As promised by Nayib Bukele, the President of El Salvador, El Salvador has become the first country in the world to pass legislation on the economic use of Bitcoin.

On Tuesday, June 6th, at midnight local time, the Legislative Assembly of the aforementioned Central American country voted to pass the law on Bitcoin.

Sponsored

The legislation primarily focuses on the legal applications of Bitcoin, and states that “every economic agent must accept bitcoin as payment when offered to him by whoever acquires a good or service.”

The Bill opens with the statement:

The purpose of this law is to regulate bitcoin as unrestricted legal tender with liberating power, unlimited in any transaction, and to any title that public or private natural or legal persons require carrying out.

The new legislation also declares that the price of products and services may be expressed in bitcoin, and that tax contributions can also be made in bitcoin.

Sponsored

Exchanges in BTC, according to this law, will not be subject to capital gains taxation, moving it in line with more traditional legal tender. It states that for accounting purposes, the U.S. dollar will be used as the currency of reference.

On the Flipside

- There is still no precedent as to the state-wide, legal adaptation of Bitcoin, making it difficult to predict how the implementation of such an ambitious project is likely to be carried out.

- El Salvador’s economy has experienced considerably low rates of GDP growth relative to other developing countries, which means that the results of any financial legislation might not be replicable in more economically developed countries.

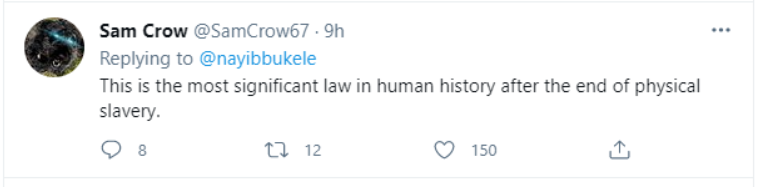

UPDATE: Thousands of reactions are continuing to post regarding President Bukele’s Twitter stream announcing the news, with comments spanning the spectrum of responses, from near euphoria likening the legislation to financial emancipation…

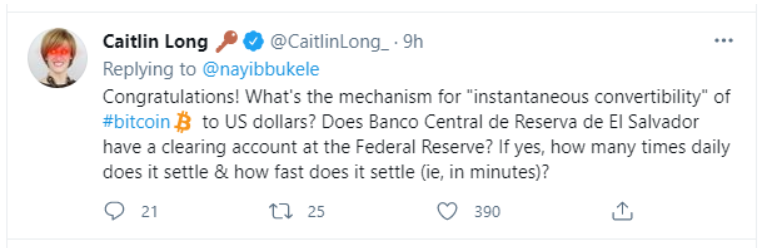

…to skeptical naysayers such as this individual.

Whether people support or oppose this historic development, there are significant questions regarding actual implementation of the Bitcoin law that remain as seen in this Twitter response posted by crypto-influencer Caitlin Long.

As far as implementation, it was announced earlier this week that El Salvador was planning to deploy Bitcoin as legal tender using the cryptocurrency’s Lightning Network, level two solution via digital wallet provider, Strike. The country will also partner with Blockstream, which will contribute technologies like its Liquid Network and satellite infrastructure to make El Salvador “…a model for the world.”

According to Strike, its mobile payments app already launched in El Salvador in March and quickly became the number one downloaded app in the country. This rapid adoption of the digital wallet app is not surprising given the fact that more than 70% of El Salvadorians do not have access to banking or financial services, but mobile device penetration in that country is 146%.

This is important because Bitcoin’s lightning network requires its users to have a digital wallet to facilitate peer-to-peer transactions. This is necessary because the Bitcoin blockchain on its own is notoriously slow compared to other blockchain networks due to its original coding and proof-of-work consensus model. Adding to the Bitcoin network difficulties, is that as more people use it the congestion builds, as do the fees, and further delays occur.

The lightning network was built on top of the BTC blockchain to enable direct transfer of the coin between two individuals using their digital wallets, sidestepping transaction fees and delays. The network upgrade creates payment channels between two users so that they can transact with each other directly. It’s important to understand that lightning network transactions occur off-chain to allow Bitcoin micropayments between users.

By enabling off-chain transactions, the volume and speed of moving Bitcoin would theoretically improve. However, it’s not clear if the lighting network can effectively support the additional load of onboarding the entire population of a country to its infrastructure – in El Salvador’s case, that would be nearly 6.5 million residents.

Additionally, while the lightning network is an improvement to the Bitcoin blockchain it doesn’t fully resolve issues surrounding Bitcoin’s volatility. That’s a serious consideration since the new law will enable merchants and service providers to price their wares in fractional units of the BTC cryptocurrency called Satoshis. A Satoshi is the equivalent of one hundred millionth of a full Bitcoin. Over the years, Bitcoin has seen dozens of double-digit price swings within daily timeframes – sometimes within hourly windows. It remains to be seen how that volatility affects merchant pricing.

Lastly, it remains to be seen if the lightning network can still handle transactions when Bitcoin mining outages occur, such as the recent one in April, that sent shockwaves across the entire crypto-sphere.

While many questions remain and much work must be done, it’s worth it for the promise of economic equality and the hope of future financial freedom for the unbanked of the world. El Salvador has taken the first step to blaze that trail forward.

On the Flipside

- It’s not clear how the U.S. government will respond to El Salvador’s Bitcoin adoption law. Bottom line, the law diminishes the supremacy of the U.S. dollar as the sole currency in that Central American country.

- El Salvador’s action is likely to create a U.S. dollar domino effect across Central and South America, it’s unlikely that American politicians will support a global trend that displays the U.S. dollar.