- Real World Asset Tokenization offers heightened access to “safer” products.

- Crypto-native investors holding stablecoins could use tokenized treasuries for increased yield.

- Some DAOs have already cashed in on the opportunity.

Real World Asset Tokenization could bring significant change to the financial system. By improving transparency, speed, accessibility, and costs of transactions, it could dramatically change the landscape for market participants.

While estimates for growth are lower than last year, a recent Citi report estimated that the global tokenization market could reach $4-5 trillion by 2030. The institution stated the technology continues to be blockchain’s “killer use case” and predicts significant adoption.

Globally, the industry is taking notice. Blackrock CEO Larry Fink, once a firm skeptic of tokenized potential, said, “the next generation for markets, the next generation for securities, will be tokenization of securities.”

Sponsored

This interest is turning into an investment.

Investment in Tokenized Treasuries Rises Despite Market Volatility

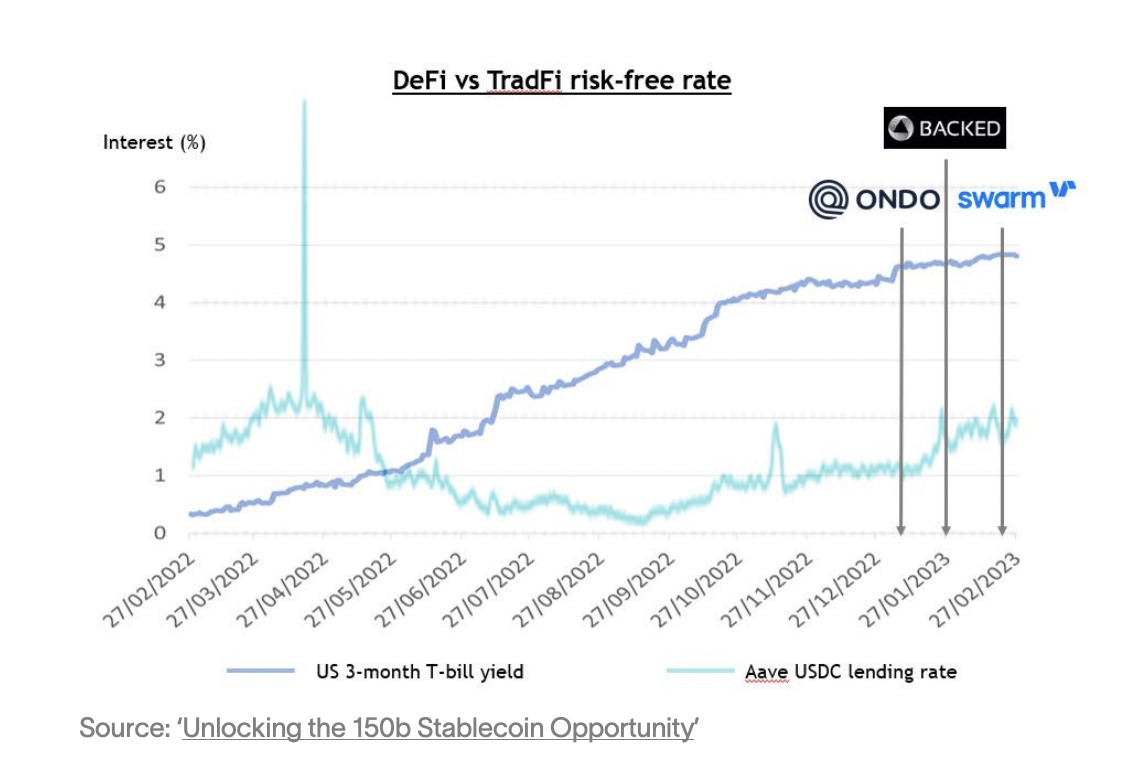

The landscape of heightened volatility has had many crypto investors on the back foot. The collapse of multiple high-profile crypto companies, and lower demand for assets, has caused DeFi yields to plummet. Investors have gone searching for alternative sources.

A July 11 report published by RWA.xyz found that current investment into U.S. tokenized treasuries had surpassed $600 million. Despite a continued lack of regulatory clarity towards digital assets, particularly in the US, the total value is currently hovering around $617 million.

Perceived as a “safe” asset, demand for tokenized treasuries has been rising. The US’s rapid rate increases, while putting a strain on much of the economy, have caused bond yields to rise significantly.

Sponsored

The tokenization of these bonds has brought the assets onto blockchain, allowing for increased access.

The result is two-fold:

- It allows crypto-native investors to diversify into new assets.

- It provides a bridge for incumbent issuers to enter into the DeFi landscape.

