- Central and Southern Asia and Oceania countries rank highly for adoption.

- Global cryptocurrency adoption is trending down.

- Lower-income countries lead adoption recovery.

Once confined to niche cypherpunk circles, cryptocurrency adoption has expanded beyond its obscure origins in recent years. Yet adoption rates remain uneven, with some regions embracing cryptocurrency far faster than others.

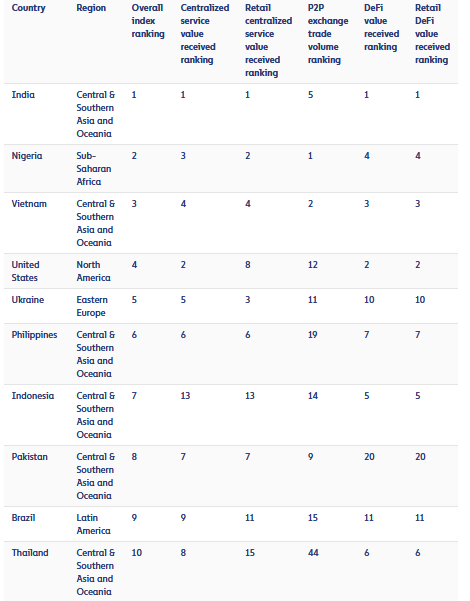

The latest data from Chainalysis’ Global Crypto Adoption Index (CGCAI) found that countries in the Central and Southern Asia and Oceania (CSAO) region lead the way for grassroots adoption. In particular, India ranked highly for digital asset use at the grassroots level.

Chainalysis Global Crypto Adoption Index

The CGCAI focused on grassroots adoption by looking at countries where most people allocate the highest share of their wealth to cryptocurrency.

Sponsored

This approach is in stark contrast to ranking countries with the most transactional volume, which would tend to favor wealthy nations and give an inaccurate picture of digital asset adoption on a global basis.

According to Chainalysis’ grassroots adoption methodology, six out of the top ten ranked countries are located in the CSAO region. India leads overall at number one, ranking first across all metrics except for peer-to-peer exchange volume. Meanwhile, Vietnam and the Philippines are notable CSAO entries, placing third and sixth, respectively.

Interestingly, of the twenty countries featured in the CGCAI, just four countries, the US, the UK, Japan, and Canada, are considered “advanced economies” per G7 criteria, implying that grassroots cryptocurrency demand is lower in developed countries.

Sponsored

The precise reason for this is subject to debate. Still, research conducted by Bitstamp suggested that factors in underdeveloped countries, such as poor financial rails and relatively low trust in authorities, convene to favor digital assets as a remedy for locals to better their lives.

“The reasons could include crypto’s utility as a store of value compared to a volatile local currency, low trust in governments, and the role of crypto in cross-border remittances,” suggested Bitstamp.

Despite the strong pull towards cryptocurrency usage in underdeveloped nations, overall global adoption has been on the slide since the Q4 2021 market top.

Global Adoption Falls

Since the market top, the Global Index, which compiles worldwide cryptocurrency grassroots adoption into a single figure, fell from a score of approximately 0.90 to a local bottom of 0.15 by Q4 2022.

Although there has been a move higher since the local bottom, grassroots adoption continues to show weakness under current bearish conditions, topping out at 0.30 in the prior quarter.

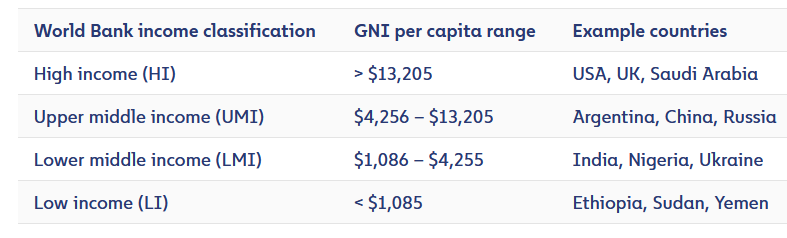

Despite the adoption downtrend, Chainalysis noted that according to World Bank income classifications, recategorizing countries revealed that lower-middle-income countries showed the strongest recovery for grassroots adoption since Q4 2022. In contrast, upper-middle-income countries continue to languish.

On the Flipside

- The overall adoption trend is down significantly despite lower-middle-income countries leading the recovery.

- Chainalysis’ research does not consider the speculation element of cryptocurrency adoption.

- Policy-driven adoption metrics, as opposed to grassroots methodologies, indicate Singapore is the leading country for adoption.

Why This Matters

Despite India ranking first for grassroots crypto adoption, the country’s lawmakers remain staunchly crypto-skeptical. This contrast exemplifies the digital asset industry’s challenges in turning grassroots demand into mature adoption without supportive regulation, even in democracies like India.

Learn more about Henley & Partners research on crypto adoption here:

Inaugural Crypto Adoption Index Names Surprising Country #1

Read about Swan Bitcoin’s response to a security breach involving custody partner Fortress Trust here:

Swan Bitcoin on the Defensive Following Fortress Hack