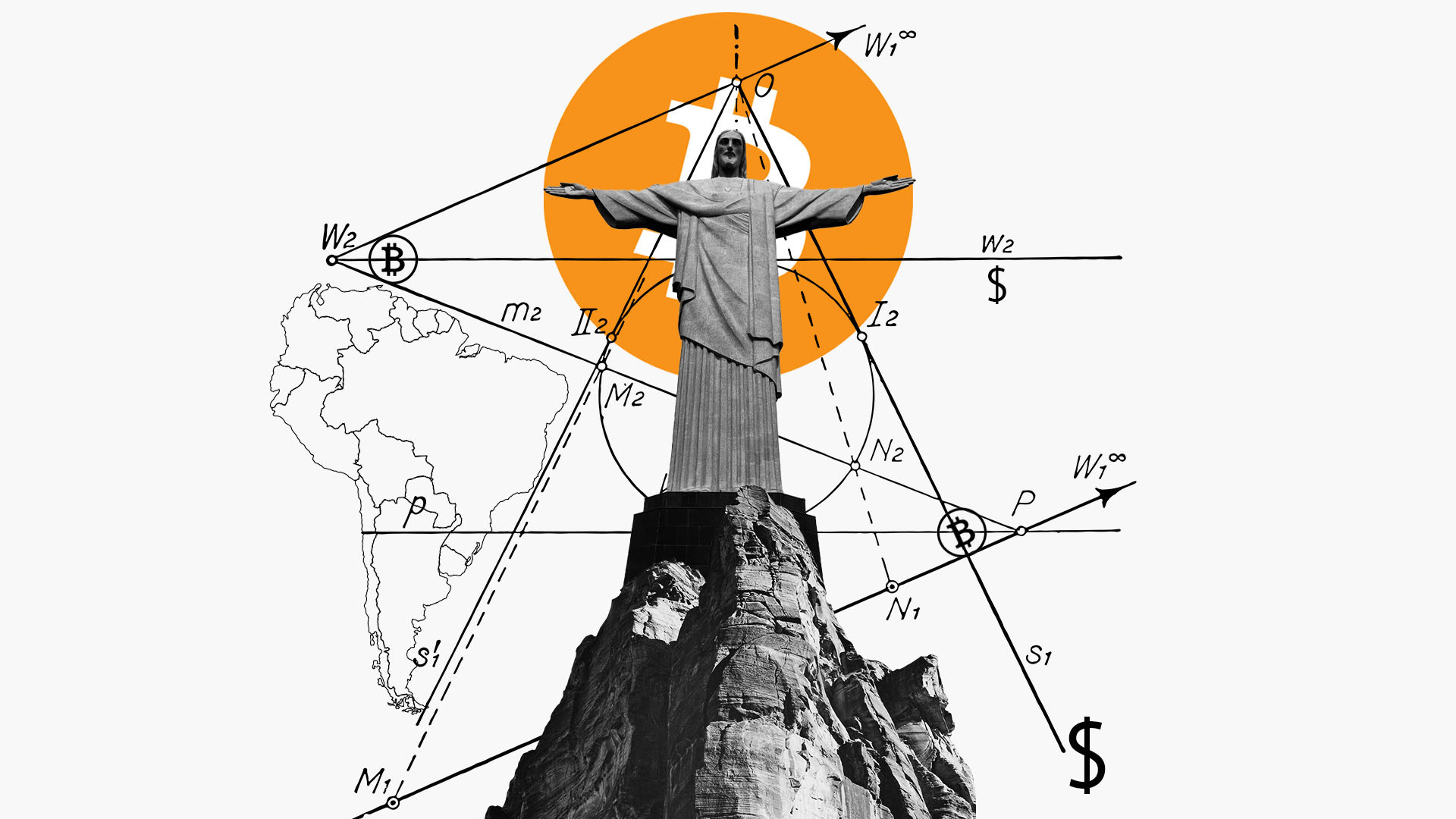

- Politicians from several Central and South American countries, announced plans to legitimize BTC.

- Such support occurred within 48 hours of the initial announcement from the President of El Salvador.

- One of the issues is that there are transaction fees that will need to be addressed.

On Monday, June 7th a handful of politicians from different Latino countries, in both Central and South America, publicly announced their plans to pursue efforts to legitimize Bitcoin as sovereign currencies within their respective geographies. This surprising support among multiple nation states occurred within 48 hours of the initial announcement from the President of El Salvador, that El Salvador will designate Bitcoin as legal tender.