The heightened demand has brought new players into the ecosystem, attracting both DeFi and TradFi entities. RWA.xyz stated that within six months, they had seen over ten companies bring tokenized US treasuries into their offering for the first time.

"Tokenized treasuries are still relatively small compared to the size of government bond markets, but reaching $600 million is a positive indication of where the demand for tokenized treasuries is heading,” said Philipp Pieper, co-founder of Swarm, one of the entities mentioned in the RWA.xyz report. “In February this year, we launched tokenized real-world assets and have seen a huge uptake in these already, with several digital issuance sell outs.”

The fact liquidity is building in the tokenized treasury market during a bear market is a very encouraging indicator of investor sentiment for these products. While it’s not possible to predict the direction of markets, we would expect to see a major expansion into digital assets in the next bull run.”

Other entities have stated to RWA.xyz that these are the first products in a long tokenized fund line.

DAOs Turn to RWA in Light of Crypto Volatility

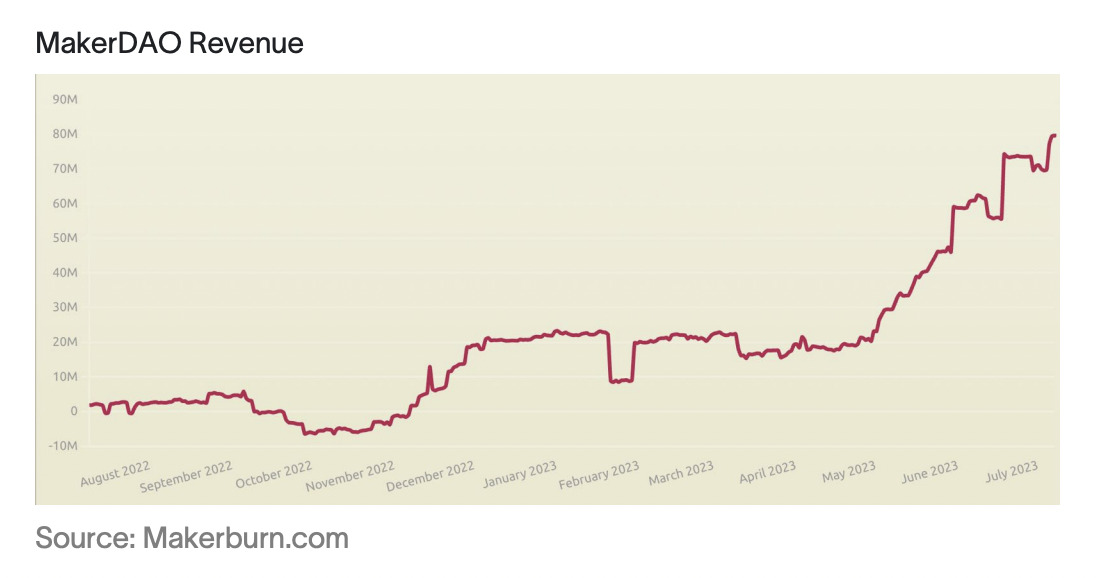

DAOs like MakerDAO are turning to tokenized real-world assets to create the bulk of their revenue.

MakerDAO makes almost all of its revenue through lending to real-world borrowers.

Last year, in the wake of the Terra (LUNA) collapse, the DeFi protocol turned to US Treasuries and bonds to increase yield. At the time, much of the protocol’s native DAI token was collateralized with USDC, offering no yield at all in a high-rate environment.

As stated in the RWA.xyz report, tokenized US Treasuries allow stablecoin holders two advantages in this context. They can diversify their collateral into assets with a similar risk to fiat currency while increasing yield opportunity.

MakerDAO has cashed out on this opportunity, increasing revenue since investing in October 2022.

On the Flipside

- The regulatory landscape for tokenization is still unclear, and further growth could be stunted by too restrictive regulation.

- This year, the SEC has targeted digital assets, going head-to-head with companies to clarify existing guidelines. This could add uncertainty to the issuance of RWA.

- TradFi companies, as regulated entities, could have an advantage over DeFi entities already in the field.

Why This Matters

The turn to tokenized real-world assets could shift market sentiment towards crypto. While regulators remain on the fence, the industry sends a strong message, with heightened demand and new market participants entering the field.

The tokenized treasuries offer heightened global access to a market perceived as “safer” at higher yields than those currently provided by DeFi-native assets. It could be a step further toward delivering crypto’s potential in enhancing financial inclusion.

Read more:

Ripple’s Value Report Spotlights Key Trends in Crypto, Tokenization, and DeFi

J.P. Morgan Enters DeFi Space with Asset Tokenization Pilot for Singapore MAS