As the global financial landscape transforms, with 420 million worldwide owning digital currencies, jurisdictions are rushing to declare their intentions to become crypto-friendly.

While some are newly joining the bandwagon, others have been in the crypto adoption game for years. The question is: have their efforts paid off? Has the status of being crypto-friendly truly brought any benefits?

Sponsored

DailyCoin looks into the pioneering crypto hubs across the globe.

Zug: Swiss Crypto Valey

A tiny city in Switzerland with only 30K people, Zug became synonymous with Swiss Crypto Valley when, back in 2013, the first blockchain companies started to settle there. In 2020, Switzerland passed the “Distributed Ledger Technology (DLT) Act,” a set of financial reforms that opened doors to a fully regulated digital asset industry. The Act came into force in February 2021, securing a legal environment and allowing the local blockchain ecosystem to flourish.

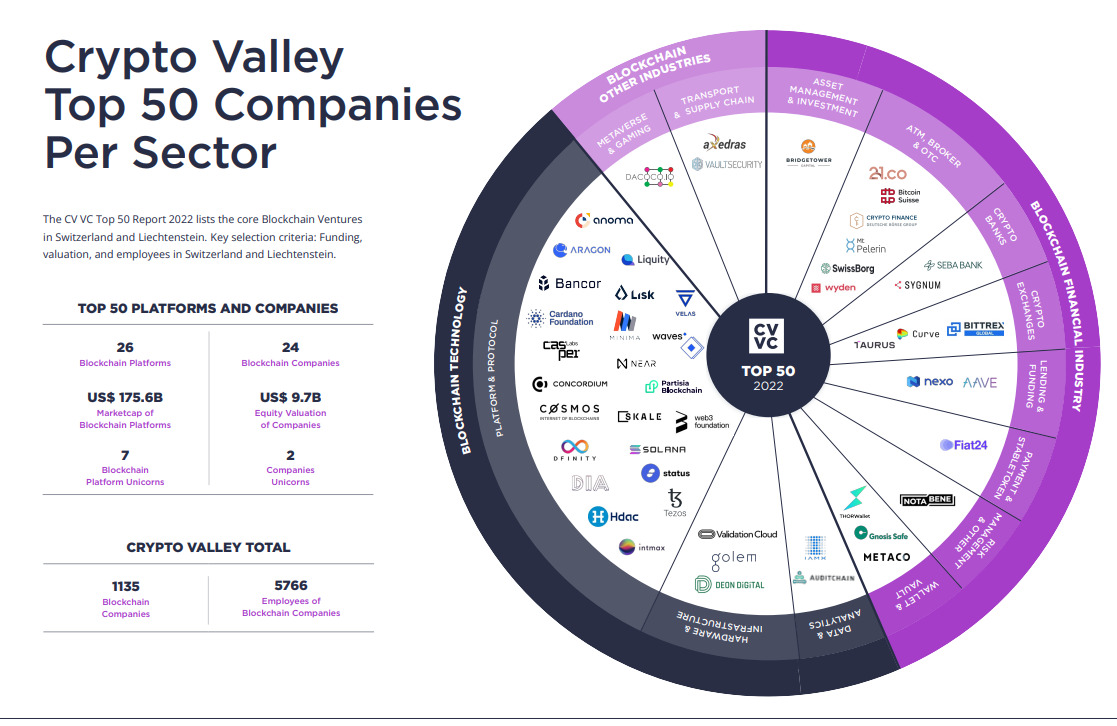

Since then, the Canton of Zug has become a home for 1,135 blockchain and crypto companies, creating a workplace for more than 5,760 employees, according to the venture capital firm’s CV VC Top 50 Report.

In 2022 alone, 216 new companies moved into the region, whose crypto industry today accounts for more than 4% of the city’s business ecosystem of 27K companies.

Sponsored

Named after Silicon Valley, Swiss Crypto Valley hosts some of the biggest names in the industry.

It is home to nine crypto-related unicorns, crypto companies, and blockchain platforms with more than $1 billion valuation: Dfinity, Near, Cosmos, Solana, Web3 Foundation, Cardano, Ethereum, safe, and 21.co.