President Nayib Bukele timed the announcement with the massive 2021 Bitcoin conference held in Miami, Florida, this past weekend, where he said he would have a proposal ready this week to submit to the El Salvadorian Congress. He provided this new update to his Twitter account on Monday.

The #BitcoinLaw has been approved by a supermajority in the Salvadoran Congress.

— Nayib Bukele 🇸🇻 (@nayibbukele) June 9, 2021

62 out of 84 votes!

History! #Btc🇸🇻

Once designated as legal tender by a nation state, several legitimizing benefits would instantly be conveyed to the designated currency, which include: payment of government taxes, settlement of debt, as well as elimination of transaction costs associated with the use of multiple competing currencies.

Sponsored

President Bukele further stated that he wants to attract the best and brightest crypto-entrepreneurs and programmers to the country to help make his vision for El Salvador a reality. He listed several economic incentives such as the fact that El Salvador is one of the few countries in the world with no property tax. He also promised to eliminate capital gains taxes on Bitcoin transactions, since it will be a legal currency, as well as the promise of immediate, permanent residency for crypto entrepreneurs who move there.

His actions triggered a series of Latino leaders to announce their own efforts to embrace e-currencies. One of them is Panamanian diplomat, Gabriel Silva, his original tweet on the topic is pictured below and translates into English as:

This is important. And Panama cannot be left behind. If we want to be a true technology and entrepreneurship hub, we have to support cryptocurrencies. We will be preparing a proposal to present at the Assembly. If you are interested in building it, you can contact me.

Esto es importante. Y Panamá no se puede quedar atrás. Si queremos ser un verdadero hub de tecnología y emprendimiento tenemos que apoyar las criptomonedas

— Gabriel Silva (@gabrielsilva8_7) June 7, 2021

Estaremos preparando una propuesta para presentar en la Asamblea. Si están interesados en construirla me pueden contactarte https://t.co/yiAzPpD9nj

This was followed by a “laser eye” profile picture update by one of Brazil’s State Deputies, Fabio Ostermann. The use of “laser eyes” in memes and profile pictures on social media has been adopted largely by Bitcoin enthusiasts to convey a public message that symbolizes “powering up,” bullish solidarity, and general support for the cryptocurrency space.

#LaserEyes #LaserEyesTill100k #NovaFotoDoPerfil pic.twitter.com/tbxThxh5Ps

— Fábio Ostermann (@FabioOstermann) June 7, 2021

The parade of politicians continued with this tweet from the Circumstantially Deputy of Paraguay, Carlitos Rejala, who combined a pro-Bitcoin statement with laser eyes in a tweet to his followers. The translation of his Twitter message is:

As I was saying a long time ago, our country needs to advance hand in hand with the new generation. The moment has come, our moment. This week we start with an important project to innovate Paraguay in front of the world! The real one to the moon #btc & #paypal.

Como ya lo decía hace un buen tiempo, nuestro país necesita avanzar de la mano de la nueva generación.

— Carlitos Rejala 🙏🇵🇾🙌 (@carlitosrejala) June 7, 2021

Llegó el momento, nuestro momento.

Esta semana empezamos con un proyecto importante para innovar a Paraguay frente al mundo!

El verdadero to the moon 🚀#btc & #paypal pic.twitter.com/ZMRJgAIxgO

Rejala’s mention of PayPal is the first glimpse as to how a Bitcoin-based economy might actually be implemented by a government to meet the day-to-day needs of its citizenry, because this type of monetary move creates many questions.

Will goods and services be priced using the current legal tender, which is U.S. dollars in El Salvador, or in Satoshis which are a one-hundred-millionth fractional measure of a single Bitcoin? Will the governments that grant Bitcoin sovereign currency status use it for its store-of-value utility in the same way the U.S. government pegged the value of every dollar to the gold standard during most of the 20th Century? Will the governments pay their own bills with Bitcoin?

The only thing for sure, is that only time will tell and that we are truly living in exciting times – especially for cryptocurrency enthusiasts.

On the Flipside

- Bitcoin is an excellent asset when it comes to store of value, but its weakest attribute is when it’s used as a method of exchange. It doesn’t scale well and can only process a very limited number of transactions per second.

- Currently, the Bitcoin network can only handle around 5 transactions a second – by comparison, Visa can process 1,700 transactions per second. How will the Bitcoin network support the expected exponential spike in transactions if tens of thousands new people start using it every day?

- The other issue is that there are transaction fees that will somehow need to be addressed. If a resident of El Salvador buys $5 U.S. worth of groceries but also has to pay another $5 in transaction fees – that’s not going to work.