El Salvador’s decision to adopt Bitcoin (BTC) as a legal tender was polarizing. Cryptocurrency enthusiasts celebrated the shift as a critical step toward mass adoption, while economists trashed the idea and mourned for the Salvadoran people.

Since becoming the first country in the world to officially adopt Bitcoin, the Salvadoran Government is more committed than ever to its blockchain-based future. Regardless of volatility in the crypto market, president Nayib Bukele’s resolve remains unswayed.

Even after the collapse of FTX, when digital currency looked to be finished forever (again), the Bukele government doubled down and announced they’d buy one bitcoin daily. Despite the government’s confidence, the Salvadoran public’s usage and adoption of Bitcoin remains low.

Sponsored

With the construction of Bitcoin City lagging and the price of Bitcoin still far from all-time highs, is time running out for Nayib Bukele’s vision?

Legal Tender Pioneers

After proposing the bill on June 5th at the Bitcoin Conference in Miami, El Salvador officially adopted Bitcoin as a legal tender on September 7, 2021. At the time, BTC was trading at around $50,000, and market sentiment had never been higher.

Long before the Bitcoin Law came into effect, pockets of El Salvadoran society had been using the digital asset as a currency of exchange. The local economy of El Zonte, a coastal fishing village, had been transacting in BTC for years.

Even during his tenure as the Mayor of San Salvador, the nation’s capital, Nayib Bukele, had expressed an interest in the national adoption of Bitcoin.

Sponsored

While many businesses accepted Bitcoin before the announcement, its status as legal tender means that operators must accept BTC as payment.

Why Did President Nayib Bukele Adopt Bitcoin?

In many respects, the Central American nation is a perfect example of why Bitcoin was created in the first place. According to Nayib Bukele, 70% of the El Salvadoran people don’t have a bank account and live and work in an informal economy.

However, mobile internet usage in the country is widespread, with over 9.94 million active mobile connections in early 2023. This figure represents around 156% of the total population and indicates that a mobile-first financial service, like a Bitcoin wallet, would be far more accessible than traditional central banks.

Around 25% of El Salvador’s gross domestic product (GDP) comes from remittance payments. This means that a significant portion of wealth within the country comes in from overseas payments. Remittance fees are typically high, sometimes costing around 30-50% of the value of the transfer.

Like many Central American nations, El Salvador uses the US Dollar as its national currency. In 2001, the El Salvadoran government began de-circulating their previous currency, the Salvadoran colón, replacing it with USD as the more stable and secure national currency.

Twenty years later, the Salvadoran government wanted to move away from its reliance on the US dollar and its loss of value due to inflation.

What Are the Risks of Using Bitcoin as a Legal Tender?

Using Bitcoin as a legal tender has raised many concerns among the Salvadoran public. There are concerns that the cryptocurrency network will be used for scams and money laundering. The Salvadoran government argues Bitcoin has the opposite effect; blockchain’s transparency means that tracking funds is easier than ever.

The International Monetary Fund (IMF) has implored El Salvador to reverse its decision about using Bitcoin as a legal tender. They argue that the cryptocurrency is too volatile and poses a risk to the nation’s financial stability and consumer protection.

If the price of Bitcoin drops significantly, there is a substantial risk that the El Salvadoran government will default on its loans and be unable to repay its lenders.

Bitcoin City

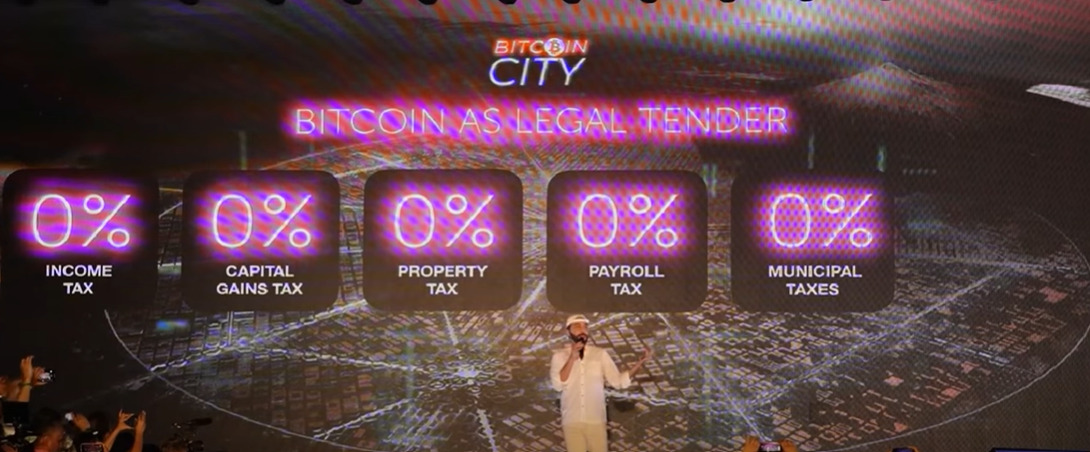

With the vision of turning El Salvador into a cryptocurrency utopia, Nayib Bukele has promised to build Bitcoin City on the side of a volcano. The proposed city is expected to be built on the Gulf of Fonseca on the nation’s southern coast.