The 50 biggest crypto companies operating in Swiss Crypto Valley alone constituted $9.7 B value by the end of 2022, 55% more compared to previous years.

Currently, 1.9% of Switzerland’s 8.7 million population own digital assets, according to TripleA Global Crypto Ownership data.

Dubai: The UAE’s Crypto Oasis

The oil-rich Gulf state of the United Arab Emirates, and especially Dubai, has also adopted policies to attract the virtual asset industry as part of the country’s diversification strategy beyond fossil fuels.

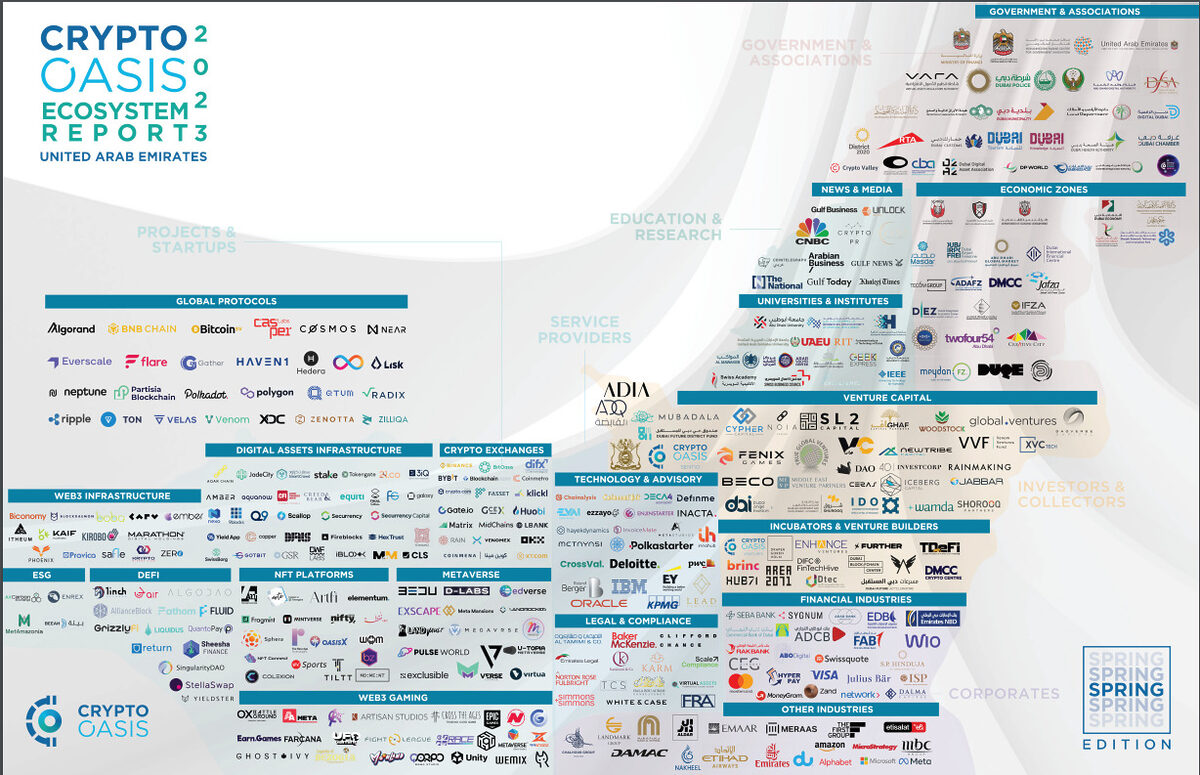

After recognizing ICO tokens as securities, the country has taken steps to boost its crypto industry since 2018. With the ambition to make the UAE the global crypto capital, the county’s Crypto Oasis, or a blockchain ecosystem working with investors, governmental authorities, and researchers, was founded in 2021. The same year, the country enacted tax exemptions for cryptocurrency businesses operating in Dubai and Abu Dhabi free trade zones.

