- The SSR’s cryptic clues have been revealing vital insights into exchange activity.

- An intriguing connection between a stagnant SSR and a Bitcoin price surge has been unraveled.

- The implications of a low SSR, signaling heightened Bitcoin purchasing power, have been uncovered.

Understanding market trends has become crucial to successful trading and investment strategies. Among the plethora of metrics available, one has emerged as a significant and insightful tool.

Decoding Market Volatility

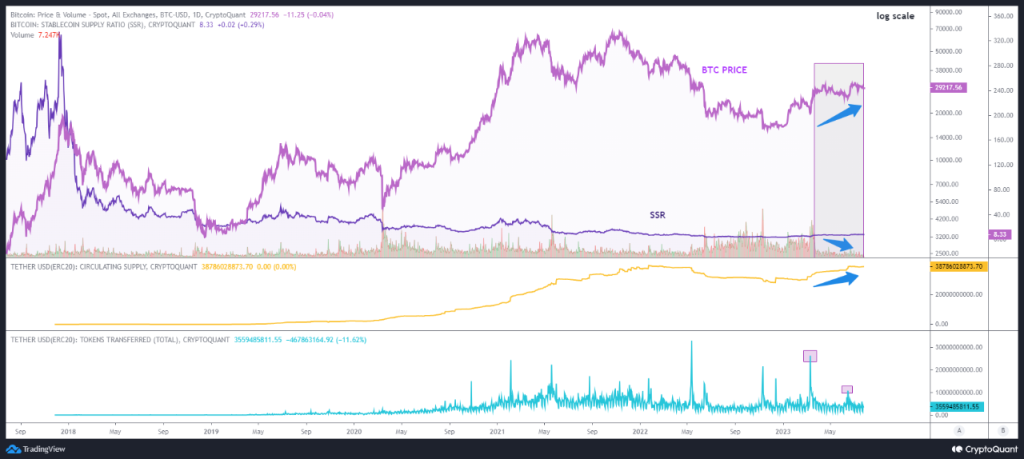

The Stablecoin Supply Ratio (SSR). This metric, which measures the relationship between the market capitalization of Bitcoin (BTC) and all stablecoins, has garnered attention for its ability to unravel hidden patterns and shed light on the dynamics of the crypto landscape.

A veritable yardstick, the SSR is key to comprehending exchange activity and market volatility. When the SSR experiences an upward trajectory, it heralds a deceleration in stablecoin buying power, often indicative of a bearish or sideways market sentiment.

Sponsored

Conversely, a declining SSR signals an ascent in stablecoin buying power, typically aligned with a bullish market sentiment.

Potential Bullish Trend for Bitcoin Amid Declining Trading Volume

Trading volume, another crucial metric, plays a fundamental role in understanding the flow of assets within the market. Although it may not encompass over-the-counter (OTC) transactions, trading volume remains a useful indicator for monitoring price movements, buyer interest, and, most importantly, the liquidity of the asset.

Recent observations reveal a decline in trading volume and a stagnation in the SSR since the end of March. Interestingly, this aligns with a surge in the circulating supply of Tether, the leading stablecoin in terms of volume, and a subsequent rise in Bitcoin’s price.

Sponsored

Market observers interpret these trends as potential signs that significant investors have accumulated stablecoins, awaiting more favorable prices. The recent surge in Bitcoin may result from a rotation of existing funds within the market.

A low SSR implies heightened purchasing power for Bitcoin, hinting at the potential for a bullish trend when large buyers re-enter the market to acquire Bitcoin.

On the Flipside

- The SSR may not be a foolproof indicator of market sentiment, as it solely focuses on the market cap of Bitcoin in relation to stablecoins.

- While the SSR may offer insights into stablecoin buying power, it does not account for the potential impact of market manipulation or large-scale coordinated trading activities that could distort the perceived trends.

- An overly bullish interpretation of a low SSR may lead to excessive optimism, potentially overlooking other factors impacting the cryptocurrency market’s trajectory.

Why This Matters

By providing key insights into stablecoin buying power relative to Bitcoin’s market cap, this metric empowers investors to discern market sentiment, gauge exchange activity, and predict potential trends.

To learn more about how a seemingly mundane FOMC speech and a predicted rate hike failed to stir the crypto market, read here:

Boring FOMC Speech and Predicted Rate Hike Fails to Stir Crypto Market

For insights into the recent approval of crypto bills by Congress, paving the way for regulatory clarity in the cryptocurrency space, read here: