- Polygon’s MATIC is moving higher despite a broader market correction.

- The move follows an uptick in whale activity.

- The asset faces obstacles on its road to $1.

The crypto markets have kicked things off with significant volatility in October 2023.

Essentially moving in lockstep with Bitcoin (BTC), most major crypto asset prices were locked in a correction on Tuesday, October 3, after enjoying a significant pump the day before. However, Polygon (MATIC) has managed to swim against the current as whales come out to play. Can MATIC sustain its run?

Whale Moves Big Bag

On Tuesday, October 3, Santiment Feed highlighted that MATIC experienced a 4% jump to $0.568, its highest point since August 2023, while other crypto assets shed early October 2023 gains.

Santiment noted that MATIC’s recent spike coincided with the movement of 37 million MATIC (worth approximately $20.7 million) on-chain, the largest single transaction on the Polygon network since July. It comes as whale activity on Polygon has entered an uptrend in the past week.

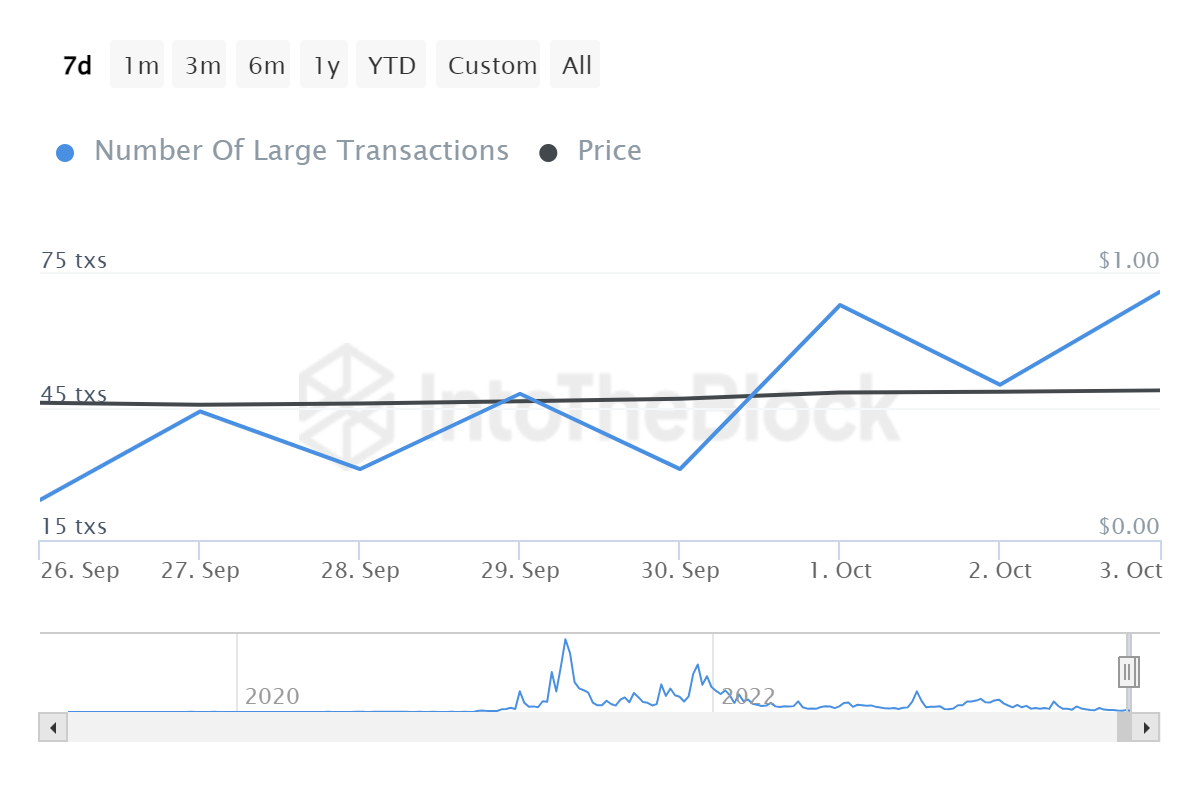

As highlighted by IntoTheBlock data, the number of transactions valued at over $100k on the Polygon network has jumped from 24 on September 26 to 71 on October 3, a whopping 195% increase. At the same time, the volume of these large transactions has also surged from 56 million MATIC on September 26 to 159.02 million MATIC on October 3, representing a massive 184% increase.

While the specific reason for this recent uptick in whale activity on Polygon is unclear, the network has had a string of positive developments in the past few days, with Google becoming a validator as the network works toward its 2.0 roadmap.

What’s Next for MATIC’s Price?

While the immediate goal for many members of the Polygon community remains a return to $1, MATIC’s price still faces significant hurdles. For one, in the short term, the price continues to face resistance at $0.5778 and appears to be forming a double-top pattern on the four-hour chart. Completing this bearish chart formation could see the price drop to $0.5260.

Alternatively, MATIC could get locked in a range between the potential neckline of the double-top pattern at $0.5450 and the resistance at $0.5778. These are the levels to watch over the next few days, as a close above them could indicate the asset’s next direction in the short term, either towards $0.6 or $0.5.

On the Flipside

- Most major altcoins are averaging 2% losses over the past 24 hours at the time of writing.

- With the Polygon 2.0 roadmap, developers will upgrade MATIC to POL, an inflationary token to serve Polygon’s envisioned ecosystem of zero-knowledge-powered Ethereum Layer-2 chains.

Why This Matters

Despite Polygon’s multiple developmental strides, MATIC’s price action has remained largely muted amid a broader disinterest in crypto assets brought on by macroeconomic conditions and the collapse of numerous crypto firms. The lack of movement has sparked frustration among investors. However, MATIC’s resilience amid a broader market correction could suggest the potential for a solid finish to 2023.

Read this to learn more about Polygon’s recent strides:

Polygon Smashes Total Transaction Milestone as 2.0 Nears

Learn more about Bitcoin’s recent price action and what analysts think of the asset’s prospects in October:

Bitcoin Sheds Early October Gains: Is $30K Still in Play?