The country enacted its crypto regulator, Virtual Asser Regulatory Authority (VARA), in 2022, responsible for licensing and regulating the sector.

Since then, 1,800 crypto-related organizations settled in the country, marking a 28% growth over the past year alone. More than 8,650 people are employed in the space.

Influential players from FTX to Binance, Kraken, Bybit, and Crypto.com expanded their operations to the UAE and opened their regional headquarters here. Almost any sector of the crypto space has a company settled in UAE.

The United Arab Emirates is one of the Top 35 economies in the world, with a $415 billion GDP. The World Bank said the country’s GDP increased by more than 7.6% in 2022, marking one of the most significant economic growth rates ever recorded.

The country also shows one of the highest crypto adoption rates, as 27.67% of its 9.5 million population owns digital currencies.

Singapore: Asia’s Crypto Hub

Singapore, a city-state of 5.4 million, is a renowned Southeast Asian business hotspot with blockchain companies settling there since 2013. It’s also been on the map of Asia’s early crypto hubs since 2018 after the local government shared ambitions to establish a robust crypto sector and adopted a positive approach toward digital currency regulation.

A few years after, Singapore began licensing crypto industry companies and allowed retail and institutional trading of digital currencies. The global investments into its fintech ecosystem increased by 22% to a record $4.1 billion in 2022, according to a KPMG report. The crypto and blockchain sector was the second largest contributor to this growth.

Since then, some of the industry’s biggest names have based themselves in Singapore: Terraform Labs, Three Arrow Capital, Hodlnaut, Crypto.com, Gemini, and many others were among those opening corporate offices or operation centers. Crypto.com alone was said to have 1,800 employees at its Singaporean corporate office.

At the same time, Singapore was the second-largest market of FTX before its collapse. Nearly 240K monthly visitors from Singapore accounted for almost 5% of FTX’s traffic. The notorious crashes of Terra, then 3 Arrow Capital, and finally FTX resulted in numerous retail investors and traders losing their life savings.

This led the Monetary Authority of Singapore (MAS) to change its position as a crypto-friendly city and introduce restrictions on retail access to digital currencies. The city-state banned crypto ads and various types of incentives for crypto traders. It also topped the list of major cities that suffered the biggest crypto-related layoffs caused by the crypto winter.

Singapore’s government shifted its vision from a safe crypto hub to a blockchain hub, focusing more on blockchain technology development and applications than financial digital asset services.

The city-state, however, remains the home for numerous crypto players, with Ripple and Gemini being the latest to receive operating licenses. Singapore’s crypto adoption rate is close to 14%, meaning over 840K locals own or deal with cryptocurrencies.

El Salvador

The smallest country in Central America, El Salvador, became the world’s first jurisdiction to legalize Bitcoin in 2021 when it made BTC an official currency. The move was a solution to attract investments, create jobs, and include more of the populace in the economy since nearly 70% of the 6.3 million population do not have bank accounts.

President Nayib Bukele then announced plans for crypto mining via the state-owned geothermal electric company that uses volcano power and a plan to build up a Bitcoin City powered by volcano energy and funded by Bitcoin-backed bonds.

However, the country lacked an established legal framework regulating the issuance and operations of digital assets to attract investors. No official data reveals the number of crypto-companies moving into El Salvador after 2021.

As far as it is possible to find, crypto companies like Strike, Bitfinex, Galoy, Ibex, and Tiankii announced the commencement of operations in El Salvador after 2021. They also committed to offering jobs for local crypto developers and engaged in a training program for 21 students. But as LinkedIn research shows, none operates offices employing locals in any significant number.

A few years after making Bitcoin legal tender and declaring ambitions of a regional crypto hub, El Salvador struggles with implementation. 86% of local merchants reported they have never made a sale in Bitcoin. Usage of El Salvador’s Chivo Wallet has stalled after the Bitcoin bonus for downloading it.

Only 2% of remittances were transferred via digital wallets, while back in 2021, more than 26% of El Salvador’s Gross Domestic Product (GDP) came from money sent from its citizens living and working abroad.

