- Crypto hacking losses fall in March.

- Chainalysis foresees a sustained decline in crypto hack losses.

- Crypto platforms are improving their security response procedures.

Crypto hacks have resulted in billions of dollars in losses and shaken investor confidence to hinder wider mainstream adoption. However, Peckshield noted that crypto losses stemming from hacks plunged 48% in March, supporting expectations that crypto security measures are finally tightening up.

Crypto Hacks Fall in March

Data from Peckshield showed that crypto hack losses fell 48% in March to $187.3 million compared to February, which saw $360.8 million in crypto hacking losses. March’s figure was on par with January, in which $182.5 million was lost to hackers.

Among the biggest breaches in March were $97 million stolen from Munchables, though those funds have since been recovered. Curio Network suffered a $40 million hack, and Prisma Finance lost $11.6 million, which is currently under negotiation for return. NFP and WooFi were hit for $10 million and $8.5 million, respectively, according to PeckShield’s breakdown of the top 5 incidents.

Sponsored

The latest PeckShield data aligns with analysis from blockchain analytics firm Chainalysis. Their 2023 Crypto Crime Report revealed a steep decline in total crypto hacking losses last year, which they attributed to platforms implementing more robust security practices and swifter incident response measures to counter ever-evolving hacker tactics.

Hacking Losses Tail Off in 2023

According to Chainalysis, the decline in crypto hacking losses in 2023 was the result of improved security practices, including the honing of incident response capabilities and better coordination of fund freezing with assistance from centralized exchanges. Over time, Chainalysis believes loss from crypto hacks will continue to fall as these practices improve.

Sponsored

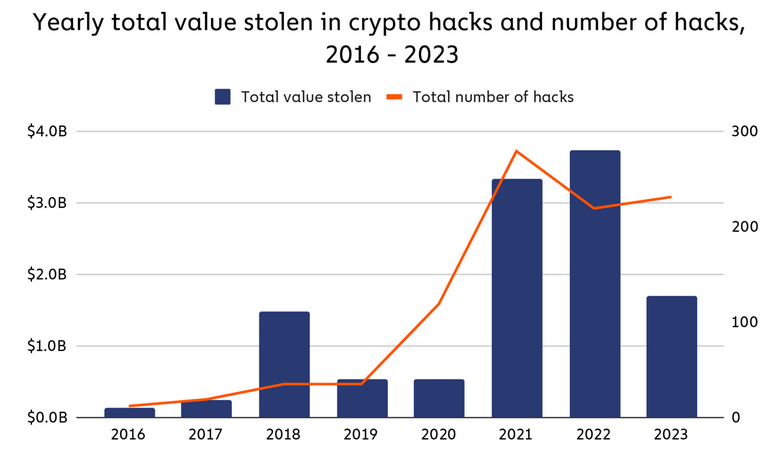

Chainalysis data showed total crypto hacking losses in 2023 amounted to around $1.7 billion across 231 separate incidents. This represented a 54% decline from 2022’s record $3.7 billion in losses stemming from 219 hacking incidents.

A large portion of the decline can be explained by a significant 63.7% year-over-year reduction in DeFi protocol hacking losses. DeFi protocols accounted for around $1.1 billion in losses across 2023, down from over $3.1 billion in 2022. As DeFi hacks propelled much of the surge in recent years, this decrease heavily impacted the overall decline in total crypto losses last year.

On the Flipside

- Regulatory scrutiny on crypto platforms may have contributed to better defenses.

- Solana users have been reporting wallet drains of unknown origin in recent weeks.

Why This Matters

The apparent curtailing of crypto hacking signals a positive shift for an industry that has grappled with security issues and user trust. As platforms bolster their defenses, it could attract more institutional and retail investors who previously stayed away due to hacking concerns.

Read more on the most prominent crypto hacks from last year:

Biggest Crypto Hacks of 2023 Resulted in Over 70% of Losses

Argentina rolls out FAFT enforcement rules, increasing surveillance. Read more here: