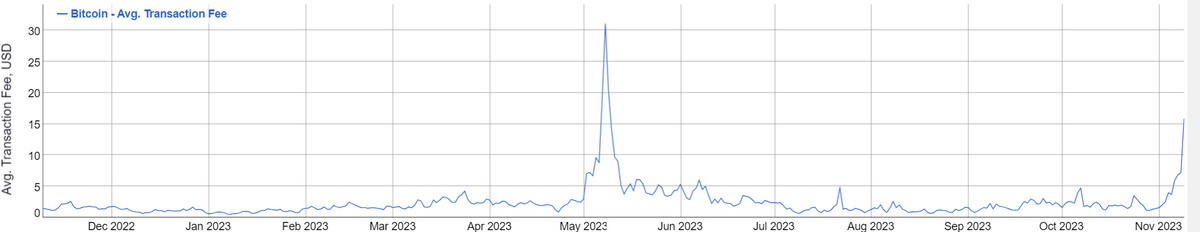

Bitcoin Costs – Bitcoin’s transaction fees can vary significantly, influenced by factors like network congestion and the transaction’s data size. During periods of high demand, fees can escalate as users bid higher to prioritize their transactions in the network.

During the Bitcoin ordinal and BRC-20 frenzy of early 2023, Bitcoin transactions spiked to $50 for some basic ordinal inscriptions.

This volatility makes Bitcoin less predictable and often impractical for small transactions. Additionally, the energy-intensive nature of Bitcoin’s Proof-of-Work (PoW) consensus mechanism indirectly contributes to its cost, requiring substantial computational power and electricity.

Ripple Costs – Again, Ripple wins. The network is renowned for its minimal transaction fees, generally charging users a fraction of a cent. In the same way that BTC is used to pay for Bitcoin transactions, every transaction fee on the XRP Ledger is charged in XRP tokens.

Moreover, Ripple’s protocol design ensures that the costs remain low, regardless of network congestion, making it an attractive option for financial institutions and transactions where minimizing costs is a priority.

Consensus Mechanism

Now that network speeds and costs have been handled, let’s look at each architecture.

Bitcoin’s Consensus Mechanism – Bitcoin validates transactions and records data to the blockchain using the Proof-of-Work (PoW) consensus mechanism. In PoW, Bitcoin miners use computational power to solve complex mathematical puzzles and earn the right to add new blocks to the network in exchange for rewards.

This mechanism, while secure, is energy-intensive and contributes to slower transaction speeds and higher costs, as discussed earlier.

Ripple’s Consensus Mechanism – To avoid the energy-intensive and inefficient PoW method, Ripple designed a unique consensus algorithm that does not rely on mining.

Instead, it utilizes a network of validator nodes that verify transactions and record them to the distributed ledger. Nodes compare transaction records to reach a real-time consensus on the order and validity of XRP transactions.

This process is significantly faster and less energy-consuming than Bitcoin’s PoW mechanism. The absence of mining in Ripple’s system speeds up transaction processing and keeps transaction costs exceptionally low.

Decentralization

So far, it looks like Ripple is clearly in the lead. The network is not only faster and more affordable, but it’s also more energy efficient. Is there any hope for Bitcoin against this rival altcoin?

Bitcoin’s Decentralization – Bitcoin is the epitome of decentralization in the cryptocurrency realm. It operates on a distributed ledger technology, the blockchain, maintained by a global network of miners.

No single entity owns or controls the Bitcoin network, making it a truly distributed system. This decentralization is fundamental to Bitcoin’s design, ensuring it remains free from central authority control and manipulation. It’s one of the key features that attract users seeking a system that offers financial autonomy and security.

Ripple’s Decentralization – while utilizing a form of distributed ledger technology, Ripple takes a different approach to decentralization. RippleNet’s network is maintained by a series of validating servers, most of which Ripple Labs owns and operates.

This gives Ripple Labs a significant, albeit not total, degree of control over the network. While Ripple has taken steps to increase the decentralization of its network by adding independent validators, it is still perceived as more centralized than Bitcoin.

Why Bitcoin Is Better than Ripple

It’s hard to argue that Bitcoin is objectively better than Ripple. The truth is that Ripple is simply a far more efficient payment network capable of handling an influx of transactions that would overwhelm the Bitcoin network in seconds.

Yet, Bitcoin has evolved into something far bigger than a simple payment network. It’s a completely decentralized service that cannot be shut down or altered. Bitcoin’s founder disappeared over a decade ago, but the Bitcoin network lives on through a global community.

In contrast, Ripple is far more centralized. Ripple Labs holds most of the XRP cryptocurrency in its escrow accounts and controls most of the network. Some would even argue that Ripple is a betrayal of the crypto’s foundational ethos, providing services for the financial elite.

Millions of people all over the world have turned to Bitcoin as a permissionless, censorship-resistant platform that is free from centralized control. Capped at a maximum supply of 21M BTC, the world’s first cryptocurrency is now considered a store of value and a hedge against inflation.

It has the largest market capitalization of all digital currencies. It has become the face of an emerging industry that’s trying to reinvent the global financial system for the benefit of everyone, not just the fat cats at the top of the heap.

Why Ripple Is Better than Bitcoin

Bitcoin might be the face of cryptocurrency, but if you think it’s an efficient and reliable way of transferring value, you’ve never actually tried using it. In the cryptocurrency world, 10 minutes for a simple transaction feels like a lifetime, and transactions can sometimes cost more than the value of the transaction itself.

In its quest to reimagine cross-border payments, Ripple Labs has partnered with banks and financial institutions worldwide, including Santander, Australia’s Commonwealth Bank, and Thailand’s Siam Commercial Bank.

As a payment network, Ripple is the clear winner. It has faster transactions, cheaper fees, and is even better for the environment. If you need to send funds abroad and want to ensure they arrive quickly, the XRP network is a much better bet.

BTC vs. XRP: Head-to-Head

Who comes out on top in the Ripple vs Bitcoin battle? Is Bitcoin’s legendary status and unmatched decentralization enough to give it the edge? Or is Ripple’s far more efficient architecture too powerful for clumsy old Bitcoin?

Let’s recap the key facts:

| Bitcoin | Ripple | |

| Ownership | Dencentralized | Centralized |

| Transactions Per Second | 7 | 3,400 |

| Transaction Processing Time | ~10 mins | 3-5 Seconds |

| Transaction Fee | $5-$15 | 0.0002 |

| Max Supply | 21M | 100B |

| Energy Consumption | 57B kWh | 474,000 kWh |

It comes down to personal preference.

If you believe in decentralization and everything cryptocurrency stands for, Bitcoin is the network for you.

Use Ripple if you want to send money abroad as fast as possible without spending an arm and a leg.

On the Flipside

- The cryptocurrency and blockchain industry is now around 15 years old. At this stage, Bitcoin and Ripple are far outclassed by newer networks that are far more efficient and offer smart contract support.

Why This Matters

Now that Ripple Labs’ legal battle with the US Securities and Exchange Commission has drawn to a close, the XRP market will be able to grow without the doubtful shadow of a relentless lawsuit hanging over its head.

FAQs

You can buy XRP and BTC on leading cryptocurrency exchanges like Binance and Coinbase.

It is unlikely that XRP will ever have a larger market capitalization and overtake Bitcoin as the world’s biggest cryptocurrency.

That depends on your perspective. Ripple is objectively a better payment network based on its speed and usage costs; however, Bitcoin is the face of the crypto market and represents everything blockchain technology aims to achieve.