The country is still among the poorest in the region, with a $29 billion GDP, compared to the world average of $123 billion. A mere 1.72% of the nation’s population holds cryptos.

New York

In 2015, the New York State Department of Financial Services (NYDFS) issued BitLicense, a regulatory framework allowing to conduct virtual currency businesses. The move attracted crypto exchanges like Gemini to the city.

Since then, New York City’s regulatory basis and crypto ecosystem have visibly evolved. Today New York’s crypto landscape includes various crypto service providers, venture capital firms, and traditional financial institutions such as JPMorgan, Goldman Sachs, and Morgan Stanley exploring blockchain applications.

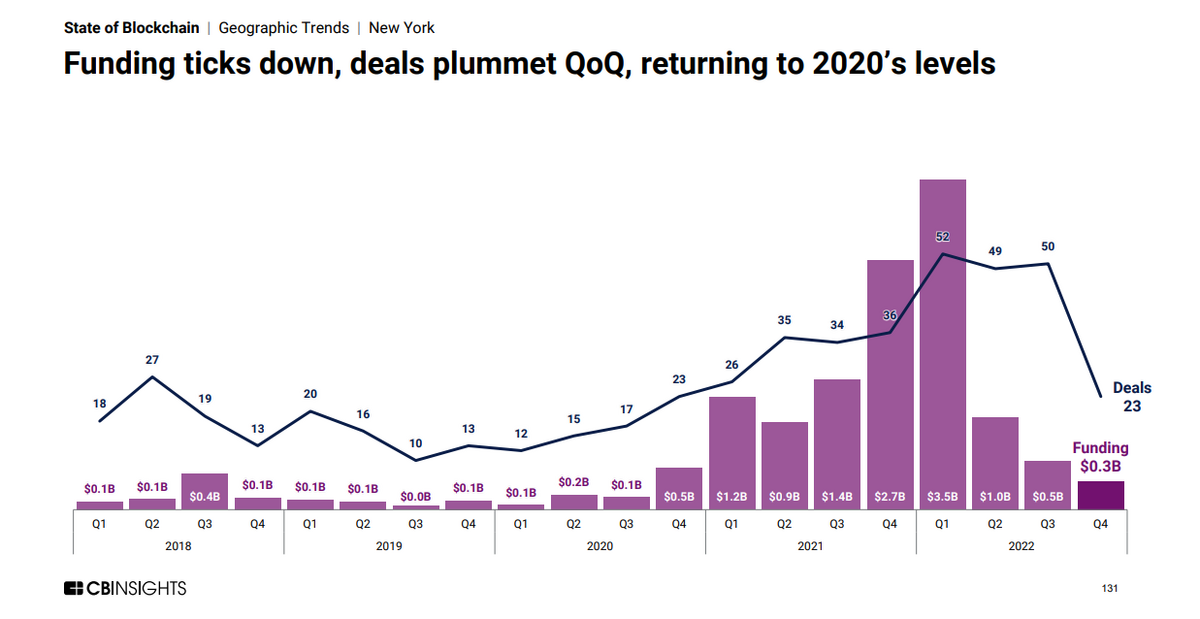

Last year New York ranked first among the world’s biggest cities with the highest venture capital investment rate in cryptocurrency and blockchain companies. More than $5.3B was invested in the NY-based crypto ecosystem in 2022, which accounts for 19.7% of the world’s total $26.8B VC investments in crypto projects of the same year.

According to CB Insights 2022 report, nearly three-quarters of these investments went into early-stage start-ups.

Currently, New York stands as one of the prominent leaders in cryptocurrency adoption within the United States, with approximately 48% of residents owning digital currencies.

However, with more and more cities jumping into the race aspiring to become crypto-friendly, early adopters are also here. Even if their success stories and experience differ, they have established the infrastructure, regulatory framework, and industry connections to build a supportive environment and attract investments. It may take time for newcomers to catch up.

Take a deeper look at what it takes to become a crypto hub:

Lugano Plan B: Inside the Crypto Capital

Find out more about how to pay with Bitcoin anywhere in the world:

Paying in Bitcoins via Lightning Network: It’s not Rocket Science