Geothermic energy harnessed from the Conchagua volcano will be used to operate Bitcoin mining operations. Additionally, Bukele envisions a digital asset tax haven with no income or capital gains tax. This is expected to attract wealth and investment to El Salvador.

To fund the construction of Bitcoin City, the Salvadoran government will begin the issuance of Bitcoin Bonds. The first ten-year issue is known as the ‘Volcano Bond’ and is estimated to be worth around $1B. Half of the funds raised are invested in Bitcoin, with the rest being put towards the development of Bitcoin City.

Has El Salvador’s Bitcoin Bet Paid Off?

From an investment standpoint, El Salvador’s BTC holdings are still at a loss. According to Bloomberg, El Salvador holds approximately 2,546 BTC acquired at a cost basis of around $108 million. For these holdings to break even, the price of one bitcoin must be $42,419.

From a social perspective, it’s hard to gauge the success of Bukele’s move. As an incentive during the initial rollout, the Salvadoran government gifted every citizen $30 in BTC. Everyone who downloaded the Chivo wallet, El Salvador’s national wallet, was eligible. However, according to Reuters, usage rates indicate that just 20% of users have continued using the app since claiming the sign-up bonus.

A recent study by the University of Central America found that 77% of respondents believed Bukele’s Bitcoin experiment failed. Perceived security seems a significant roadblock, with many citizens not understanding and trusting Bitcoin.

Despite negative sentiment from the population, Nayib Bukele remains committed to the future. The latest news out of the country suggests that the Salvadoran government has paid off over $800 million in debts.

Bukele was happy to call out the hundreds of mainstream media articles suggesting he would default on the loan.

Ultimately, it’s still too early to say whether the adoption of Bitcoin has been a successful endeavor for the nation. The verdict will likely be directly correlated to Bitcoin price as opposed to its effectiveness as a network.

Bitcoin Legal Tender: Who’s Next?

While El Salvador is leading the charge regarding Bitcoin adoption, it’s not the only nation with its eyes on the digital horizon. Other Latin American countries like Paraguay and Panama have shown an interest in Bitcoin and have progressive laws around mining and taxation.

When Paraguay proposed a bill to make Bitcoin a legal tender in June 2021, things looked positive for Paraguayan crypto enthusiasts. The South American country has a reputation as a top destination for Bitcoin mining.

Conversely, Panama has passed a bill that aims to make the nation more crypto-friendly. While Bitcoin is not yet legal tender, profits from cryptocurrency-related endeavors are not subject to capital gains tax.

On the Flipside

- The Bitcoin blockchain is far from perfect. Even with upgrades like the Lightning Network, it’s still comparatively slow and expensive. Recent gas spikes from Ordinal NFTs and BRC-20 tokens have congested the network and driven transaction fees to all-time highs, proving that Bitcoin still has some scalability issues.

Why This Matters

While Bitcoin being recognized as a legal tender is undoubtedly a step toward mass adoption, El Salvador’s experiment will have huge ramifications on how the digital asset is perceived. If Bitcoin’s price drops and El Salvador becomes insolvent, it is doubtful that another country would want to adopt BTC.

FAQs

According to Bloomberg, El Salvador owns roughly 2,546 bitcoins as of April 2023. This number is expected to continue rising as El Salvador continues to buy Bitcoin.

The International Monetary Fund has recommended that El Salvador reserve its decision to adopt Bitcoin as a legal tender on the grounds that it was too unstable. El Salvador refused the recommendation.

El Salvador invested in Bitcoin for three main reasons. The El Salvadoran government wants to give every citizen better access to financial services, reduce their reliance on US dollars and expensive remittance costs and avoid inflation.

It’s still too early to say whether or not El Salvador is benefitting from Bitcoin. While the price of Bitcoin has dropped since El Salvador’s first purchase, tourism has enjoyed a 30% boost since the Bitcoin Law was set in motion.